AUD/USD Forecast: Steeper decline on a break below 0.6980

AUD/USD Current Price: 0.7025

- Renewed fears of a global economic setback benefited the greenback on Monday.

- The Reserve Bank of Australia will publish the Minutes of its latest meeting on Tuesday.

- AUD/USD is gaining bearish traction but still trading above the 0.7000 threshold.

The AUD/USD pair trades around 0.7020, down on Monday amid renewed greenback demand. The pair shed roughly 90 pips throughout the first half of the day, mainly affected by renewed recession concerns. Tepid Chinese data and an unexpected rate cut from the local central bank put investors on alert as the country struggles to recover its pre-pandemic growth levels. The pair spent most of the US session consolidating in a tight range, as the positive tone of US equities limited the downside for AUD/USD.

On Tuesday, the Reserve Bank of Australia will publish the Minutes of its latest monetary policy meeting. On August 2, the central bank decided to hike the cash rate by 50 bps to 1.85%, as inflation in the country stands at levels last seen in the early 1990s. According to Governor Philip Lowe, the Board "places a high priority on the return of inflation to the 2–3 per cent range over time, while keeping the economy on an even keel." Lowe added that future rate increases would depend on incoming data and the Board's assessment of the outlook for inflation and the labour market.

AUD/USD short-term technical outlook

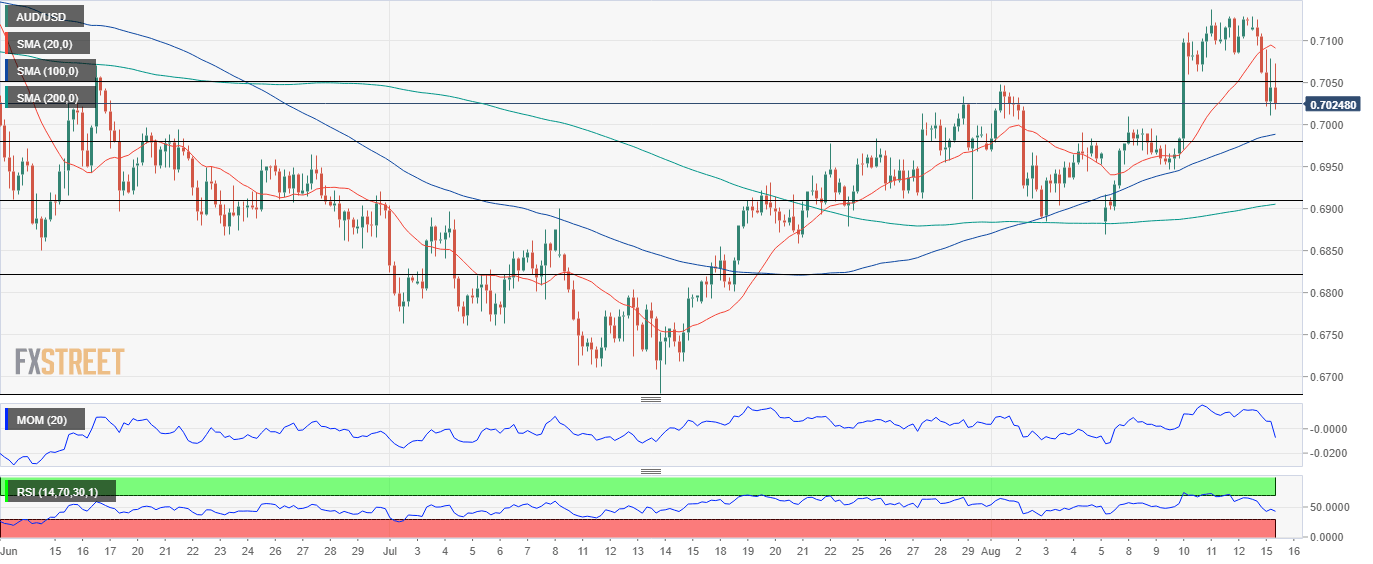

According to the daily chart, the AUD/USD pair is at risk of falling further. It has broken below its 100 SMA, which heads south, while technical indicators also turned lower, holding within positive levels. The 20 SMA, in the meantime, maintains its bullish slope below the current level, converging with Fibonacci support at 0.6980, the 50% retracement of the June/July decline.

The 4-hour chart shows that technical indicators keep heading lower near oversold readings, hinting at a bearish continuation. Additionally, the pair is trading below a now flat 20 SMA, while the 100 SMA maintains its bullish slope, also converging with the aforementioned Fibonacci support. A breakthrough of 0.6980 should open the door for a steeper decline towards the 0.6900 price zone.

Support levels: 0.6980 0.6940 0.6900

Resistance levels: 0.7050 0.7090 0.7040

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.