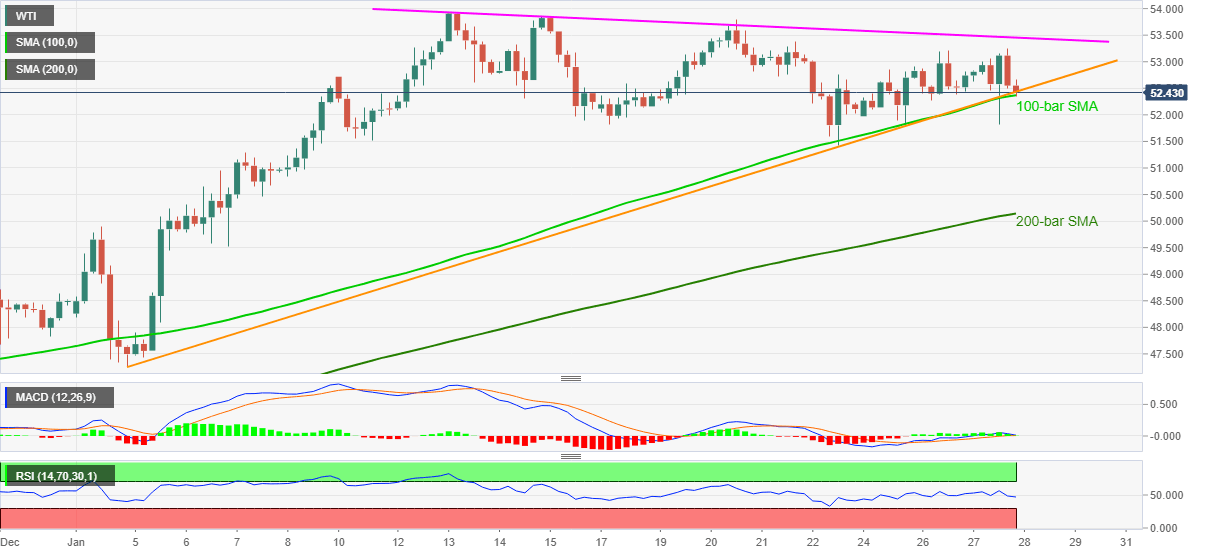

WTI Price Analysis: Bears attack key support confluence above $52.00

- WTI stays depressed while fading the bounce off $51.82.

- Sellers remain hopeful as MACD teases bears, RSI also weakens.

- Bulls await clear break of two-wee-old resistance line for fresh entry.

WTI drops to $52.35 while battling with 100-bar SMA and an ascending support line from January 04 amid Thursday’s Asian session. In doing so, the energy benchmark fails to keep the previous day’s corrective pullback amid downbeat RSI and MACD signals.

However, a clear break of $52.30 becomes necessary for WTI sellers to enter. Though, Friday’s low near $51.40 and January 07 top surrounding $50.95 can challenge the short-term bears afterward.

In a case where the black gold drops below $50.95, a 200-bar SMA level of $50.14 and the $50.00 threshold will be the key to watch.

Meanwhile, the $53.00 round-figure guards the commodity’s immediate upside ahead of a short-term resistance line near $53.45 and the monthly peak surrounding $53.90.

It should be noted that the quote’s run-up past-$53.90 needs validation from the $54.00 round-figure to aim for February 2020 top surrounding $54.70.

Overall, WTI is up for a correction as buyers seem to fade the upside momentum. However, a clear downside break of the stated support confluence near $52.30 becomes necessary to please the oil bears.

WTI four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.