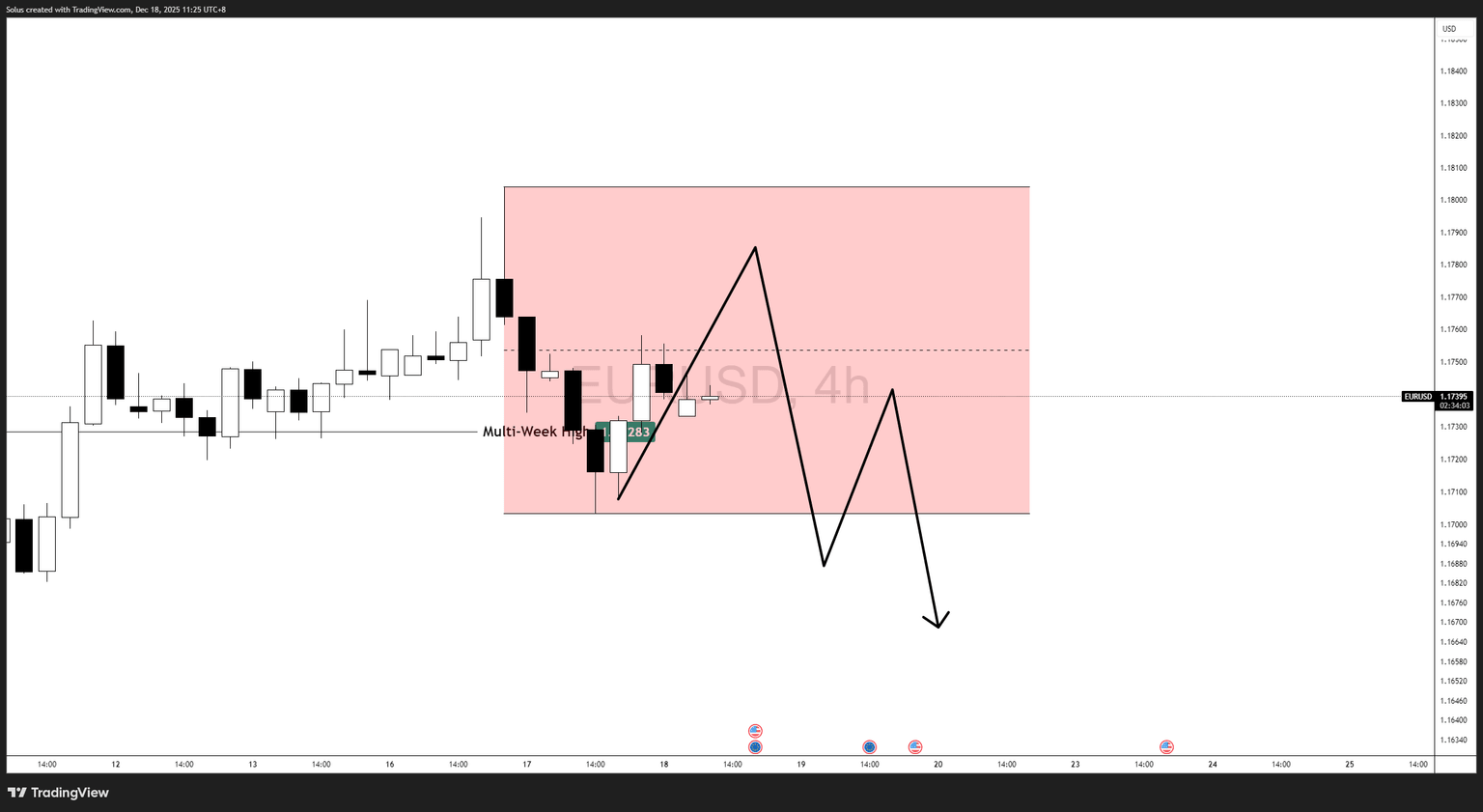

EUR/USD forecast: Bulls hold control above 1.1728 as price ranges

- EUR/USD remains structurally bullish, holding above the 1.1728 multi-week high despite entering a consolidation phase.

- Dollar softness and narrowing Fed-ECB policy divergence continue to provide a supportive backdrop for euro strength.

- Technical bias favors continuation, with strength expected to return if price reclaims and holds above equilibrium (range midpoint).

EUR/USD market narrative – Consolidation, not reversal

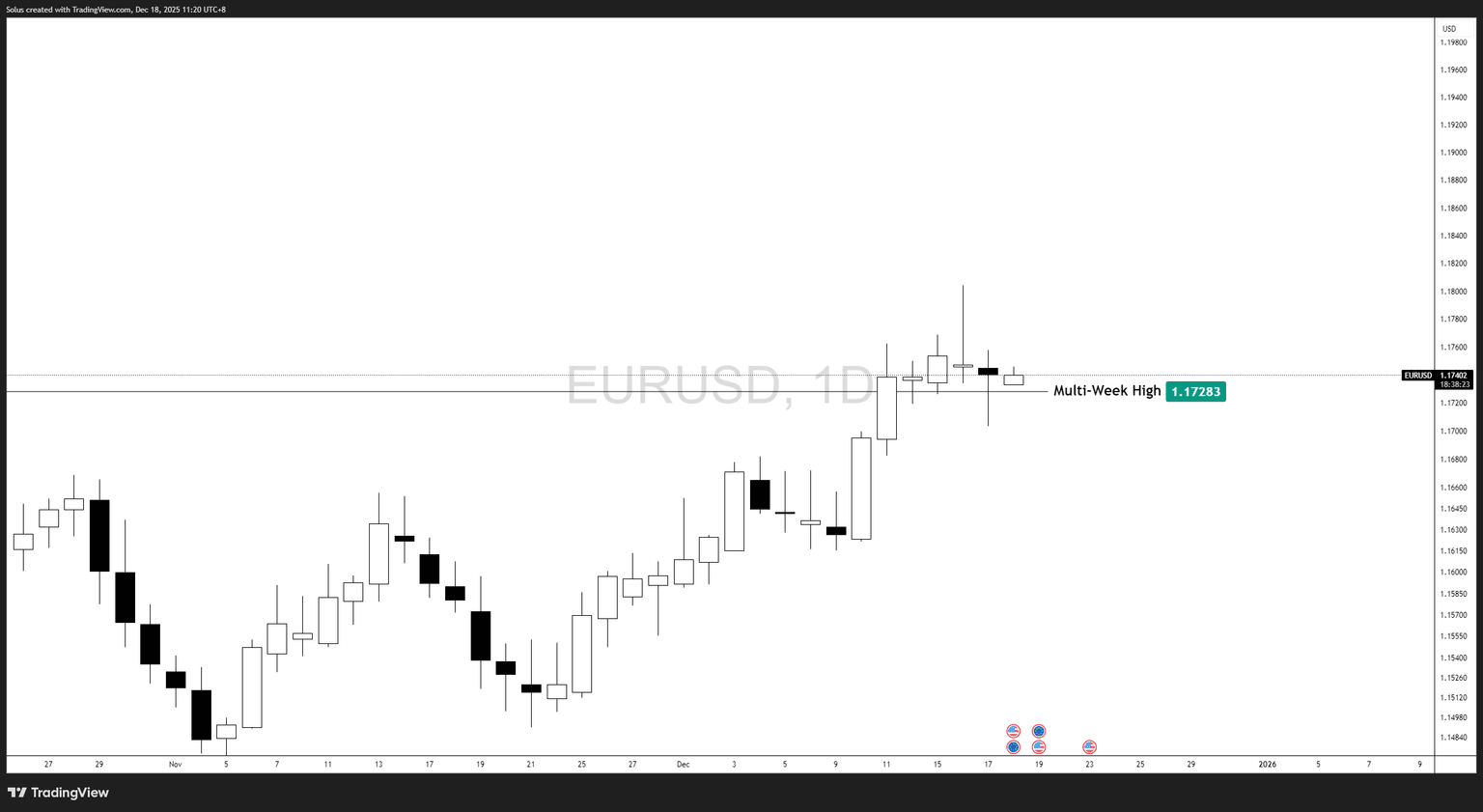

EUR/USD is currently transitioning from impulsive expansion into balance, consolidating above the 1.1728 multi-week high. This behavior reflects acceptance at higher prices, rather than exhaustion or trend failure.

After reclaiming a key structural level, the market has paused to allow two-sided trade — a natural and healthy process in trending environments. Importantly, price has not collapsed back below prior resistance, nor has it shown aggressive distribution. Instead, EUR/USD is oscillating within a defined range, signaling re-pricing rather than rejection.

From a macro perspective, this consolidation is occurring against a backdrop of persistent USD softness. The Federal Reserve’s shift toward rate cuts and a more data-dependent stance has reduced the dollar’s yield advantage, while expectations for aggressive ECB easing remain restrained. This narrowing policy divergence continues to favor EUR/USD on a medium-term basis.

As a result, the current price action should be viewed as digesting gains, not undoing them.

How the previous EUR/USD forecast materialized

The prior EUR/USD forecast did not call for immediate continuation higher. Instead, it emphasized that acceptance above the multi-week high would be more important than chasing momentum.

Specifically, the expectation was for:

- A pullback or consolidation above 1.1728

- Shallow retracements rather than structural failure

- A pause that allows the market to rebalance before the next move

That scenario has materialized cleanly.

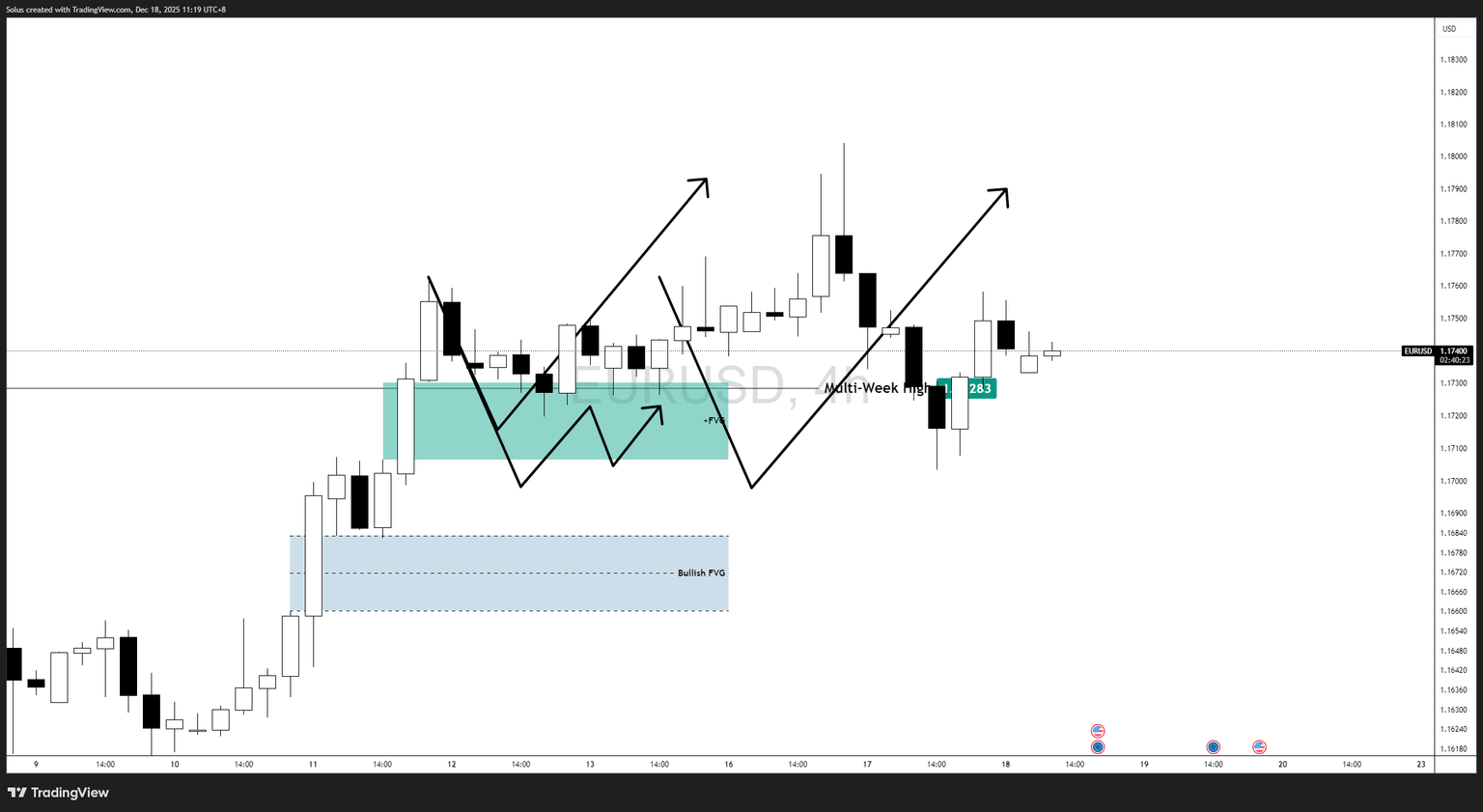

Following the breakout, EUR/USD pulled back into the highlighted re-pricing zone, held above the multi-week high, and formed higher lows rather than accelerating lower. Sellers failed to force acceptance back below prior resistance, while buyers consistently absorbed downside pressure.

This confirms that the breakout was structural, not false. The current consolidation reflects controlled digestion, aligning with the original expectation that the market would pause before determining its next expansion leg.

In short, the market followed process, not prediction — rewarding patience and structural alignment rather than aggressive positioning.

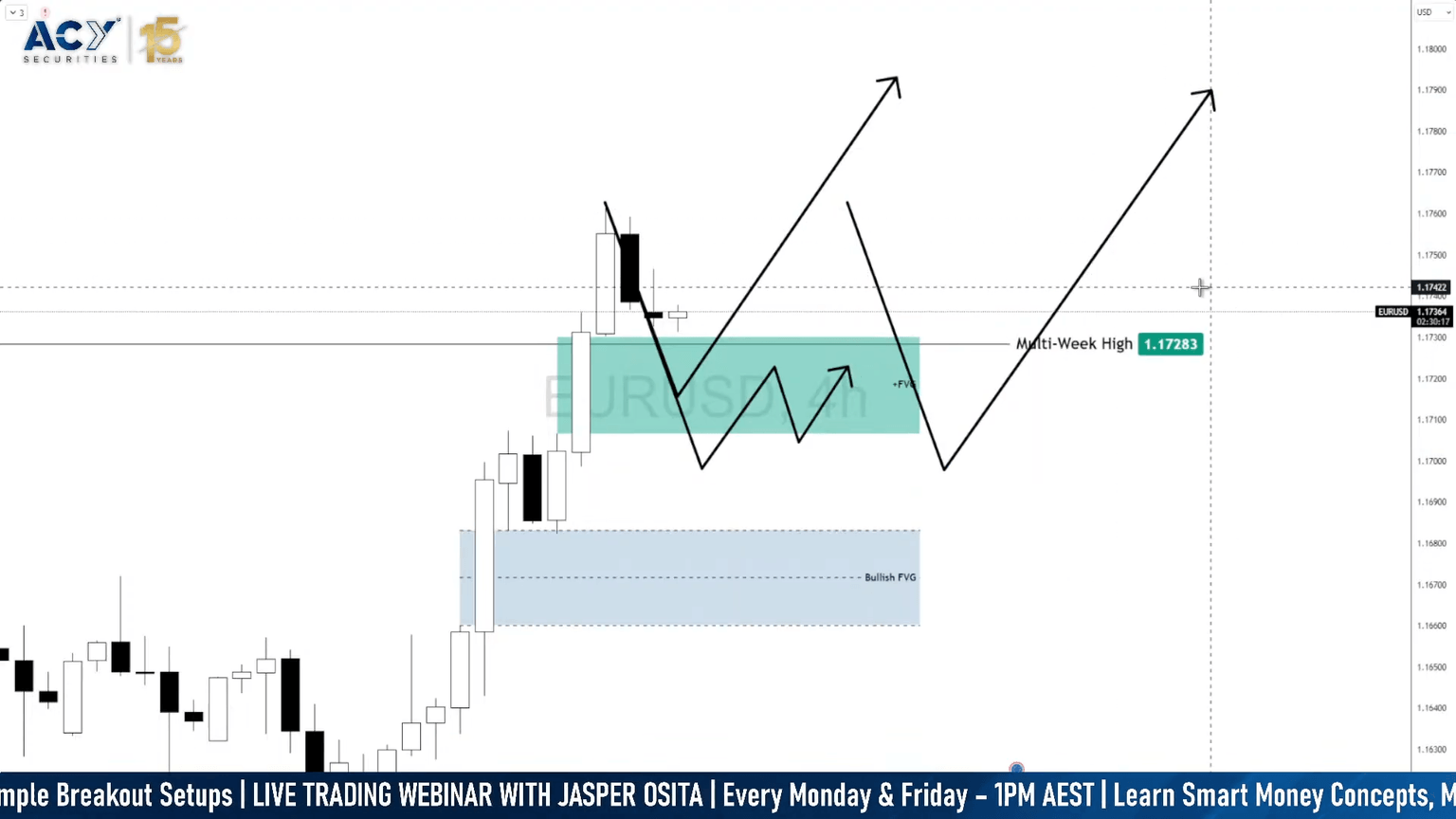

Technical structure – Balance around key levels

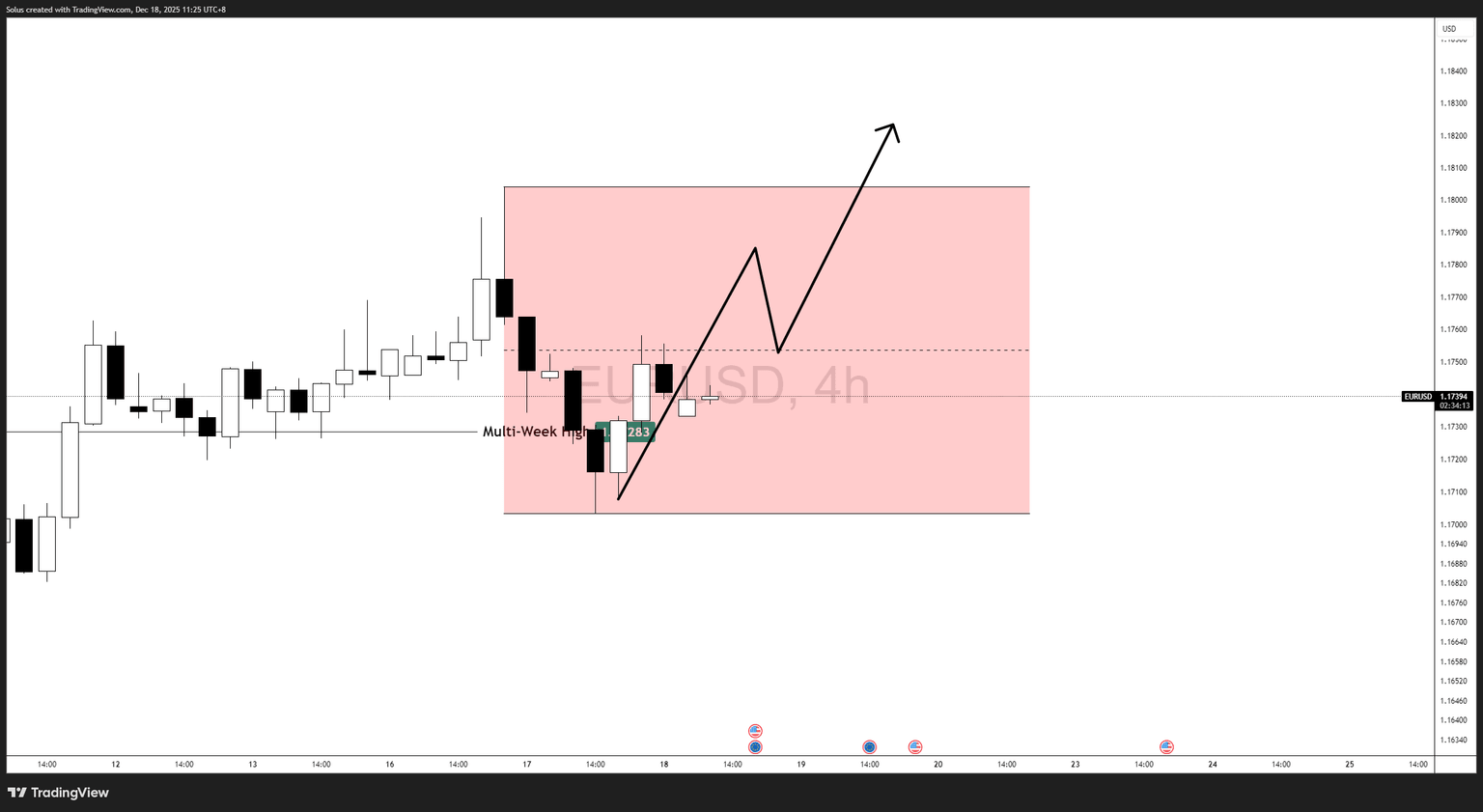

EUR/USD is now trading inside a defined range, with both buyers and sellers actively participating. In this environment, the most important reference is no longer the highs or lows — but equilibrium, or the middle of the range.

Equilibrium represents fair value. How price behaves around this level reveals intent.

Bullish scenario – Strength returns above equilibrium

The bullish scenario re-engages if EUR/USD breaks above the equilibrium level and holds above it.

Acceptance above the midpoint of the range signals that buyers are willing to transact at premium prices, not just defend the lows. In strong trends, equilibrium often acts as a launchpad, not resistance.

If price reclaims equilibrium and stays above it:

- Higher-timeframe bullish structure remains intact.

- Liquidity below has already been absorbed.

- Momentum can re-expand without revisiting range lows.

- USD weakness and narrowing rate differentials reinforce upside pressure.

Bullish expectation:

Rotation toward the range high, followed by a potential continuation toward new multi-week highs if momentum builds.

Bearish scenario – Deeper rebalancing below equilibrium

The bearish scenario develops if EUR/USD fails to reclaim equilibrium and consistently trades below the midpoint of the range.

In this case, equilibrium acts as resistance, suggesting sellers control fair value. This would likely lead to:

- Further rotation toward the lower boundary of the range.

- A deeper corrective move into prior demand.

- Short-term bearish momentum.

However, it is critical to distinguish correction from reversal. Even a sustained move below equilibrium would still be considered rebalancing, unless broader daily structure breaks decisively.

Final thoughts

EUR/USD is not weakening — it is pausing with structure intact.

The market is currently balanced, and equilibrium is the line that separates continuation from deeper correction. Acceptance above it favors renewed strength, while failure keeps price rotational.

Until that decision is made, patience remains the edge.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.