WTI pushes into fresh weekly high late Friday as Crude oil recovers ground

- WTI testing towards $80 per barrel as energy markets step higher.

- Risk appetite is on the rise, bolstered by rate cut hopes.

- Easing US inflation data and declining US Crude Oil reserves spark barrel bids.

West Texas Intermediate (WTI) rose in late-day bidding on Friday as Crude Oil markets recover, but still remains within recent consolidation levels. US Crude Oil was propped up by a backslide in US barrel counts from the Energy Information Administration (EIA) and the American Petroleum Institute (API) this week, with broad-market risk appetite pinning deeper into ‘buy it all’ territory after US Consumer Price Index (CPI) inflation data eased more than expected in April.

Risk appetite increased during the latter half of the trading week after US inflation figures kicked investor hope for Federal Reserve (Fed) rate cuts higher, helping to drag Crude Oil bids up from its lowest bids since late February. Despite refreshed rate trim bids, Fedspeak is striking a notably moderate tone, with multiple Fed officials cautioning for patience on rates from the Fed, and the possibility that rates could remain higher for much longer than markets might be prepared for.

With Fedspeak dominating the financial news cycle to wrap up the trading week, investors will be bracing for early next week when a slew of Fed appearances show up on Monday and Tuesday. A volley of talking points from Fed policymakers will be hitting the wires in the front half of next trading week.

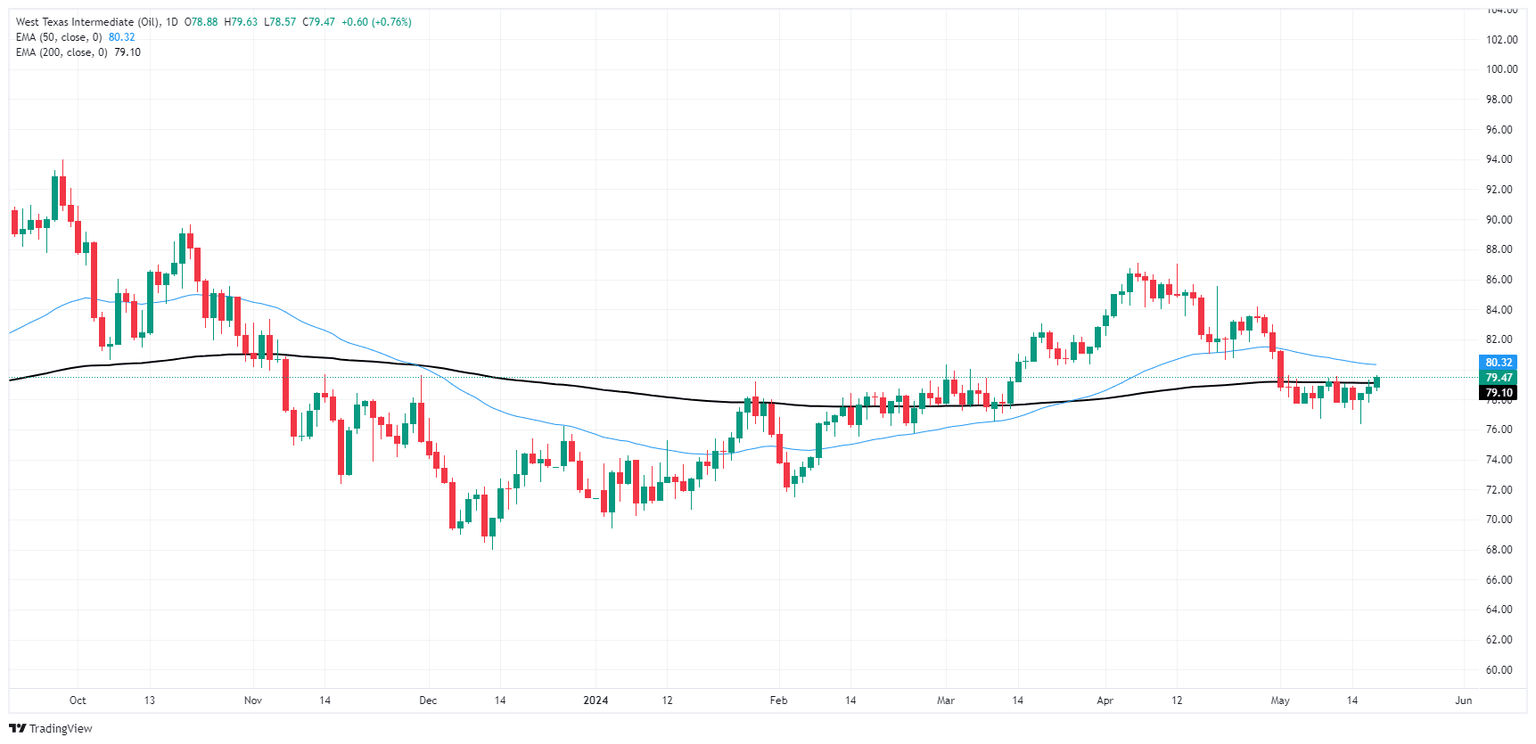

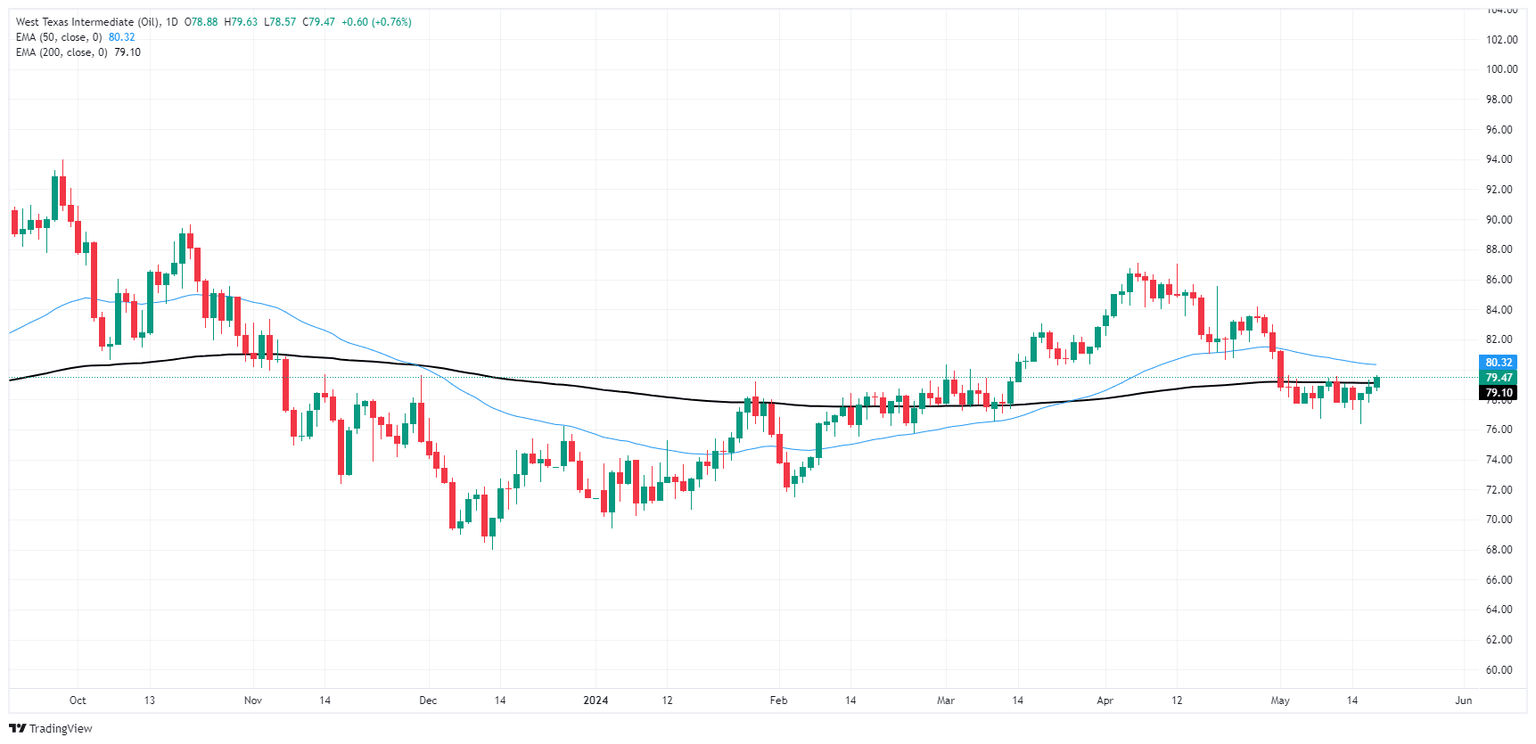

WTI technical outlook

US Crude Oil rose into a late weekly high on Friday, pushing through the 200-day Exponential Moving Average (EMA) at 79.10, ticking into 79.63 before the closing bell. WTI is pushing into a consolidation zone between the 50-day and 200-day EMAs.

The near-term ceiling is priced in at the last swing high near 87.00, but US Crude Oil is still up over 10% in 2024 despite trading down from the year’s early peaks.

WTI daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.