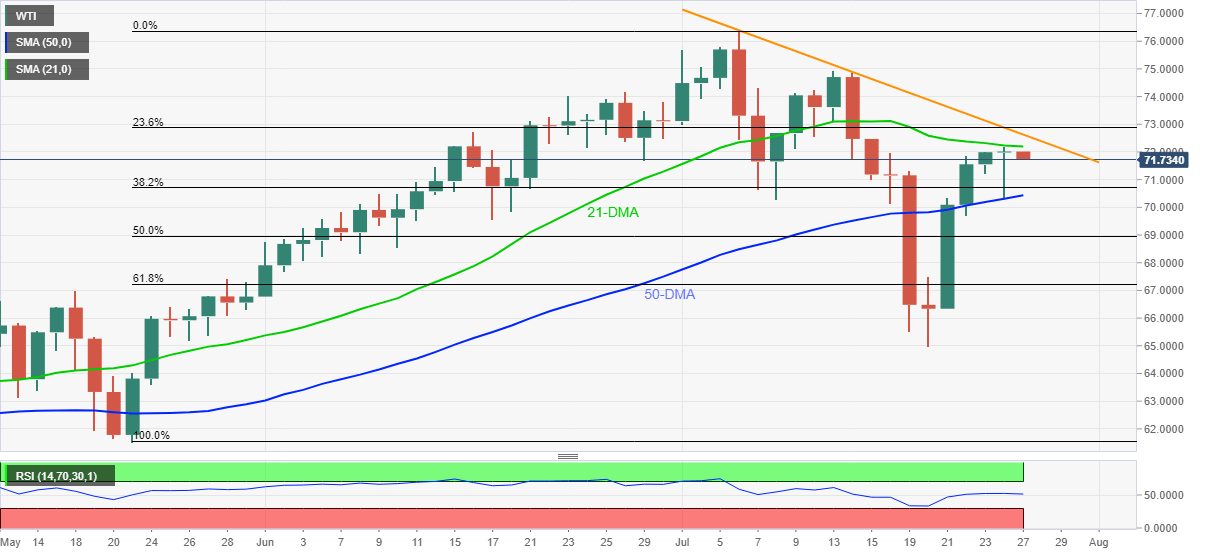

WTI Price Analysis: Mildly offered below $72.00 as bulls step back from 21-DMA

- WTI refreshes intraday low, drops the most in a week.

- Steady RSI backs sideways moves between 21 and 50-DMA.

- Three-week-old descending trend line adds to the upside filters.

WTI crude oil takes offers around $71.70, down 0.40% intraday, amid Tuesday’s Asian trading. The oil benchmark refreshed one week top the previous day before taking a U-turn from 21-DMA. It should be noted, however, that the quote keeps an upside break of 50-DMA amid a steady RSI line.

Hence, a sideways grind is likely to continue, despite anticipated short-term weakness towards the 50-DMA support of $70.43.

If at all the WTI sellers break the $70.40 level, the $70.00 threshold will be important before the 61.8% Fibonacci retracement level of May-July upside, around $67.20.

Meanwhile, an upside clearance of 21-DMA, at $72.20 by the press time, isn’t offering a green pass to the oil bulls as a descending resistance line from July 06, near $72.65, will challenge the quote’s short-term advances.

Also acting as the key upside hurdle is the July 13 peak surrounding $75.00, a break of which will refresh the multi-month top, marked early in July, around $76.40.

WTI: Daily chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.