Yields, SPY and clearer prospects

S&P 500 came knocking again on low 6,060s, and succeeded – I had an open mind, calling for the best bearish times as over with the China countermeasures announcement – such were the gains for clients the day before, and what about yesterday? The ride towards the resistance was fine in intraday tech terms as the pre-ARM earnings atmosphere allowed for solid daily outperformance. Trading Signals clients benefited greatly on gold resilience and as well on the little noticed oil short call reaching exactly my ultimate daily target of $71.

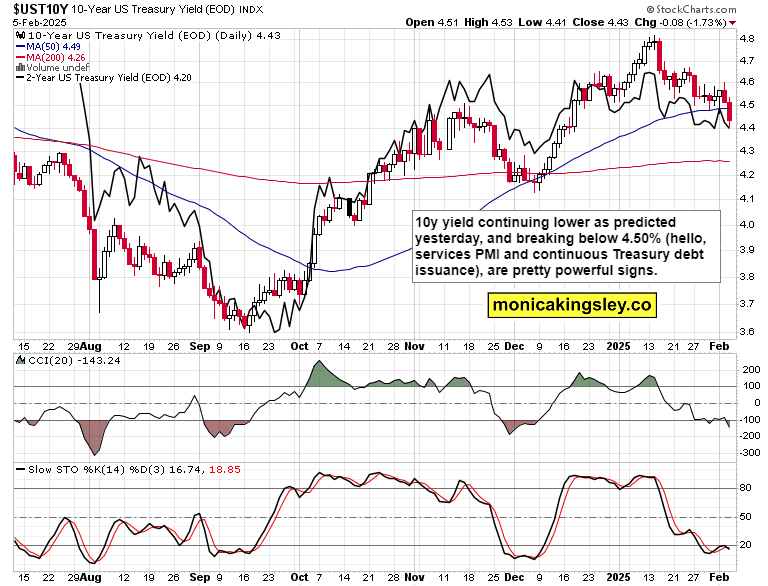

Where do we go today, is there a pullback or even rug pull coming? That‘s what covers today‘s fast 5min video talking tech outperformance of ES prospects, yields path and S&P 500 breadth lessons among much else.

AMD had been my bearish pick for earnings, but today it‘ll hitch a ride on NVDA coattails. GOOGL tanked as it missed on cloud, META is the (open source) winner, AMZN I‘m leaning a bit bearish (AWS not making its numbers all too greatly). NVDA holding 200-day moving average, is that enough? AVGO stepped into the void, and is doing fine still, I would be cautious TSLA (short-term outlook switched bearish as opposed to the boring bullish financials – this is just a small example of what kind of guidance clients are getting (ARM is closer to being my cup of tea really!). Check Russell 2000 performance, too.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.