AUD/USD Price Forecast: Bears face initial contention near 0.6260

- AUD/USD added to Tuesday’s pullback and revisited the 0.6320 zone.

- The US Dollar gathered fresh upside impulse ahead of the Fed meeting.

- Attention shifts to the Australian labour market report on Thursday.

The Australian Dollar (AUD) remained on the defensive for the second straight day on Wednesday, prompting AUD/USD to extend Tuesday’s rejection from the boundaries of the key 0.6400 hurdle and revisit the 0.6330-0.6320 band.

On the other hand, the US Dollar (USD) managed to regain some balance amid steady cautiousness ahead of the FOMC gathering, motivating the US Dollar Index (DXY) to set aside part of the recent three-day decline.

Trade tensions in focus

Unpredictable trade policies from Washington continue to keep markets on edge, as investors anticipate possible countermeasures from US trading partners. With the threat of an escalating trade war looming, risk-sensitive assets remain under pressure, undermining the upside potential in the Australian currency.

Australia, heavily reliant on commodity exports to China, remains particularly vulnerable to US tariffs on Chinese goods. Any slowdown in China—Australia’s largest trading partner—could impact heavily on the Aussie Dollar.

Central banks and the inflation puzzle

Fears that trade-induced inflation could prompt the Federal Reserve (Fed) to extend its tightening cycle are clashing with growing concerns over a US economic slowdown. Investors are anxiously awaiting the Fed’s policy announcement later on Wednesday, where interest rates are widely expected to remain unchanged.

Meanwhile, softer-than-anticipated US CPI figures for February have reinforced bets that the Fed might soon pivot to rate cuts if economic conditions deteriorate.

On the other side of the Pacific, the Reserve Bank of Australia (RBA) lowered its benchmark rate by 25 basis points in February, bringing it to 4.10%.

Governor Michele Bullock reiterated that further moves will hinge on inflation data, while Deputy Governor Andrew Hauser warned against assuming a swift sequence of rate cuts. Still, speculation persists that the RBA could deliver up to 75 basis points of additional easing should trade tensions escalate.

Recent RBA meeting minutes revealed policymakers debated holding rates steady versus a slight cut. While they opted for a 25-basis-point reduction, they stressed this doesn’t guarantee a full easing cycle. Officials also highlighted that Australia’s peak interest rate remains relatively low by global standards, thanks in part to the resilience of the domestic labour market. On this, the publication of the Australian jobs report on Thursday will be at the centre of the debate.

AUD/USD technical outlook

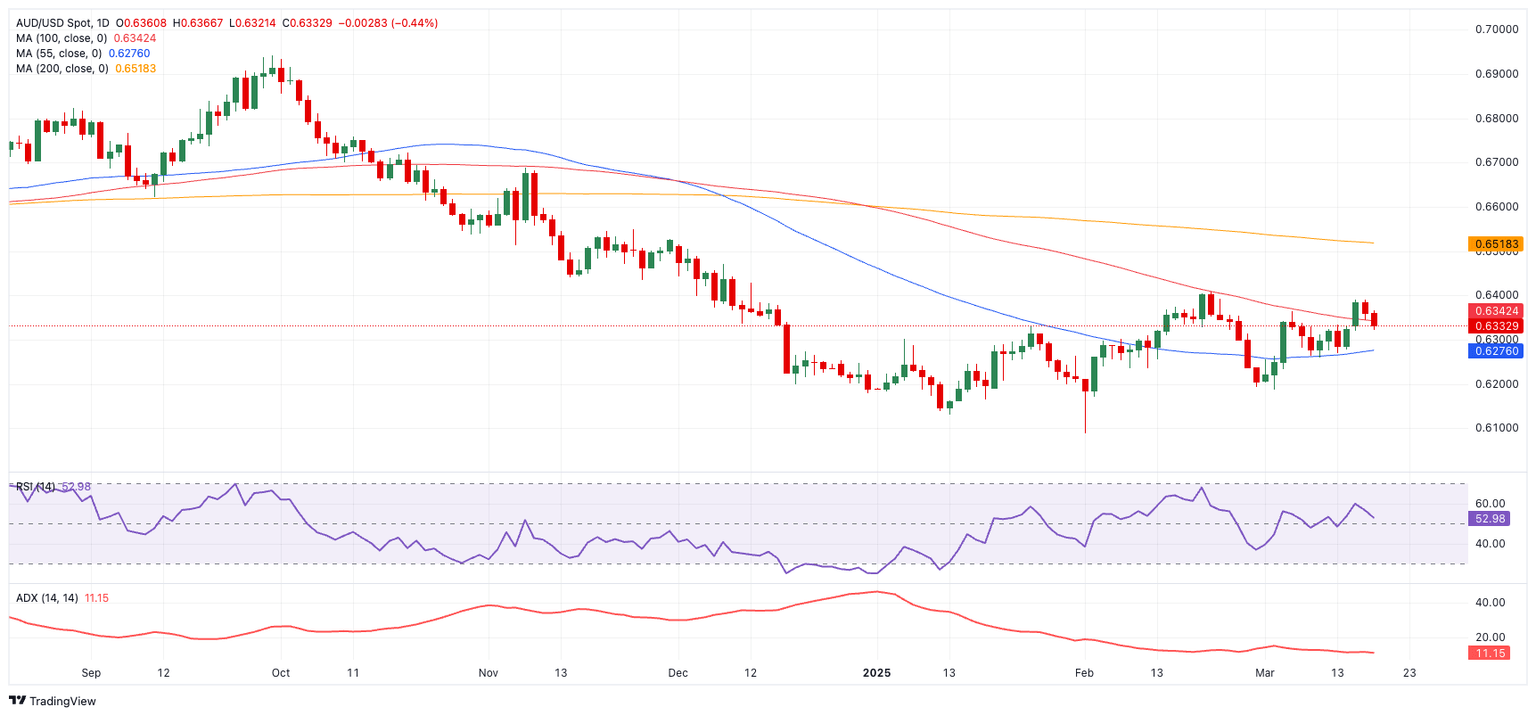

A break above the 2025 peak at 0.6408, set on February 21, could pave the way toward the 200-day Simple Moving Average (SMA) at 0.6522, with the November 2024 high at 0.6687 (November 7) as the next target.

On the downside, initial support lies at the March low of 0.6186 (March 4). A deeper pullback could aim for the 2025 trough at 0.6087, with the psychologically significant 0.6000 level looming below.

Momentum indicators present a mixed outlook. The Relative Strength Index (RSI) has slipped to 53, suggesting waning bullish momentum, while the Average Directional Index (ADX) near 11 indicates a generally weak trend.

AUD/USD daily chart

Key Data Releases Ahead

All eyes will be on Australia’s labour market report, scheduled for March 20. A stronger or weaker reading carries the potential to sway the RBA’s next policy move and set the near-term tone for AUD/USD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.