AUD/USD outlook: Aussie Dollar falls on post-Fed risk aversion

AUD/USD

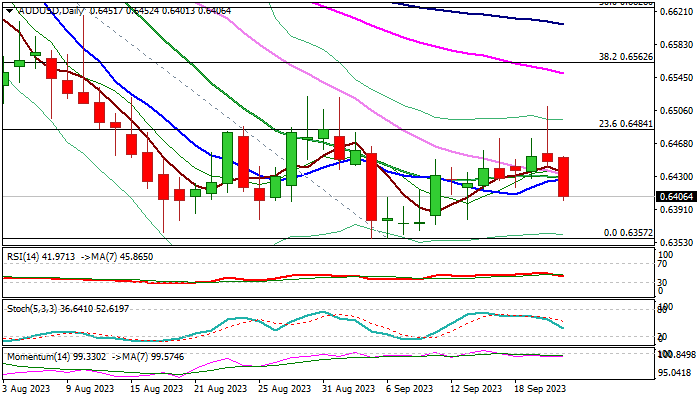

AUDUSD was down 0.7% in Asian/European trading on Thursday, extending post-Fed drop (falling in total 1.6% since FOMC announcement).

Fed’s hawkish hold, in which the central bank kept interest rates unchanged but signaled one more hike until the end of the year and likelihood of keeping high interest rates through 2024, sparked fresh risk aversion, prompting traders into dollar.

Technical structure on daily chart is weakening, following Wednesday’s strong upside rejection and formation of bull-trap pattern, as fresh acceleration lower already retraced over 61.8% of the recent 0.6357/0.6511 bull-leg).

Daily moving averages returned to bearish setup and 14-d momentum is heading deeper into negative territory, contributing to negative near-term signals.

Daily close below broken10DMA (0.6426) is needed to keep bears intact for renewed attack at near-term base at 0.6360 zone (2023 lows), violation of which would signal an end of a multi-week congestion and continuation of larger downtrend from 0.6894 (July 14 high).

Res: 0.6426; 0.6452; 0.6484; 0.6511.

Sup: 0.6380; 0.6357; 0.6272; 0.6210.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.