Xiaomi Corp (1810.HK) pulling back in wave (IV)

Xiaomi Corporation (1810.HK), founded in 2010 and headquartered in Beijing, China, is a leading global technology company known for its innovative smartphones, IoT devices, and lifestyle products. Listed on the Hong Kong Stock Exchange since July 2018, it operates through four main segments: Smartphones, IoT and Lifestyle Products, Internet Services, and Others, offering a wide range of products from smart TVs and laptops to electric vehicles. With a strong focus on affordable, high-quality tech and a growing presence in markets like Southeast Asia and India, Xiaomi has become the world’s third-largest smartphone vendor, boasting a market cap of approximately HKD 1.365 trillion as of early 2025. Below we will look at the Elliott Wave technical outlook of the company.

Xiaomi monthly Elliott Wave chart

Monthly Elliott Wave Chart of Xiaomi above shows that rally from all-time low is unfolding as a 5 waves impulse. Wave (I) ended at 33.8 and pullback in wave (II) ended at 8.31. The stock rallied higher in wave (III) towards 58.7. Expect pullback in wave (IV) to correct cycle from 10.12.2022 low in 3, 7, or 11 swing before it resumes higher.

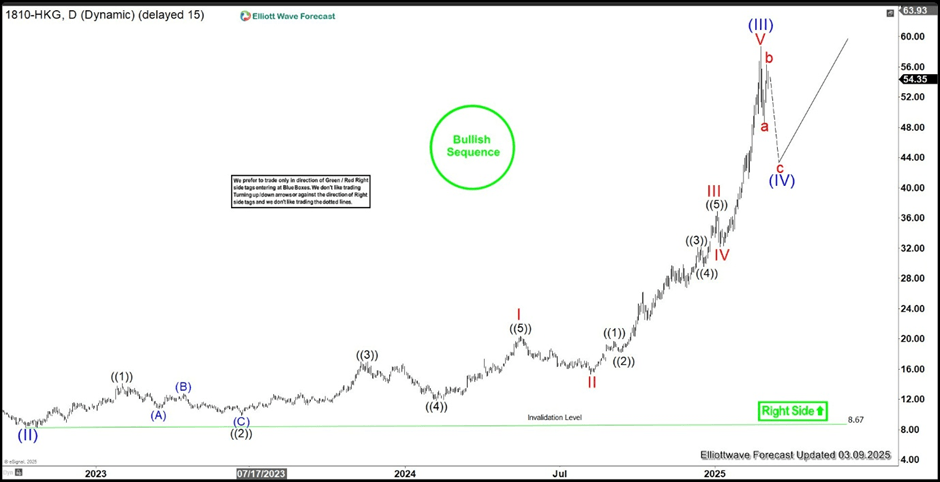

Xiaomi daily Elliott Wave chart

Daily Elliott Wave Chart of Xiaomi above shows that wave (II) ended at 8.67. The stock then nested higher from there. Wave I ended at 20.35 and wave II dips ended at 15.36. Stock then rallied higher in wave III towards 36.85 and pullback in wave IV ended at 32.2. Wave V ended at 58.7 which completed wave (III) in higher degree. Expect pullback in wave (IV) to correct cycle from 10.12.2022 low before it resumes higher again. While pivot at 8.67 low remains intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com