A big question mark is whether Trump is just playing what he thinks is a negotiating game

While Mr. Powell tries to evade specificity in his testimony to Congress, a Reuters poll shows the relentless tariff chaos has driven most economists to predict a Fed reluctant to cut. This is no surprise but poll data is nice to have. In January, “a near-60% majority of economists … had expected the central bank to reduce rates in March.” Now a majority (67 of 101) see end-June, with only 22 seeing March and 45 in Q2. “ Only 17 of 99 economists with end-2025 forecasts said the next cut will come in the second half of the year, and 16 expected no cuts this year.”

Right on cue, the 10-year yield is going up a bit, if still disappointing if the inflation reading behind the Fed forecast is taken into account. This is understandable when you consider that bugaboo of economics, Lag. The IMF noted this yesterday—too soon to tell what the global effect of Trump’s trade war will be.

We try, anyway. A big question mark is whether Trump is just playing what he thinks is a negotiating game. He said the steel and aluminum tariffs were without exception, then made Australia exempt. Unlike other tariff announcements, this one doesn’t begin until March 12, giving him time to mess with everyone’s head.

Whether the outcome is small or big, or even whether Trump is not just playing games, the effect is not zero. The press of full of who wins and loses the most from steel and aluminum tariffs. Who wins is US producers. Who loses is everyone else, even the companies the tariffs are intended to protect. The WSJ says the 2018 tariffs “… created uncertainty for U.S. manufacturers and boomeranged on steel and aluminum companies. Employment in durable goods manufacturing began to decline in early 2019, which reduced demand for steel and aluminum. Employment in fabricated metals manufacturing that used steel and aluminum plunged and is still some 35,000 lower than when the tariffs took effect.”

Tomorrow we get US CPI, now taking a back seat because of the universal expectation that future readings will be much higher, even if we don’t know when. Of the dozen or so variations, this time we look at the trimmed mean (core is not good because it excludes food and energy). Trading Economics reports it was 3.20% in Dec from 3.22% in Nov. The 1983 to 2024 average is 2.83%, so already a bit over. The headline is expected to be about the same and so not a market-mover.

The dog that didn’t bark in the night is China. Trump claims vaguely he has spoken with Xi since taking office, but that’s it—no details. China has made only the faintest of protests about being singled out for tariffs. Something is brewing. We suspect Trump will sell Taiwan to China for some benefit to him, if not the US. If he has any virtues, one is not wanting to be the guy who starts a shooting war. Uncertainty over this important issue adds to the already nearly unbearable weight of the sense of risk abroad in the world today.

Food for Thought: Something that did not make the mainstream press but we got from Canada—"The President even floated the idea of selectively not making some debt payments last night, although that may have been walked back by functioning adults within the administration later.” The comment was from an interview before that ball game on Sunday and was indeed walked back.

But he said it. Just the mere mention should have set the press’ pants on fire. That’s how Trump operates—mention something, take it back, push it out again, pretend to negotiate, surrender but call it a win. What did get press attention was the five TreasSecs and here is more from their NYT op-ed: Musk’s conduct raises “substantial cause for concern” that the United States’ financial commitments are being “unlawfully” undermined.” Here’s the kicker: “Any hint of the selective suspension of congressionally authorized payments will be a breach of trust and ultimately, a form of default. And our credibility, once lost, will prove difficult to regain.”

That’s one kind of default. The Big, Scary kind is refusing to pay some holders of US Treasuries (interest and principal) while paying some others. It goes without saying that such a thing is illegal and would get stopped at the gate by a court. But the mere mention of it sends shivers down spines at official reserve managers, sovereign wealth funds, pension managers, et al. After all, the US Treasury market is measured in the tens of trillions, $28.3 trillion as of year-end. And if it comes up again in any meaningful way—everybody is busy denying today—the dollar starts circling the drain.

Forecast

Today is turnaround Tuesday, but the barrage of volatility-inducing news keeps coming and coming and coming with no respite. Bounces have bounces of their own, making chart-reading especially tricky. The AUD and CAD are practically flat and trend-less. Even the Swiss franc is a bit confusing. You get a different reading on the various timeframes—60 and 120 minutes say sell, the 480 minute and daily charts says buy. The only folks making any gains are the quick-change artists, and the Big Picture hold-the-fort stalwarts. The Big Picture is solidly in the dollar’s favor, but remember, no straight lines in markets.

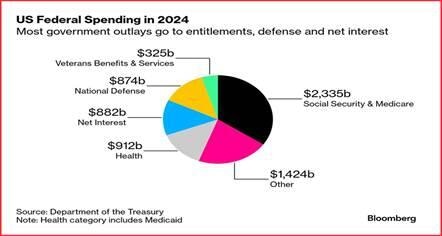

Tidbit: Bloomberg writes that Musk might have a real chance of chopping $1 trillion (but not $2) from federal spending, $6.75 trillion in the FY 2024. “Following through on that smaller figure would mean shrinking the deficit by more than half, bringing the US within range of even the euro region’s tough rules. (Setting aside tax policy, an even bigger debate.)

“The US deficit was 6.4% of GDP last year, compared with Europe’s 3% guideline. Reducing the shortfall could bring down bond yields, stoking investment-led growth.” See the chart. The obvious target is Social Security, although Trump has said it’s off limits. We know Trump lies. Envision millions of white heads and canes marching on Washington.

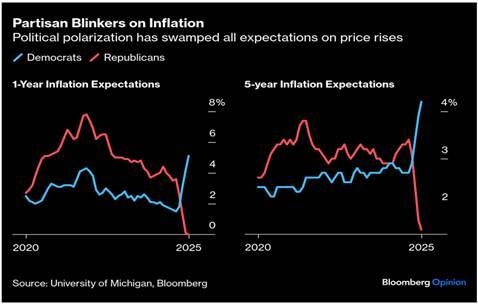

Tidbit: The University of Michigan consumer survey showed a sharp drop in all the components and a big gain in inflation expectations to 4.3%--and for the longer term, 3.3%, the highest since June 2008. What we neglected to report is the stunning difference between what Dems expect and what Republicans expect.

The perspicacious Authers at Bloomberg reports “The average Republican thinks inflation will be zero over the next 12 months, while the average Democrat is braced for price rises of more than 5%. The swing in expectations for longer-term inflation is even greater. Some divergence based on political outlook is unsurprising. These extremes, however, suggest not so much divergence as derangement.”

“For the record, there is no way inflation is going to drop to zero next year. If headline CPI just drops below 2%, that will be a massive political victory for the administration — and that also seems unlikely. If Democrats are right that CPI is heading straight back up above 5%, that would imply that the Trump political project will soon be dead (it surely couldn’t withstand that). It can safely be labeled wishful thinking. A lot of things that we cannot foresee would need to go very wrong over the next year.”

Authers points out that Michigan acknowledges the standard deviation is the highest since 1978. From 1978 to 2021, expectations were tightly bunched. Expectations matter to the Fed. Yesterday the NY Fed issued its own consumer inflation expectations. In December, median inflation expectations were unchanged at 3.0% for 1 year, up to 3% from 2.6% for 3 year ahead, and down to 2.7% from 2.9% for the 5 year.

This time The NY Fed reports no real change in inflation expectations. How can the two surveys be so different? “Median inflation expectations were unchanged at 3.0% at both the one- and three-year-ahead horizons. Median five-year-ahead inflation expectations rose by 0.3 percentage point to 3.0% in January. This increase was driven primarily by respondents with a high-school education or less. The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) increased at the one- and five-year horizons and was unchanged at the three-year horizon.

“Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—was unchanged at the one-year horizon, declined at the three-year horizon, and increased at the five-year horizon.”

We don’t like surveys for the same reason we don’t like political polls—too few respondents, answers dependent on the wording of the question (creating confirmation bias), fishiness of those who want to respond, general ignorance and stupidity, etc. The NY Fed covers a mere 1300 respondents. The sample size of the Michigan is 900-1000. Even the Conference Board covers only 3500. All the same, the Authers charts are meaningful. They display one kind of Trump derangement syndrome.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat