USD holds gains, Aussie jumps on hawkish RBA

USD holds gains on favourable data

In the FX market we note that the greenback was able to hold its gains in today’s Asian session, as favorable financial data were released in the US yesterday. The ISM manufacturing PMI figure for the past month rose beyond market expectations, showing an expansion of economic activity in the sector. On a monetary level, the markets continue to be focused on Warsh’s nomination as the next Fed Chairman and should the market’s expectations for his intentions turn hawkish we may see the USD gaining further ground.

RBA’s hikes rates, sounds hawkish

In the land of the down under, RBA hiked rates as was expected and tended to sound hawkish giving the Aussie a boost. In the accompanying statement the bank highlighted the inflationary pressures in the Australian economy and seemed ready to tighten its monetary policy further is necessary. We view the bank’s stance as supportive for the Aussie and should more hawkish comments follow in the coming days by RBA officials we may see the Aussie getting additional support.

US equities edge higher, Bitcoin still not out of the woods, Oil continues to drop

US stock markets edged higher yesterday pairing the losses of the past two Monday and Friday, which provided an optimistic tone in the markets, while oil prices continued dropped as the markets remove the premium placed in the past week, given the easing of tensions between the US and Iran, while Bitcoin seems to stabilise somewhat, yet we think that it’s still not out of the woods.

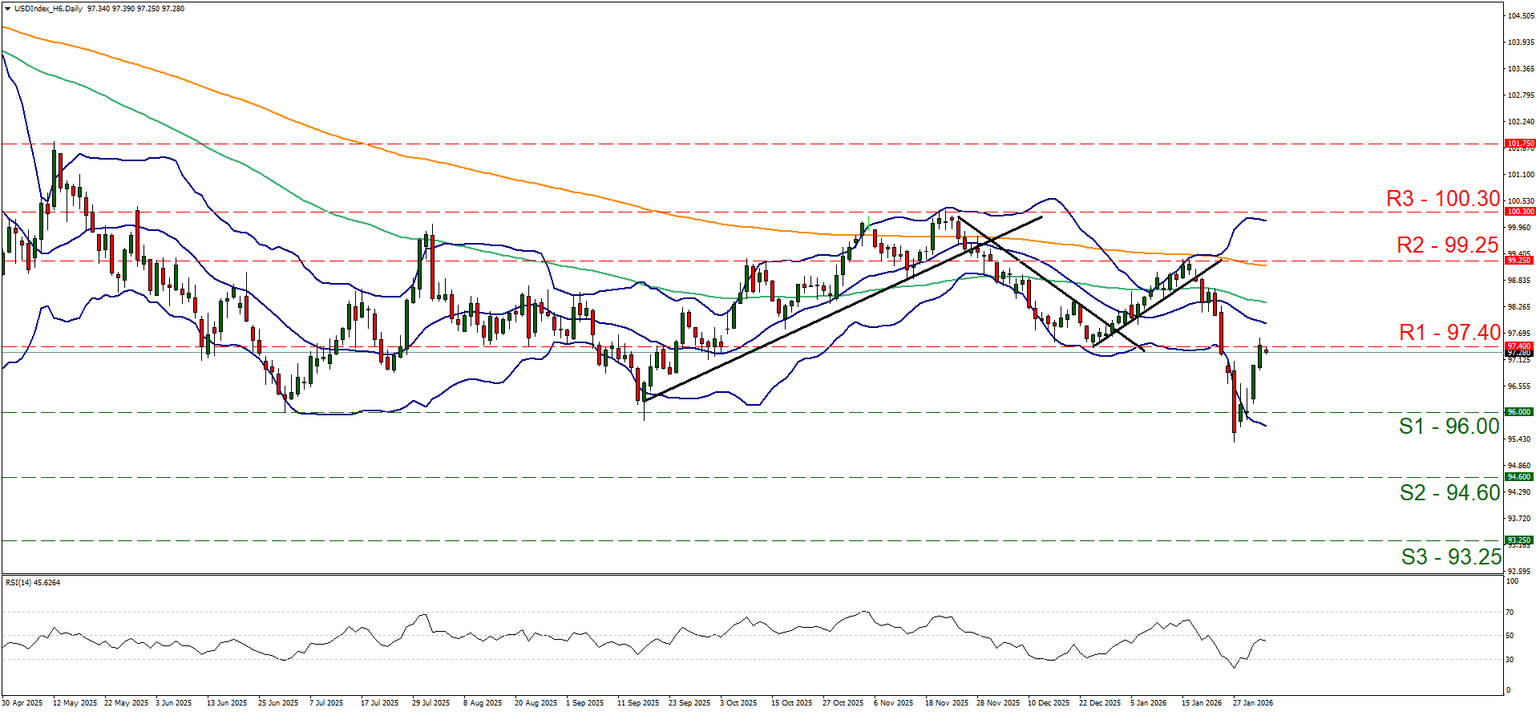

Charts to keep an eye out

The USD Index continued to rise yesterday hitting a ceiling at the 97.40 (R1) resistance line and remained there in today’s Asian session. We would like to adopt the bullish outlook, yet the RSI indicator remains just below the reading of 50, implying a rather indecisive market. For the bullish outlook to be maintained the index’s price action would have to break the 97.40 (R1) resistance line and start aiming for the 99.25 (R2) level. Should the bears take over, we may see the index reversing the gains of the past days by breaking the 96.00 (S1) support line and start aiming for the 94.60 (S2) support barrier.

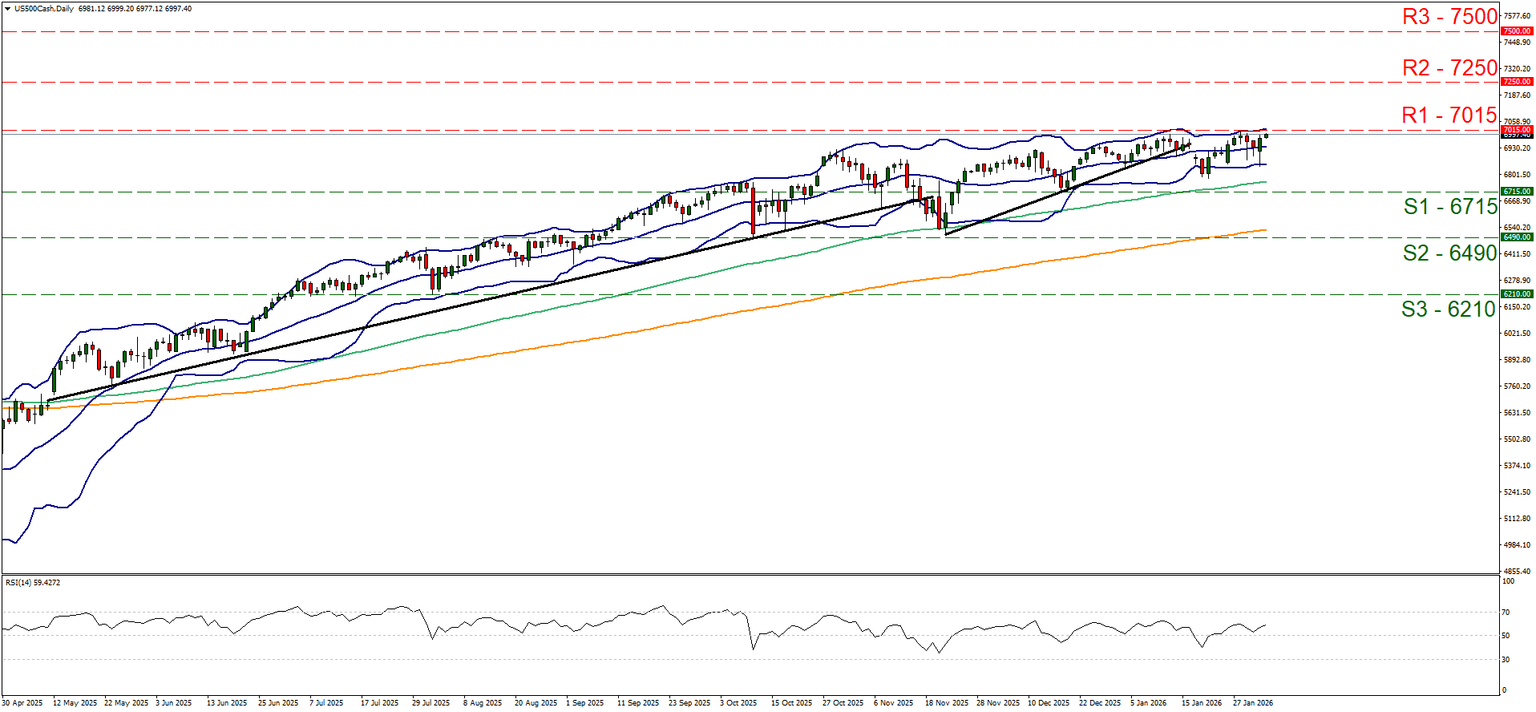

S&P 500 edged higher yesterday reapproaching the 7015 (R1) resistance line, thus remaining close to record high levels. The index maintains a nice sideways motion remaining relatively unaffected by the mayhem of the past few days in the markets, hence we maintain a bias for the rangebound motion to continue. Should the bulls take over ,we may see S&P 500’s price action entering unchartered waters by breaking the 7015 (R1) resistance line while for a bearish outlook to emerge we would require the index’s price action to drop below the 67.15 (S1) support line and start aiming for the 6490 (S2) support level.

Other highlights for the day

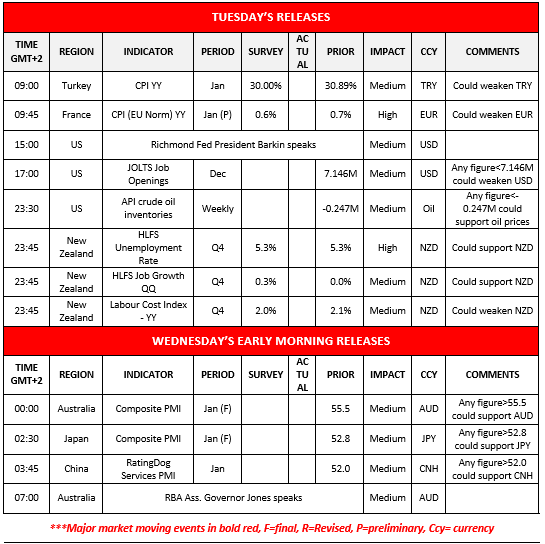

Today we note the less than expected slowdown of Turkey’s CPI rates for January, and the deceleration of France’s preliminary HICP rates for the same month. In the American session, we highlight the release of the US Jolts job openings, given the release of January’s US employment report at the end of the week, while oil traders may be more interested in the release of the weekly US API crude oil inventories figure and kiwi lovers may focus on the release of New Zealand’s employment data for Q4 25. On a monetary level, we note that Richmond Fed President Barkin and should he provide some hawkish comments we may see the USD getting some support. In tomorrow’s Asian session, we get Australia’s and Japan’s final Composite and Services PMI figures for January and China’s Rating Dog Services PMI figure for the same month, while in Australian RBA Assistant Governor Jones is speaking.

Calendar follows

USD Index daily chart

- Support: 96.00 (S1), 94.60 (S2), 93.25 (S3).

- Resistance: 97.40 (R1), 99.25 (R2), 100.30 (R3).

US 500 daily chart

- Support: 6715 (S1), 6490 (S2), 6210 (S3).

- Resistance: 7015 (R1), 7250 (R2), 7500 (R3).

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.