WTI Price Forecast: Oil struggles below $60 as bullish momentum fades

- WTI retreats from multi-month highs as geopolitical risk premium unwinds.

- Oversupply worries resurface as fears of US-Iran escalation ease

- Technicals show fading bullish momentum below the $60 handle.

West Texas Intermediate (WTI) edges lower on Thursday, giving back this week’s gains as geopolitical risk premiums fade after US President Donald Trump softened his rhetoric on Iran, easing fears of imminent military action. At the time of writing, WTI trades around $59.26 per barrel, down nearly 1.40% on the day.

However, prices are finding some support after reports that US forces in the Caribbean Sea intercepted and seized a sixth Oil tanker under sanctions, which the Trump administration says is connected to Venezuela.

The US benchmark had surged to $62.19, its highest level since October, on Wednesday as investors priced in a growing risk of supply disruptions amid fears that the United States could take military action against Iran. With those concerns now easing, broader oversupply worries are resurfacing and weighing on sentiment.

Meanwhile, a resilient US Dollar (USD) is adding to the pressure, making dollar-denominated Crude more expensive for overseas buyers.

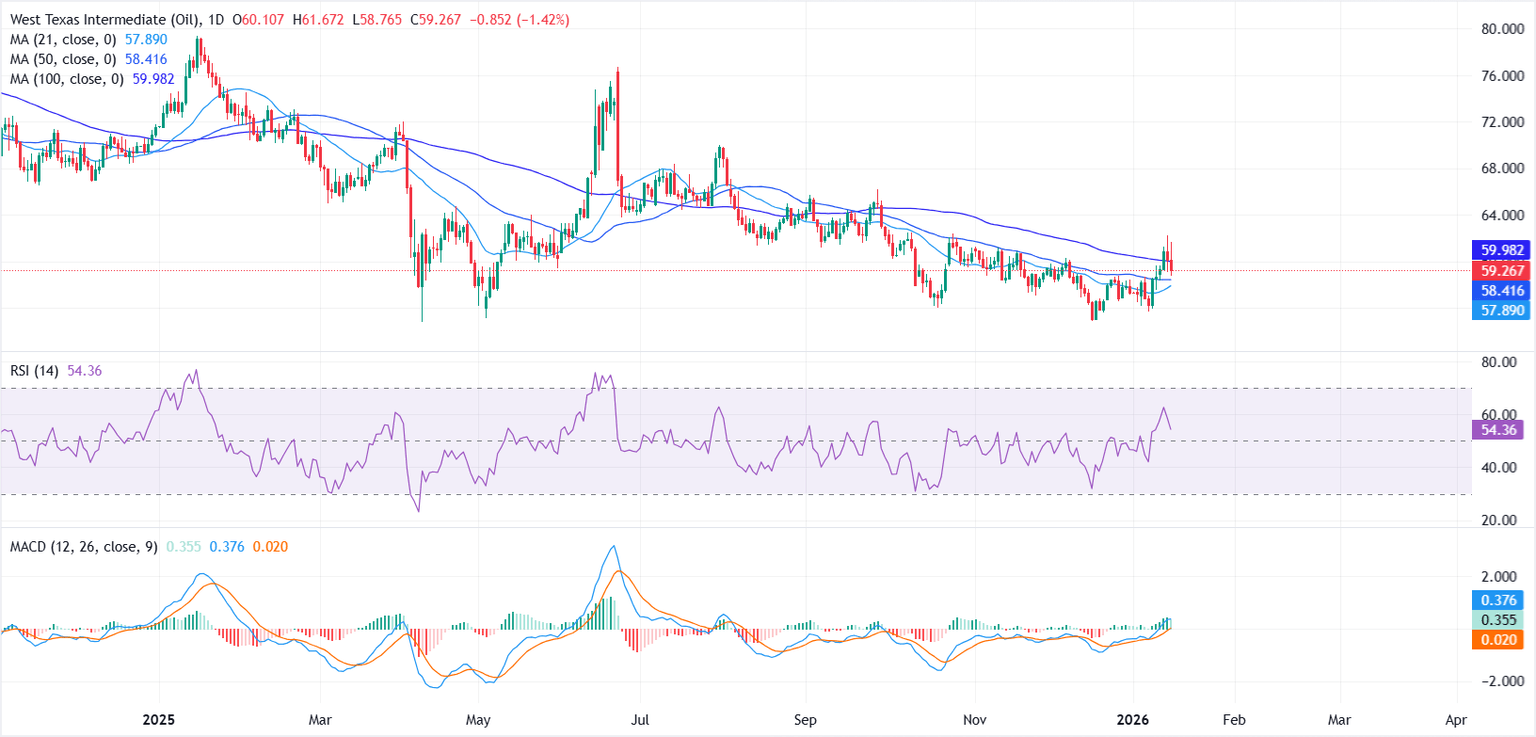

From a technical perspective, sellers remain in control after WTI failed to sustain a move above the $60.00 psychological mark. While the near-term structure appears mildly constructive, with prices holding above the 21-day and 50-day Simple Moving Averages (SMAs), the broader trend remains capped below the 100-day SMA, which continues to limit upside attempts.

The Moving Average Convergence Divergence (MACD) line remains above the Signal line in positive territory, while the histogram flattens. Meanwhile, the Relative Strength Index (RSI) hovers near 52 and is turning lower, signaling that bullish momentum is fading.

On the downside, immediate support is located in the $59.00–$58.00 zone, where short- and medium-term moving averages converge. A sustained break below this region would reinforce bearish pressure and could expose the next support area near $56.00-$55.00.

On the upside, the $60.00 handle remains the first key hurdle. A decisive close above this psychological level, alongside a clear break of the 100-day SMA, would be needed to ease downside pressure and open the door for a broader recovery.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.