AUD/USD Forecast: Dovish RBA and firmer greenback hint on further slides

AUD/USD Current Price: 0.7703

- The RBA maintained its monetary policy unchanged, despite noting economic improvement.

- Equities fell while US Treasury yields retreated, favoring the greenback.

- AUD/USD is gaining bearish strength and could soon retest the year low at 0.7531.

The AUD/USD pair trades around the 0.7700 level after falling to 0.7674, its lowest since mid-April. The Reserve Bank of Australia had a monetary policy meeting early on Tuesday, and as widely anticipated, policymakers left rates at record lows. The central bank pledged to maintain its current supportive policy, despite the rapid economic recovery. Policymakers upgraded their growth forecast to 4.75% for this year, while they now expect the unemployment rate to decline to around 5% in 2021 and to 4.5% in 2020. The RBA reiterated that rates would likely remain low at least until 2024.

Australia also published its March Trade Balance, which posted a surplus of 5574M, missing the market’s expectations as exports declined 2% while imports were up 4%. Early on Wednesday, the country will publish the April AIG Performance of Construction Index, previously at 61.8, and the Commonwealth Bank Services PMI for the same month, foreseen at 58.6. Later in the day, the country will release March Building Permits.

AUD/USD short-term technical outlook

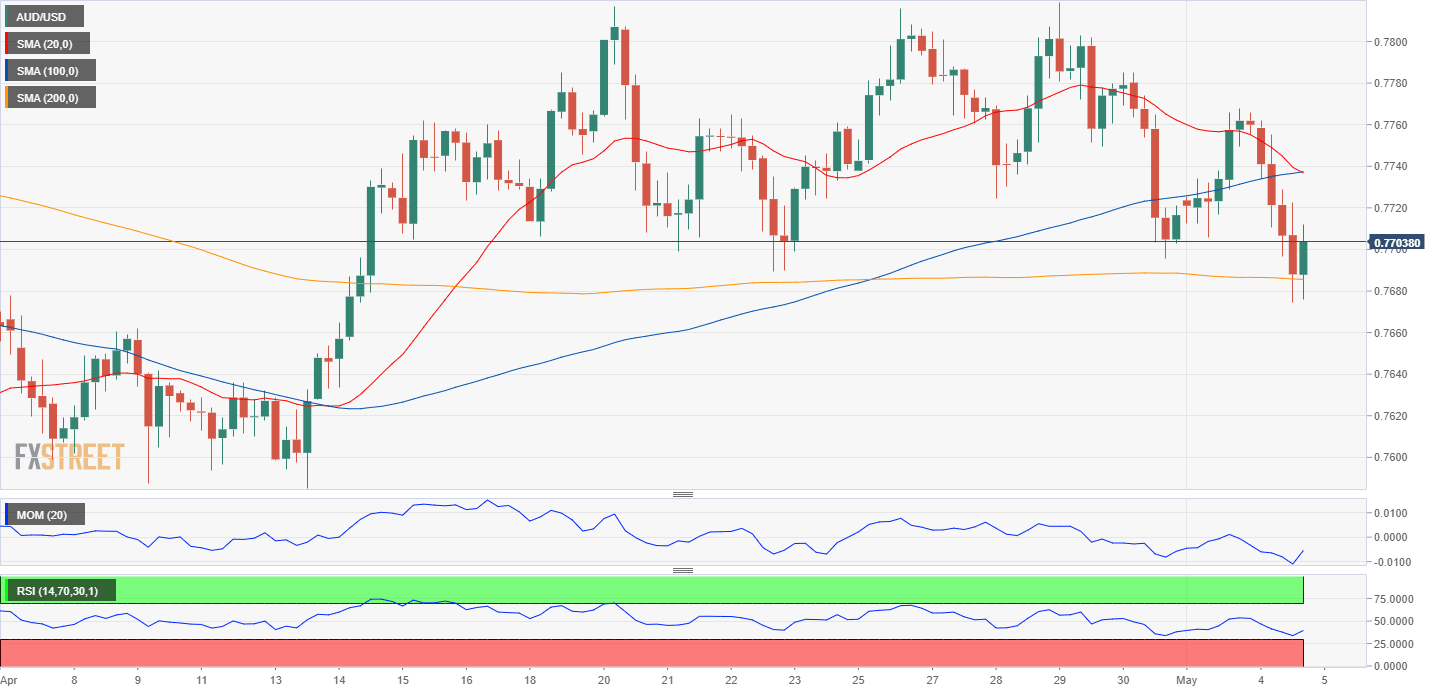

The AUD/USD pair is at risk of falling further, according to near-term technical readings. The 4-hour chart shows that the pair is below its 20 and 100 SMAs, with the shorter one heading firmly lower. Technical indicators are recovering within negative levels but with limited bullish strength. Renewed selling pressure below the mentioned daily low may see the pair extending its slide towards 0.7531, this year low.

Support levels: 0.7675 0.7630 0.7590

Resistance levels: 0.7730 0.7775 0.7820

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.