A producer price index inflation spike is on the way too

As with the CPI, a PPI year-over-year inflation spike is baked in the cake.

Producer price index month-over-month April 2020

-

PPI: -1.1%.

-

2020 Goods: -2.8%.

-

Services: -0.4%.

-

Energy: -17.3% .

Producer price index month-over-month February 2021

-

April 2020 PPI: 0.5%.

-

April 2020 Goods: 1.4%.

-

April 2020 Services: 0.1%.

-

Energy: 6.0%.

Q: Why does Energy have such a small impact on the PPI?

A: The following chart explains.

PPI final demand weights

Energy is 15.5% of goods but only 5.0% of the overall PPI.

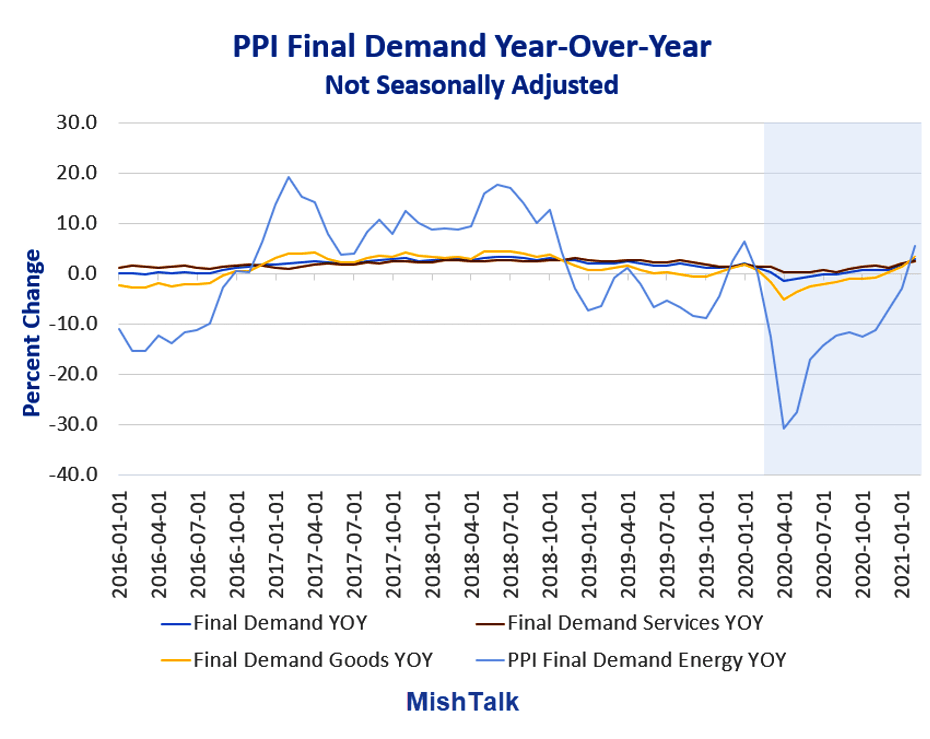

PPI year-over-year

Producer price index year-over-year April 2020

-

PPI: -1.5%.

-

Goods: -5.2%.

-

Services: +0.3%.

-

Energy: -30.7%.

Producer price index year-over-year February 2021

-

PPI: 2.8%.

-

Goods: 3.4%.

-

Services: 2.5%.

-

Energy: 5.5%.

What's going to happen?

The year-over-year comparisons in March, April, and May are going to show huge percentage year-over-year jumps, especially April and May due to comparisons vs. the initial pandemic numbers in Spring of 2020.

Services will act as a bit of a stabilizer given they constitute 66% of the PPI, but the energy numbers are so huge they will have a very noticeable impact.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc