AUD/USD Forecast: After rising over 600 pips, the worsening corona-crisis points to fresh falls

- AUD/USD has surged alongside broader markets amid massive monetary and fiscal stimulus.

- Coronavirus-related headlines, US Non-Farm Payrolls, and other figures are eyed.

- Late March's daily chart is suggesting the falls could resume after the correction.

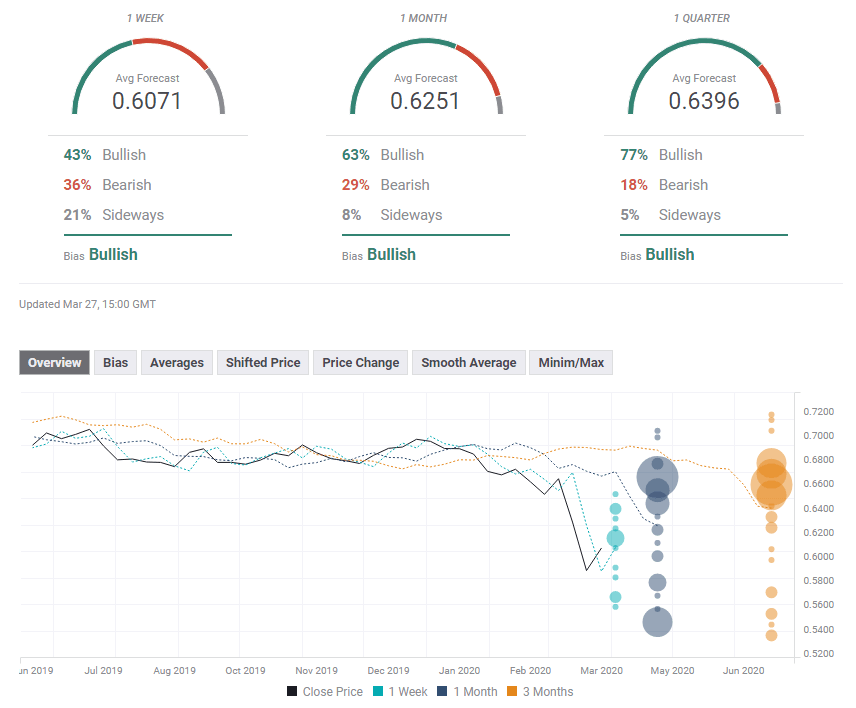

- The FX Poll is pointing to gains on all timeframes.

AUD/USD surged over 10% from the bottom – but still trades below levels seen earlier this month. A mix of fiscal and monetary stimulus raised the market mood despite the spread of coronavirus. Top-tier figures from the US, China, and Australia are set to trigger action as the first quarter draws to an end.

This week in AUD/USD: Surging on stimulus

The Federal Reserve kicked off the week by pledging open-ended bond-buying and launching generous loan programs. Jerome Powell, the Fed Chair, stressed that the bank will not run out of ammunition.

The funds provided by the central bank support the gargantuan fiscal stimulus deal agreed by the Senate – $2 trillion worth of payments and loans that will help the world's largest economy – and the rest of the world – to stop the bleeding. The bill is set to become law shortly.

AUD/USD jumped with recovering stocks – a risk-on reaction – yet these gains seemed to reach a halt late in the week.

Are policymakers' actions sufficient? US jobless claims leaped to 3.283 million – an all-time record and an increase of 1,053%. The lockdowns enacted in the US are spreading, becoming stricter, and taking their toll on the economy. The US already has the highest number of Covid-10 infections.in the world, and New York is becoming the epicenter.

Australia has only around 3,000 cases but is significantly affected by the illness. It was first by China – which reported a plunge of 38.3% in company profits in the first two months of 2020 – and now by the rest of the world. Further restrictions on movements are likely.

This has been a short summary of developments as coronavirus related headlines – health, shutdown, and fiscal stimulus – are coming thick and fast. Volatility has also increased significantly.

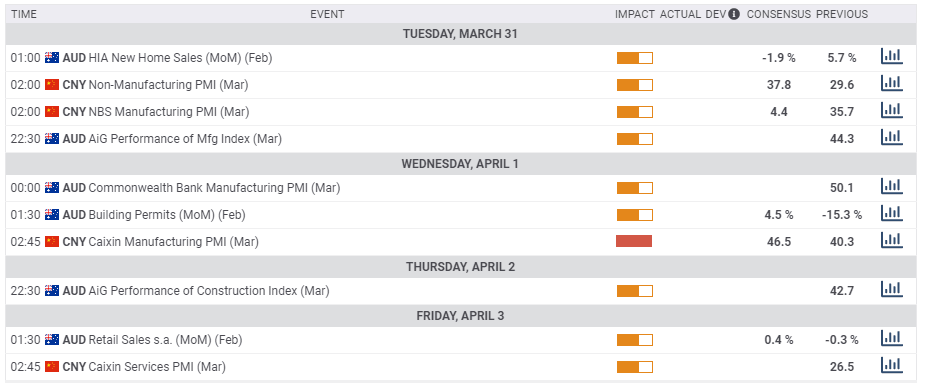

Australian and Chinese events: Coronavirus data and Chinese PMIs

Will Covid-19 take a greater toll on Australia? The land down under has taken precautions, the central bank slashed rates, and the government has opened its purse strings. Nevertheless, health updates are set to move the Aussie.

China, Australia's No. 1 trading partner, has seen its Covid-19 infections stall, but its economy is only gradually recovering. Official Purchasing Managers' Indexes are of high interest on Tuesday, with the services sector set to struggle more, as in other places in the world.

Caixin's independent Manufacturing PMI is off interest on Wednesday and the services one closes the week on Friday. It hit a devastating low of 26.5 in February – far below the 50-level that separates expansion from contraction.

Australian PMIs are released throughout the week and are also set to decline. They provide better guidance that relatively stale figures such as retail sales and building permits that predate the crisis.

Here the most prominent Australian and Chinese releases on the economic calendar:

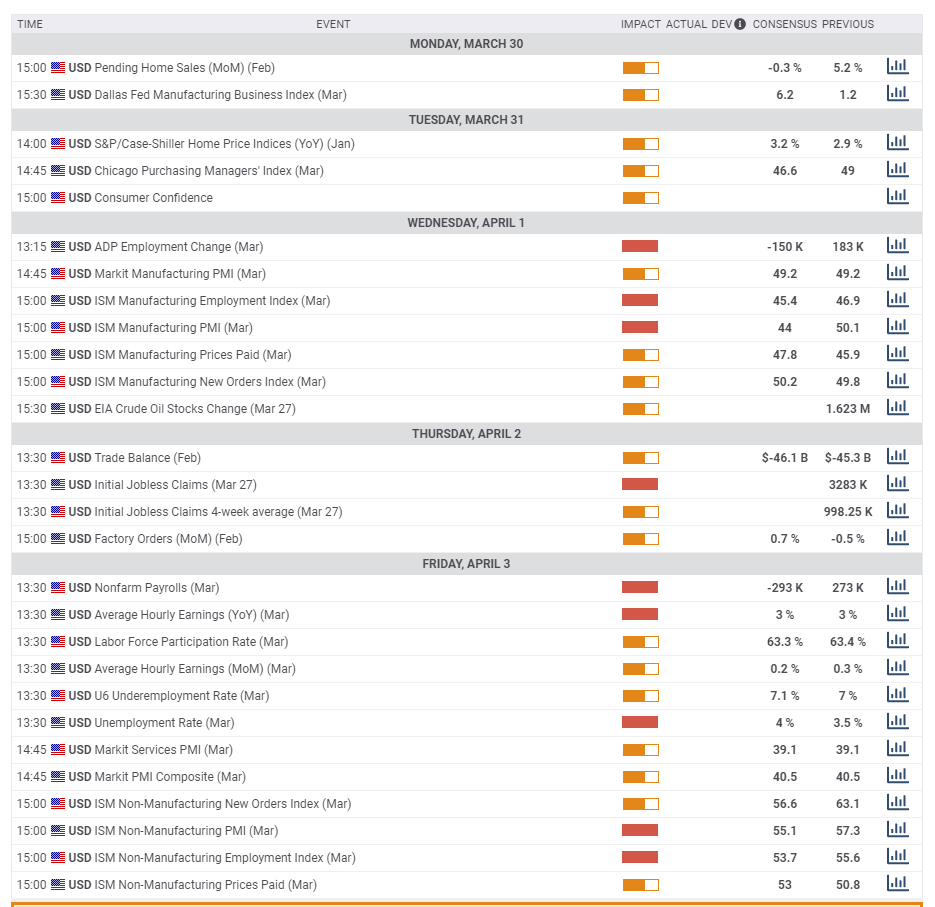

US events: First crisis-era Non-Farm Payrolls

The US will likely surpass 100,000 cases in the coming days, triggering more fears about the world's largest economy. While President Donald Trump aspires to "reopen the economy" by Easter, governors are moving to add more lockdowns. Headlines related to restrictions and health will likely overtake fiscal and monetary stimulus which are now out of the gate.

The economic calendar is packed, with the Conference Board's Consumer Confidence kicking off events before job figures stand out. ADP's private-sector labor market figures are of high interest – despite it not always being well-correlated to the official BLS figures. Thursday's jobless claims will likely continue rising, perhaps surpassing four or five million.

Finally, Friday's Non-Farm Payrolls may trigger an epic move on the charts. A considerable loss of positions is on the cards, but the scale is hard to forecast. The NFP surveys are taken in the middle of the month, in this case before the worst of the crisis. Confusion and uncertainty tend to result in volatility.

ISM's PMIs are also of interest. The manufacturing sector will likely suffer a softer blow, but the services one – due out after the NFP – could plunge. Overall, the packed US calendar is set to result in wild price action. AUD/USD is set to continue rising and falling with the general market mood.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

AUD/USD's daily chart is pointing to more moderate downside momentum – yet the Relative Strength Index has climbed above 30 – exiting oversold conditions. Will the currency pair resume its falls? It continues trading below the 50, 100, and 200-day Simple Moving Averages.

Support awaits at 0.60, a psychologically significant level and a temporary cap to the currency pair's recovery. It is followed by 0.5870, a swing low during the week. The next level to watch is 0.5660, which was a temporary low ahead of the recovery. The multi-year low of 0.5505 is the next level to watch.

Resistance awaits at 0.6130, the recovery high. It is followed by 0.63, which was a swing low in early March. Next, we find 0.6425, a swing low, followed by 0.6690.

AUD/USD Sentiment

A financial crisis has been averted, but coronavirus headlines are set to weigh on headlines. Economic indicators will probably show devastating statistics, pointing down. All in all, a worsening mood may send AUD/USD down.

The FX Poll is showing a bullish trend on all timeframes. It seems that experts foresee an ongoing recovery rather than a return to falls. The short-term target has been upgraded significantly, but the medium and long-term ones have been only modestly altered.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637209193612017859.png&w=1536&q=95)