AUD/USD Forecast: China still the biggest risk for the Aussie

AUD/USD Current Price: 0.6626

- Australian data disappointed, business output contracted in February.

- Coronavirus concerns to keep limiting Aussie’s bullish potential.

- AUD/USD at risk of falling to fresh multi-year lows below 0.6600.

The AUD/USD pair bounced sharply from a multi-year low of 0.6585 on Friday, ending the day up, but the week down in the 0.6620 price zone. The pair fell as the Australian Commonwealth Bank Services PMI fell to 48.4 in February, while the Commonwealth Bank Manufacturing PMI climbed to 49.8 in the same month, according to preliminary estimates. The Composite index came in at 48.3, below the previous 50.2 and indicating contracting output in the country. Dismal US data triggered the late recovery, although the advance was limited by plummeting equities, this last weighed by persistent coronavirus concerns.

Australia won’t release macroeconomic figures this Monday, although China has tentatively scheduled the release of January Industrial Production and Retail Sales. If Chinese data disappoints, the pair could well fall to fresh multi-year lows.

AUD/USD short-term technical outlook

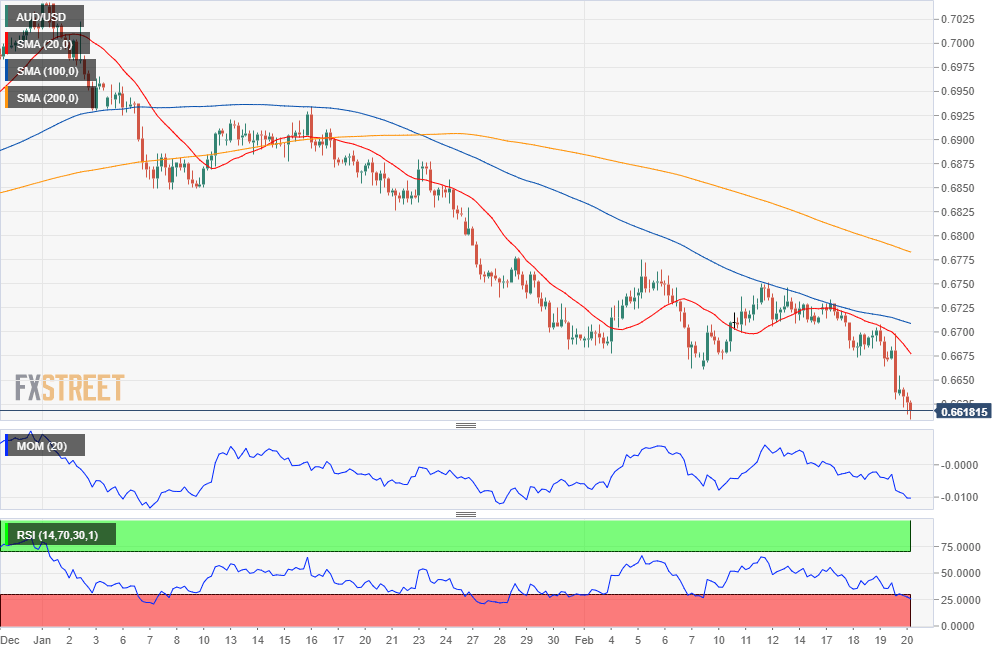

The AUD/USD pair is bearish, according to the daily chart, trading well below all of its moving averages and with the 20 DMA maintaining its strong downward slope. Technical indicators in the mentioned chart remain within negative levels, the Momentum consolidating below its 100 line and the RSI hovering around 30. In the 4-hour chart, technical indicators have corrected extreme oversold readings, although the RSI has already lost strength upward, both holding within negative levels, the 20 SMA retains its bearish slope, providing immediate resistance at around 0.6650.

Support levels: 0.6600 0.6570 0.6525

Resistance levels: 0.6650 0.6680 0.6710

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.