A decent core retail sales report, but momentum poised to slip

Summary

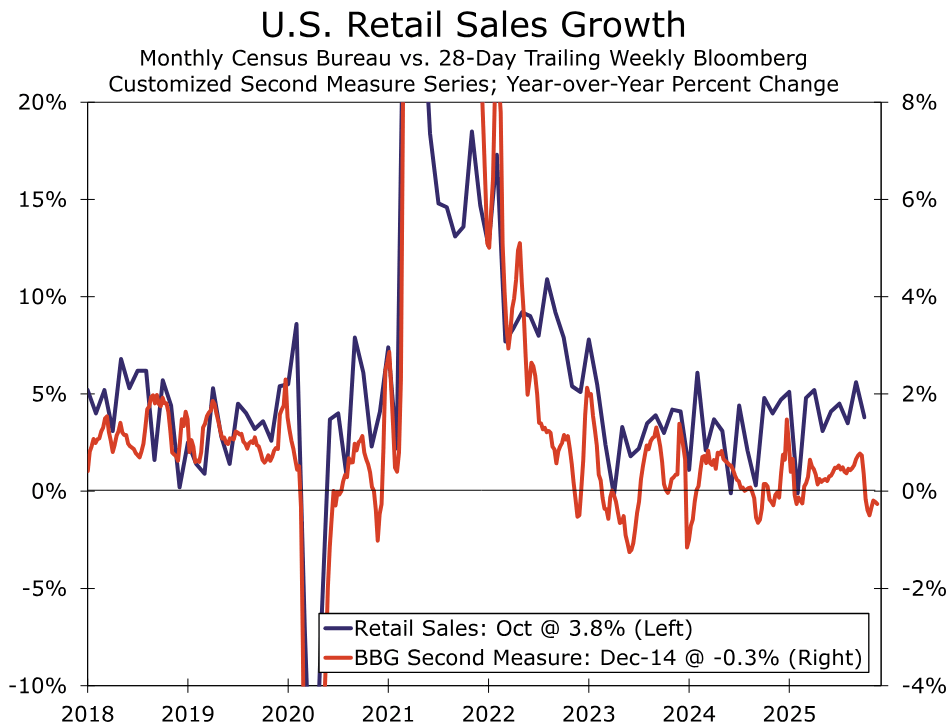

Underlying details of the October retail sales report are in-line with our Holiday Sales forecast and slightly stronger Q4 PCE growth than the 1.0% rate we have in our current forecast. Look out though, higher frequency data points to some slippage in spending in November and December.

Strength beneath the headline

On the face of it, the retail sales report for October was a dud, but the underlying details offer more encouraging signals for Q4 consumer spending and an elevated starting point for the critical two-month stretch for holiday sales.

The headline miss (0.0%) is entirely due to autos, which slipped 1.6%, reflecting payback after a pull-forward ahead of tariffs and then expiring tax credits (chart). Ex-autos, sales surprised to the upside and control group sales, which track well with broader goods consumption, came in even stronger (up 0.8%), suggesting a more solid start to Q4 consumer spending than our 1% CAGR forecast accounts for.

Author

Wells Fargo Research Team

Wells Fargo