AUD/USD Price Forecast: The bullish outlook remains in place

- AUD/USD rose past the 0.6500 mark and hit new yearly highs on Monday.

- The US Dollar resumed its downtrend, flirting with recent multi-year lows.

- Markets remain cautious on the geopolitical front and central bank events.

The resurgence of the selling pressure in the US Dollar (USD) helped the Australian Dollar (AUD) and the rest of the risk-related assets in quite an auspicious start to the new trading week.

Indeed, the AUD/USD gained momentum and surged towards the 0.6550-0.6560 band, marking new highs for the current year and extending the recent breakout above the crucial 200-day SMA.

Central bank’s divergence plays its role

Divergent central bank policies continue to captivate investors.

The Reserve Bank of Australia (RBA) lowered its cash rate by 25 basis points to 3.85% at its latest event. In addition to a slowdown in inflation to 2.6% and a moderating GDP growth to 2.1% in 2025, RBA Governor Michele Bullock stated that the bank anticipates rates to "gradually decline" towards a 3.20% level by 2027. Bullock went on to say that if domestic demand and wage growth decline, more cuts might be considered, but the RBA is prepared to halt easing if the situation abroad worsens.

Across the Pacific, the Federal Reserve (Fed) will start its two-day meeting on Tuesday, with the decision to maintain its current interest rates widely expected on Wednesday. Despite the decision having been largely anticipated by markets, all the attention should be on the updated “dots plot” as well as the always-significant press conference by Chair Jerome Powell.

Investors appear to be leaning towards a cautious stance from the Fed, despite the growing speculation of up to three rate cuts by the central bank in the latter part of the year.

China: That dark cloud over Oz

Australia continues to face external challenges as prospects are hampered by China's uneven post-pandemic recovery.

In fact, China's May data revealed some promising results, with industrial output, retail sales, and services activity all experiencing boosts from early fiscal stimulus and robust export orders. This performance is likely to maintain GDP growth above 5% on a yearly basis, which indicates potential upside to the forecast for the second quarter.

However, the ongoing property slump, coupled with the diminishing effects of stimulus measures, along with enduring US tariffs and trade-war pressures, suggests that the latter half of 2025 may present significant challenges.

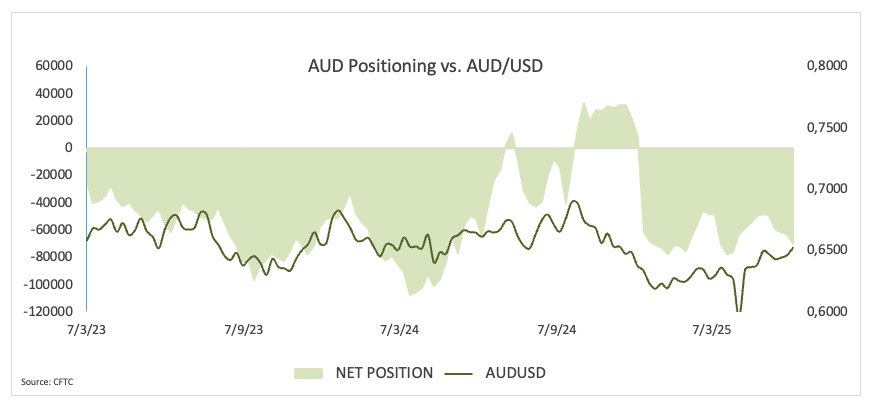

Bearish bets build up around the Aussie

The Commodity Futures Trading Commission (CFTC) data through June 10 indicates that net short bets on the Australian dollar increased to about 94K contracts, the largest bearish position since April, indicating a persistence in speculative positioning towards caution. Open interest, in the meantime, also increased to multi-week highs around 224.3K contracts.

From the technical perspective

AUD/USD faces its next up-barrier at the 2025 peak of 0.6551 (June 16). Once this level is cleared, the pair could embark on a potential visit to the November 7, 2024 peak of 0.6687, followed by the September 30, 2024 high of 0.6942, all ahead of the key 0.7000 threshold.

The 200-day simple moving average (0.6431) provides immediate support on the downside, prior to the interim 55-day and 100-day SMAs at 0.6392 and 0.6344, respectively. Further south emerges the May low of 0.6356, before the critical 0.6000 mark.

With the Relative Strength Index (RSI) rising above 59 and the Average Directional Index (ADX) beyond 26, which suggests a firmer trend, momentum indicators are leaning in the direction of further gains.

AUD/USD daily chart

What’s in store for AUD

Later in the week, The Westpac Leading Index is due on June 18, ahead of the always relevant jobs report on June 19.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.