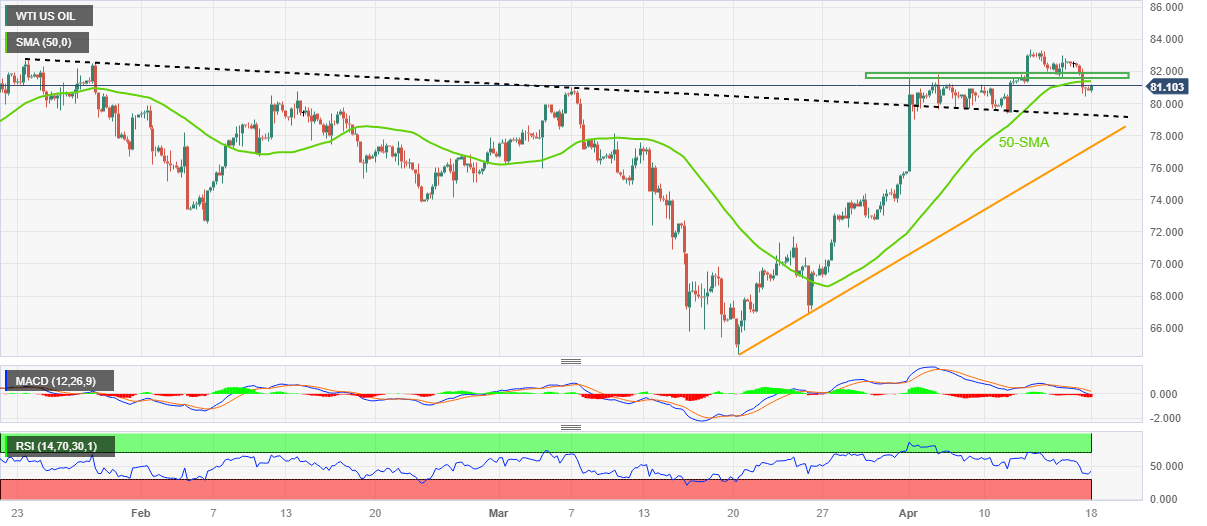

WTI Price Analysis: 50-SMA prods China data-led recovery around $81.00

- WTI crude oil clings to mild gains while paring the biggest daily loss in a month.

- China data adds strength to the corrective bounce in Oil price.

- Bearish MACD signals, 50-SMA challenges buyers but further downside needs validation from previous resistance line from January.

WTI crude oil stays defensive around the lowest level in one week, near $81.05 during early Tuesday. In doing so, the black gold struggles to cheer China’s upbeat data while consolidating the previous day’s heavy loss, the biggest in one month.

As per the latest economic updates from China’s National Bureau of Statistics (NBS), the first quarter (Q1) Gross Domestic Product (GDP) grows 2.2% QoQ versus the 2.2% expected and 0.0% prior. Further, Retail Sales growth jumps 10.9% YoY in March versus 7.4% expected and 3.5% prior whereas Industrial Production eased below 4.0% expected growth figures to 3.9%, versus 2.4% previous readings.

Apart from the mostly upbeat China data, nearly oversold RSI (14) line also allows the black gold to grind higher, recently approaching the 50-SMA hurdle of around $81.40.

It’s worth noting, however, that the bearish MACD signals and a two-week-old horizontal resistance area around $81.60-80, could challenge the commodity’s further upside. Following that, the recent multi-day high marked in the last week, around $83.40 will be in focus.

On the contrary, WTI’s further downside can aim for the $80.00 round figure ahead of challenging previous resistance line from late January, now support close to $79.20.

Should the quote remains bearish past $79.20, an upward-sloping support line from March 20, near $77.30, acts as the last defense of the WTI bulls.

WTI: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.