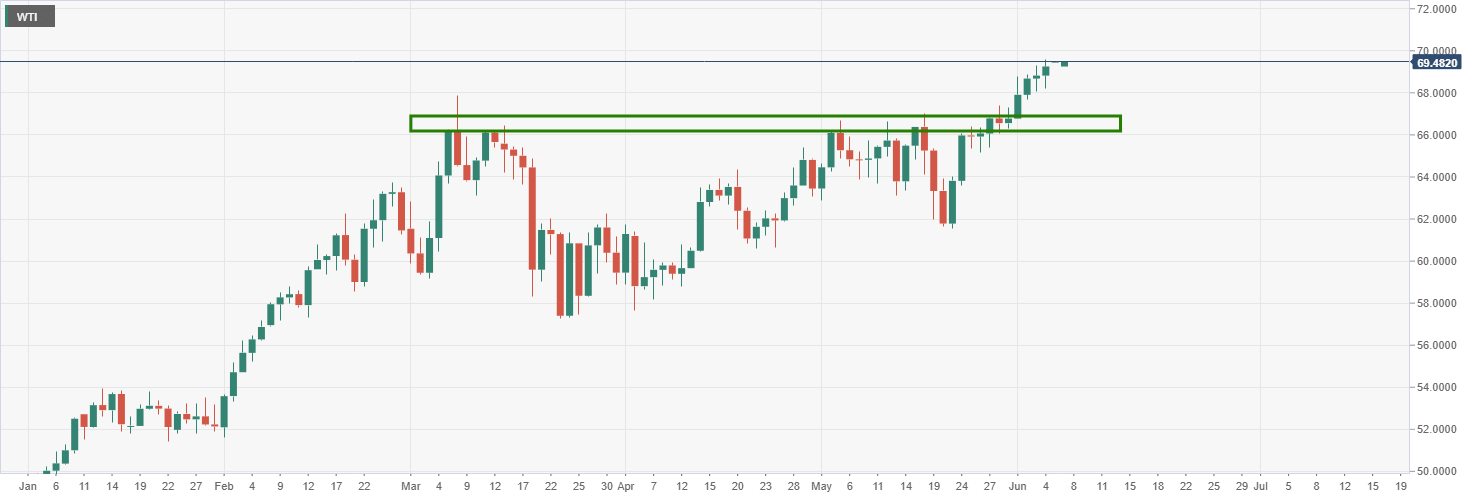

WTI prices on the way to the 2021 highs

- WTI is moving in on the 2021 highs in the open.

- Bulls looking to higher demand and inflation supporting the price of oil.

The price of oil was higher on Friday with traders focussing on OPEC+ supply discipline and recovering demand.

Brent crude added 58 cents, or 0.8%, to settle at $71.89 a barrel, after touching $72.17, its highest since May 2019 while WTI futures climbed 81 cents, or 1.2%, to settle at $69.62. The session high was $69.76, its highest since October 2018.

Spot West Texas Intermediate crude was making a fresh high of $69.73 from a low of $68.36 on Friday, ending 0.72% higher.

In the open, WTI is up 0.27% so far on the day and has risen from a low of $69.38 to a high of $69.61 and paint a bullish picture for the sessions ahead as it moves in on the highs for the year.

The weaker greenback is making oil cheaper for holders of other currencies and lending support to oil prices and the inflation theme is underpinning them also

The weekend press quoted Janet Yellen, Treasury Secretary, saying President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates.

This comes ahead of this weeks inflation data for the US.

In other news, from Friday, US energy firms this week cut the number of oil and natural gas rigs operating, for the first time in six weeks.

Also, a slowdown in talks between the United States and Iran over Tehran's nuclear programme has been a supporting factor, which reduced expectations of a return of Iranian oil supply.

WTI levels

Technically, the 4-hour 10-EMA has been supporting the price on a retest of the prior daily chart.

While the 4-hour close was lower, demand is the overriding bias at this juncture. However, according to the monthly chart, a correction might be on the cards before long.

The prior weekly highs have a confluence with the 38.2% Fibonacci retracement level at 66.60 at this point.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.