WTI sees losses following weekly API inventory data but remains broadly underpinned

- WTI saw a sudden drop lower following a larger than expected build in weekly private API inventories.

- The crude complex continues to consolidate within recent intra-day ranges, remaining underpinned by vaccine hopes and OPEC+.

WTI crude oil saw a sharp drop shortly after 21:30GMT on the release of weekly API crude oil inventory data. Headline crude oil stocks saw a build of 4.2M barrels on the week, much larger than expectations for a build of 1.7M barrels, triggering a kneejerk move to the downside. Front-month WTI futures dropped from pre-data levels of around $41.50 to below $41.20.

However, the move had mostly unwound by the time futures markets closed at 22:00GMT, with WTI recovering back to around $41.40 given that the builds in Cushing and Gasoline inventories were much more modest (at 0.1M and 0.2M barrels respectively), while Distillates showed a much larger than expected draw of over 5M barrels (expected was a draw of around 1.5M barrels). In other words, the report taken its entirety is not nearly as bearish as the headline number suggests. The futures market will re-open at 23:00GMT.

WTI remains broadly underpinned by vaccine hopes, OPEC+

WTI prices are up roughly 18% on the month, underpinned initially by the risk-on aftermath of Joe Biden’s US Presidential election victory, and then even more emphatically by vaccine optimism since the Pfizer/BioNtech announcement on 9 November.

The hope is that better than initially expected vaccine efficacy/faster than initially expected vaccine development and distribution will translate into a swifter recovery in the global economy and in fuel demand in 2021.

However, the European and North American economies are expected to falter in the coming months due to lockdown measures to contain rising vaccine numbers. Reducing virus numbers over the next few months will be more challenging than following the first wave in March, as the North Hemisphere is heading into Winter, people will be spending more time indoors and, thus, virus transmission is naturally higher.

But are crude oil markets opting to take the glass half full view of things for now, perhaps helped by the fact that unnecessary OPEC+ supply is very unlikely to be returning to the market during this difficult period for the global economy, with members of the cartel reportedly unanimously backing an output cut extension of at least 3 months.

WTI consolidating within pennant structure meaning break-out likely to come soon

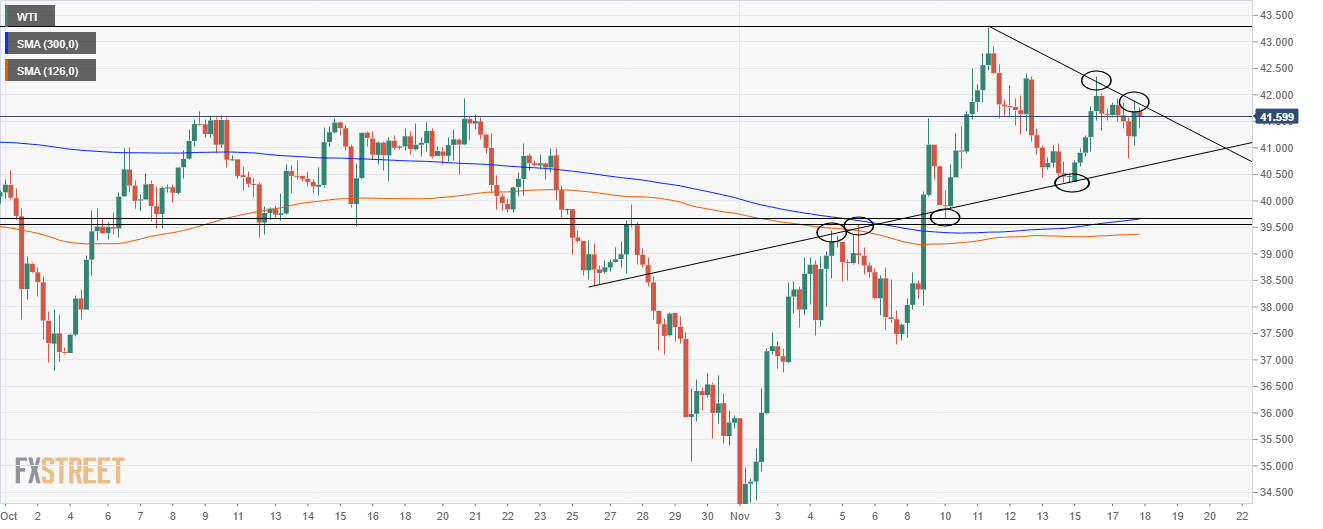

Tuesday’s price action confirms that WTI is consolidating with a short term pennant structure; to the downside, there is the rising trendline that links the 4, 5 November highs and 10, 13 November lows, while to the upside, the downwards trendline that is condensing the price action links the 11 and 16 November highs, as well as the highs made in recent highs (see the four-hour chart below).

Upon an upside break of this short-term pennant, WTI would likely retest resistance at the $42.00 level, before then potentially moving higher to challenge monthly highs at $43.00. Conversely, in the downside break scenario, 13 November lows at the psychological $40.00 level will offer the first meaningful barrier to further losses. Below that, significant support resides in the $39.30-$39.40 area, including the 21 and 50-day moving averages, as well as the 5 November high and 9 November (US session) low.

WTI four hour chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset