AUD/USD Price Annual Forecast: Is 2026 the year the Aussie breaks above 0.70?

- AUD/USD rebounded sharply in 2025 as the US Dollar suffered one of its steepest annual declines in decades.

- In 2026, diverging central-bank cycles could deepen as the Fed moves toward further easing while the RBA adopts a hawkish pause.

- The upcoming overhaul of Fed leadership, with Powell's departure, introduces a major institutional wildcard for the USD.

- Australia’s stable growth, sticky inflation and resilient labor market support an elevated yield advantage that could lift the Aussie further.

The year 2025 profoundly reshaped the dynamics of AUD/USD. The Australian Dollar (AUD) initially dropped under the shock of US tariff hikes, before rebounding sharply as the US Dollar (USD) weakened, undermined by a softening labor market, a Federal Reserve (Fed) forced to resume rate cuts and an unprecedented US government shutdown. In contrast, the Australian economy offered a far more stable narrative: growth close to potential, a resilient labor market and a Reserve Bank of Australia (RBA) that shifted from a cautious easing phase to a distinctly more hawkish stance by year-end.

This contrast between a solid Australia and the United States (US), mired in uncertainty, was the main driver behind the AUD/USD recovery. But 2026 looks even more decisive. The Fed is about to change face with Jerome Powell’s departure in May, US inflation remains uncomfortably high and political pressure on monetary policy is intensifying. The RBA, by contrast, seems set for a prolonged pause, with a tightening bias if inflation were to surprise again on the upside.

In a context where rate differentials, institutional credibility, and geopolitical dynamics are once again central, 2026 could mark a new phase in the balance of power between the Aussie and the US Dollar.

Australian Dollar in 2025: A pivotal year of tariff shock, US Dollar slide and domestic resilience

2025 was anything but linear for the Australian Dollar. The AUD/USD pair started the year around 0.6140, plunged in the spring on the back of tariff announcements from the Trump administration, and then gradually recovered as the US Dollar weakened. At the time of writing, the Aussie is trading near 0.6650, up about 7% YTD, after swinging between a low at 0.5914 on April 9 and a high at 0.6707 on September 17.

In the background, the US Dollar Index (DXY) dropped from 110.18 at the start of the year to a low of 96.22 on September 17, before stabilizing below the symbolic 100 level. This decline of more than 10% over the year, one of the largest since the shift to floating exchange rates, has profoundly reshaped the FX landscape and was a key driver behind the AUD’s rebound.

From tariff shock to the April low

The first major move of the year in AUD/USD came from Washington. The project of US President Donald Trump to reduce the US trade deficit “at all costs” through the steepest tariff hikes in nearly a century triggered a confidence shock. The February announcements caught markets off guard, sparking a sharp spike in risk aversion.

In that phase, the Australian Dollar was traded as a pure cyclical currency. Investors anticipated a slowdown in global trade, pressure on Asian demand – particularly from China – and cut exposure to commodity-linked currencies. AUD/USD subsequently dropped to 0.5914 on April 9, its lowest level of the year.

However, this initial risk-off move did not morph into a sustained US Dollar bull cycle. Very quickly, concerns shifted. It was no longer just global growth that was in question, but the US trajectory itself.

A US Dollar in crisis of confidence

The rest of the year was dominated by what several analysts describe as a “break year” for the US Dollar.

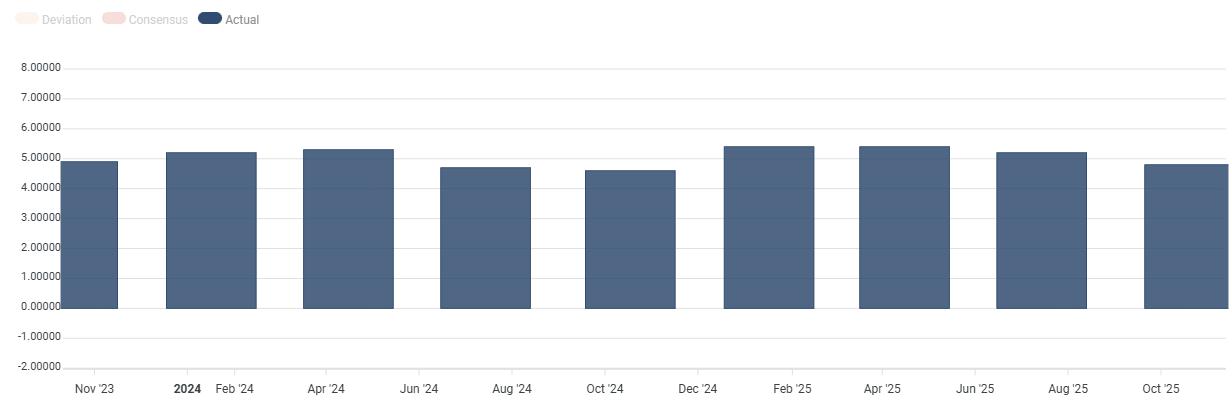

On the monetary side, the Federal Reserve, after three rate cuts in 2024, had paused at the start of 2025. But the gradual deterioration in labor market indicators forced it to restart its easing cycle from September, with three additional Fed funds rate cuts through December.

Core inflation remained uncomfortable, with Core Consumer Price Index (CPI) inflation rising back to 3% YoY in September and Core Personal Consumption Expenditures (PCE), the Fed’s preferred gauge, rebounding to 2.8%, moving further away from the central bank’s 2% target and, in theory, arguing for more caution.

However, the Fed’s center of gravity shifted. Employment took precedence over inflation. Nonfarm Payrolls (NFP) collapsed from 323,000 in December 2024 to 111,000 in January, then printed several particularly weak months, including net job losses in June (13,000) and August (4,000). The Unemployment Rate rose to 4.4% in September, increasing both political and economic pressure for lower rates to support the labor market.

As UOB succinctly puts it, “The Fed’s policy focus is likely to pivot according to a softening labor market, as unemployment - currently at a four-year high of 4.4% - continues to strike recession fears.”

This tension weighed on the US Dollar, as investors began to price in not a prolonged pause but a longer and deeper rate-cutting cycle than previously anticipated.

On top of this monetary fragility came an institutional shock: the longest US government shutdown in history, from October 1 to November 12. For more than six weeks, the publication of many official statistics, especially on employment, was halted or delayed, leaving the Fed and markets in partial data darkness. This ‘data blackout’ fuelled doubts about the true state of the economy and intensified selling of the USD.

JPMorgan underlines the unprecedented magnitude of the DXY move in H1 2025: “In 1H25, the US Dollar (DXY index) fell 10.7%, marking its worst performance for this period in over 50 years (…) Slower US growth, rising deficits, policy uncertainty, and changing global capital flows (…) are driving the US Dollar weakening.”

BNP Paribas goes further and explicitly questions US “exceptionalism”, noting that: “The questioning of US exceptionalism and the growing risk of a deterioration in the US economic outlook are limiting demand for US assets. The interest rate differential is not supportive of the USD.”

At Standard Chartered, Manpreet Gill writes that: “The 2025 fall has been among the steepest in recent years (…) we are of the view that further weakness is yet ahead, albeit after a breather,” insisting that the 2025 episode is not necessarily an endpoint, but could mark the start of a multi-year USD depreciation cycle.

The combination of aggressive tariffs, doubts over debt sustainability and persistent questions around the Fed’s independence, as Trump repeatedly pressured Fed Chair Jerome Powell to cut rates, has started to erode the USD’s status as an unquestioned safe haven. Without overturning its role as the dominant reserve currency, these doubts were enough to trigger a reallocation phase into non-US currencies and assets.

In this environment, USD weakness became a major tailwind for the AUD, which benefited from each Fed rate cut and every bout of political uncertainty in Washington.

A solid Australian economy, but without excess

Against this sweeping US narrative, the Australian story looks almost banal, and that is precisely what allowed the AUD to rebound credibly.

The Australian economy delivered in 2025 what could be described as “cruising speed” growth. Gross Domestic Product (GDP) accelerated from 1.4% YoY in Q1 to 2.1% in Q3, in line with the Reserve Bank of Australia’s projections. The Manufacturing and Services Purchasing Managers’ Indexes (PMI), at 51.6 and 52.8 in November, respectively, sat in expansion territory, reinforcing the idea of an economy that is neither spectacular nor alarming, but solid enough to absorb still-restrictive rates.

The labor market also acted as a stabilizer. Despite a modest increase in the Unemployment Rate from 4.1% in January to 4.3% in November, the overall level remains historically reasonable. The RBA describes a labor market that is “a little tight”, but normalizing via fewer new job postings rather than a wave of mass layoffs.

On the monetary front, the Reserve Bank of Australia followed a clear but cautious path. After holding its cash rate at 4.35% throughout 2024, it began its cutting cycle in February 2025, bringing the interest rate down to 3.60% by August, and then paused. This sequence marked the first phase of an adjustment toward a more neutral rate as inflation moved back toward the target.

But the story changed at the end of the year. Headline inflation, measured by the Consumer Price Index (CPI), which had fallen back to 1.9% YoY in July, re-accelerated to 3.8% in October. The key gauge for the central bank, Trimmed Mean CPI, rose from 2.8% YoY to 3.3% in the same period, pushing back above the 2%-3% target band.

In its December assessment, the RBA stressed that risks had “clearly shifted to the upside” on inflation. Governor Michele Bullock hammered home a central message: “There are no rate cuts on the horizon for the foreseeable future; the choice is between an extended hold and, if necessary, a hike.”

Analysts at WATC summarize this tonal shift by describing the December meeting as a “hawkish wait-and-see”. The RBA is giving itself time to observe incoming data, but is determined not to fuel expectations of a quick return to an accommodative stance.

For AUD/USD, this stance matters. While the Federal Reserve is already engaged in a rate-cutting cycle that could extend further, the RBA retains the option to tighten again if inflation surprises persist. The divergent perception of the two central banks has supported the Australian Dollar for the last three months.

China: A quiet but valuable source of support for the Aussie

China remains a key backdrop for the Australian Dollar, even if 2025 bears little resemblance to the boom years when Chinese demand almost automatically set the tone.

With GDP growth at 4.8% YoY in Q3, Retail Sales up 2.9% YoY in October, and inflation barely back in positive territory, the Chinese economy looks moderately supportive for Australia. The latest PMIs are mixed. The official Manufacturing Index fluctuates just below 50, private surveys show small export-oriented firms under pressure, and Services are growing but without exuberance.

For the AUD, this means China is acting more like a safety net than a performance driver. Commodity flows and bilateral trade remain solid, but do not generate either euphoric upside or systemic downside fear. In this context, the AUD has been driven far more by the Fed–RBA–USD triangle, with China playing a stabilizing role in the background.

What shaped AUD/USD in 2025

To sum up, AUD/USD in 2025 was defined by a sharp US tariff shock that initially drove the Aussie lower in April, before a broader loss of confidence in the US Dollar took over. Trade tensions, institutional uncertainty, a weakening US labor market and the prolonged government shutdown progressively eroded the Greenback’s appeal.

At the same time, Australia’s economy proved resilient with steady growth, a solid labor market, and a more hawkish RBA than the Fed, which helped the AUD recover as USD momentum faded.

China added a layer of quiet stability. Not strong enough to boost the Aussie on its own, but supportive enough to keep downside risks contained.

This configuration sets up the central question for 2026: Did the Aussie simply benefit from a one-off USD accident, or are we entering a structurally more favorable environment for the Australian Dollar against the US Dollar?

Australian Dollar in 2026: Between hawkish RBA signals and a softening US Dollar

If 2025 was a year of progressive recovery for the Australian Dollar, 2026 will determine whether AUD/USD can settle into a new regime of sustained appreciation. The equation is not straightforward. It does not depend only on tensions or easing in Australia, but on a cluster of global dynamics that converge, or at times conflict, around a central player: the US Dollar.

In fact, it is the reshaping of US monetary policy, even more than that of the Reserve Bank of Australia, that is likely to set the tone for the pair in the new year.

The United States in 2026: Late-cycle dynamics, sticky inflation and a Fed under new leadership

The US economy enters 2026 with a mixed profile. According to the Fed’s revised projections in December, growth is expected to climb back toward 2.3% as the recessionary drag from tariffs fades and the Fed’s rate cuts begin to feed through. But this rebound masks an uncomfortable reality, as inflation refuses to return to the 2% target, and a labor market that was extremely tight for years now shows clear signs of fatigue.

This puts the Federal Reserve in a tricky position, trying to support an economy that is slowing without reigniting inflationary momentum.

And this is precisely the context in which an event arrives that could, by itself, reshape the USD’s trajectory: Jerome Powell’s departure and the arrival of a Trump-appointed Fed Chair in May 2026.

Kevin Hassett, Trump’s top economic adviser at the White House, has the edge in the race to become Fed chair, but former Fed Governor Kevin Warsh has gained traction as another alternative that appeals to Trump.

Hassett, a long-time economic adviser to the Republican camp, is perceived as distinctly more dovish than Powell. He has repeatedly argued for “pro-growth” monetary policy and subscribes to the idea that interest rates should be kept low to support domestic investment. This change could weigh heavily on the USD.

A UOB analyst puts it this way: “If the Fed shifts toward a governance more favorable to low rates, markets will start to price in a much lower terminal point for the cycle, which will anchor sustained downward pressure on the Dollar.”

Markets have already started to anticipate this shift. Rate expectations derived from money-market pricing, particularly Overnight Index Swaps (OIS), which reflect investors’ views on future policy rates, now suggest that the Fed should bring its terminal rate down to around 3%–3.25%. The CME FedWatch tool shows that investors now assign a 31.8% chance to the Fed funds rate falling to 3.00%-3.25% by December 2026, effectively signaling expectations of two additional rate cuts.

This arithmetic creates a classic recipe for a structurally weaker USD, via rate differentials, political risk and weakening domestic fundamentals.

The USD versus the world: Weakened leadership and declining financial appeal

In the new global environment of 2026, the USD no longer plays quite the centripetal role it has held since the 2008 crisis. US trade policy, characterized by high tariffs and a sometimes confrontational economic diplomacy, has reduced the appeal of US assets for part of the institutional investor base. The extended government shutdown at the end of 2025 also undermined confidence in US institutional continuity.

The result is a reconfiguration of global capital flows, with funds no longer automatically rushing into the United States whenever uncertainty rises. ING, for example, describes a more fragmented FX landscape in 2026, where “the absence of a dominant USD theme leaves more room for currencies with solid fundamentals.”

The Australian Dollar fits neatly into this new map.

A relatively stable Australia in an unstable world: A contrast that supports the AUD

Against the US slowdown, Australia almost looks like an island of stability. Growth is running around 2% based on the 2025 pace, a level very close to the Australian economy’s estimated potential according to the RBA. This dynamic is far from spectacular, but it has the advantage of being predictable, a rare quality in today’s macro environment. Inflation, though still too high, is far less explosive than in the US.

The monetary policy, now more cautious, has anchored expectations for the Cash Rate around 3.6%, though markets have recently begun to price a modest risk of tightening. According to the ASX RBA Rate Tracker, the chance of a 25 basis-point rate hike in February 2026 has climbed from 0% to 27% in a matter of days, reflecting the recent RBA’s hawkish tone.

In this game of mirrors, the comparison becomes crucial. Australia does not need to deliver exceptional growth to attract foreign capital, it simply needs to look less fragile than the United States, and that appears to be the case heading into 2026.

Consumption, in particular, is recovering more convincingly than in Europe or North America. The labor market remains solid, housing and energy-transition investment flows are picking up again, and exports benefit from a China whose growth path is stabilizing around 4.5%.

Even though risks remain, notably in the event of renewed tariff tensions, the overall picture is that the AUD enjoys a more predictable domestic backdrop than the USD.

As an ING strategist notes, “The Australian Dollar enters 2026 with a macro-fundamental mix superior to that of many G10 currencies”, an advantage in a fragmented FX landscape.

Rate differentials and carry: Central engines for AUD/USD in 2026

Historically, AUD/USD has been extremely sensitive to short-term rate differentials. And 2026 is likely to see that differential move significantly in favor of the AUD. If the Fed continues to cut, reinforced by a more dovish leadership after May, while the RBA keeps its cash rate around 3.6%, Australia would offer one of the most attractive real yields in the G10, drawing in carry-trade capital flows.

In other words, relatively higher yields on AUD assets become a central driver, as capital tends to flow toward the currency that pays more, which in turn supports that currency’s appreciation.

China: The key external risk for the Australian Dollar in 2026

Although the global backdrop increasingly favors a structurally firmer Aussie, one major risk could still derail the AUD’s trajectory in 2026: a sharper-than-expected slowdown in China. The Chinese economy remains a key anchor for Australia through commodity demand, tourism flows and investment linkages. If China’s momentum weakens materially, the impact on Australia’s export engine could be immediate.

Such a scenario would not only weigh on Australia’s growth outlook but could also reduce the perceived resilience that has supported the AUD against the USD. A drop in Iron Ore demand or renewed contraction in China’s Manufacturing PMIs would likely translate into lower terms of trade, softer business sentiment, and reduced carry appetite for the AUD.

In that sense, while domestic fundamentals and central-bank dynamics favor the Australian Dollar, China remains the prominent external wildcard that could cap or delay its appreciation path in 2026.

AUD/USD 2026 Technical Analysis: A major breakout is brewing

The AUD/USD pair has extended its rally and is starting to show notable signs of a bullish reversal, still in need of confirmation, but increasingly credible.

The Aussie has repeatedly found support around the 0.6400 area since May. This zone corresponds to the 23.6% Fibonacci retracement of the decline from the February 2021 high to the April 2025 low, while the 50-week Simple Moving Average (SMA), currently near 0.6435, has reinforced that support.

On the topside, key historical resistances are now being challenged. The 200-week SMA, currently around 0.6642, and a long-term descending trendline drawn from the February 2021 high, now intersecting near 0.6640, are in the process of giving way. If the bullish momentum above these levels is confirmed, it could signal the start of a more sustained upside reversal in 2026.

The first notable resistance zone lies around the 2025 high at 0.6707, reinforced by the 38.2% Fibonacci retracement at 0.6714. Beyond that, the pair could face another major resistance cluster near the 2024 high at 0.6942 and the 50% Fibonacci retracement at 0.6961.

On the downside, a break back below the trendline would undermine the bullish structure and expose the pair to a return toward the 0.6400 area. A decisive move below that zone would likely signal the return of stronger bearish pressure, bringing the 2023 low at 0.6270 and the 2022 low at 0.6170 back into view.

The Relative Strength Index (RSI), rising and hovering around 60, supports the bullish bias on AUD/USD but also suggests some caution.

Conclusion

After a 2025 marked by deep fractures in the global macro-financial balance, the AUD/USD pair heads into 2026 with a much more evenly balanced playing field. The Australian Dollar has shown it can benefit from a volatile global environment as long as the domestic economy remains resilient and the Reserve Bank of Australia maintains a stance that is more credible and more predictable than that of the Federal Reserve. Conversely, the US Dollar, weakened by a dual monetary and institutional shock, is entering a transition phase whose outcome will depend largely on the Fed’s new leadership, the behavior of US inflation and the coherence of economic policy in Washington.

2026 is unlikely to be a calm year, but it offers AUD/USD a framework that is more conducive to sustained directional moves. Rate differentials, central-bank trajectories and the ability of the US and Australian economies to preserve their respective stability will be the key drivers of the trend.

If current signals hold – a more accommodative Fed, a more vigilant RBA, a less dominant USD – the Aussie could well extend its recovery. But in an environment where political tariffs and geopolitical shocks remain frequent, volatility will be an unavoidable traveling companion.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.