Asia stocks fall as tensions between the US and China rise

The price of crude oil declined during the Asian session as traders refocused on the upcoming OPEC+ meeting. West Texas Intermediate and Brent fell by more than 2% to $39.18 and $41.86, respectively. Traders are paying close attention to details of the virtual meeting that will happen tomorrow. Most traders expect the cartel and its allies to reduce the ongoing cuts by more than 2 million barrels. The meeting comes a day after a report by OPEC said that its member countries sold an average 22.5 million barrels a day in 2019 as exports from non-members increased.

Asian stocks declined as traders reacted to the upcoming earnings season from the US, geopolitical issues, and the rising number of coronavirus cases in the US. The Shanghai composite fell by more than 1% while the Hang Seng declined by more than 1.7%. The earnings season will start today as banks like JP Morgan, Citi, and Wells Fargo release their quarterly earnings. Meanwhile, tensions between the US and China rose as the US hardened its stance against Chinese claims in South China sea. The decision came after China imposed sanctions on several US lawmakers.

The Australian dollar declined slightly even after China released upbeat trade numbers. According to the country’s statistics office, exports rose by 0.5% in June after falling by 3.3% in May. Analysts polled by Reuters were expecting the exports to have fallen by 1.5%. The country also imported goods worth 2.7% in June after falling by 16.7% the previous month. Analysts were expecting the two to fall by 10%. As a result, the trade surplus reduced from the previous $62.93 billion to $46.42 billion. Later today, we will receive GDP numbers from the UK, inflation numbers from Sweden and the US.

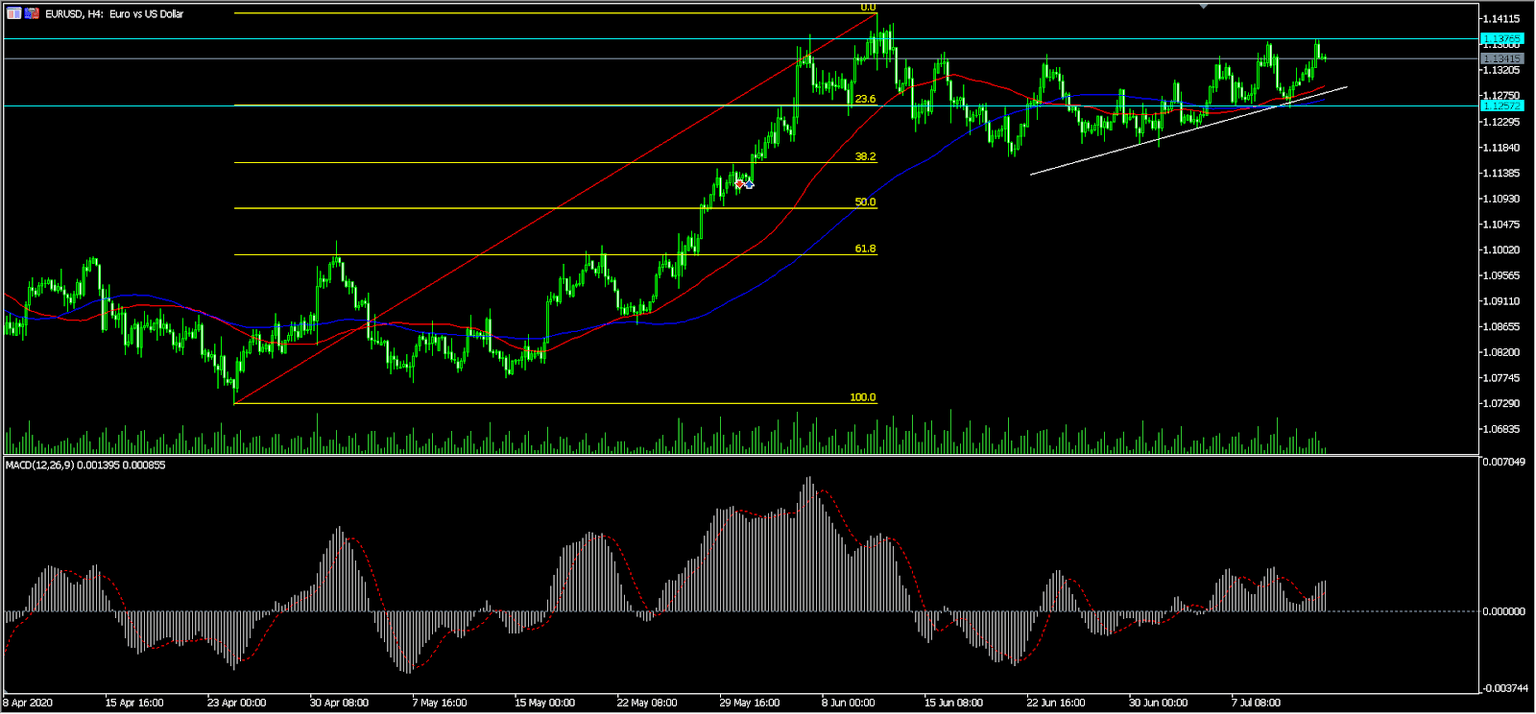

EUR/USD

The EUR/USD pair declined slightly during the Asian session. It is trading at 1.1340, which is slightly below yesterday’s high of 1.1375. On the hourly chart, the price is slightly above the 50-day and 100-day exponential moving averages and the 23.6% Fibonacci retracement level. The signal line and the main line of the MACD have remained above the neutral line. The pair has also formed a double top pattern. Therefore, it might continue to fall as bears attempt to test the 23.6% retracement at 1.1257.

XBR/USD

The XBR/USD pair declined sharply today ahead of the OPEC meeting. It is trading at 41.96, which is lower than yesterday’s high of 43.45. On the hourly chart, this price is below the 50-day and 100-day EMA while the RSI has declined to the oversold level of 30. The same is true with the fast and slower lines of the Stochastic oscillator. Therefore, the pair may continue to fall as bears attempt to test the next support at 41.38.

AUD/USD

The AUD/USD pair declined to an intraday low of 0.6927, which is below yesterday’s high of 0.6995. On the four-hour chart, the pair is slightly below the 50-day and 100-day EMAs and the triple top at 0.7000. The pair has also formed an ascending triangle pattern and the price is along its lower side. Therefore, the pair is likely to rise again as bulls attempt to test the upper side of the triangle at 0.7000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.