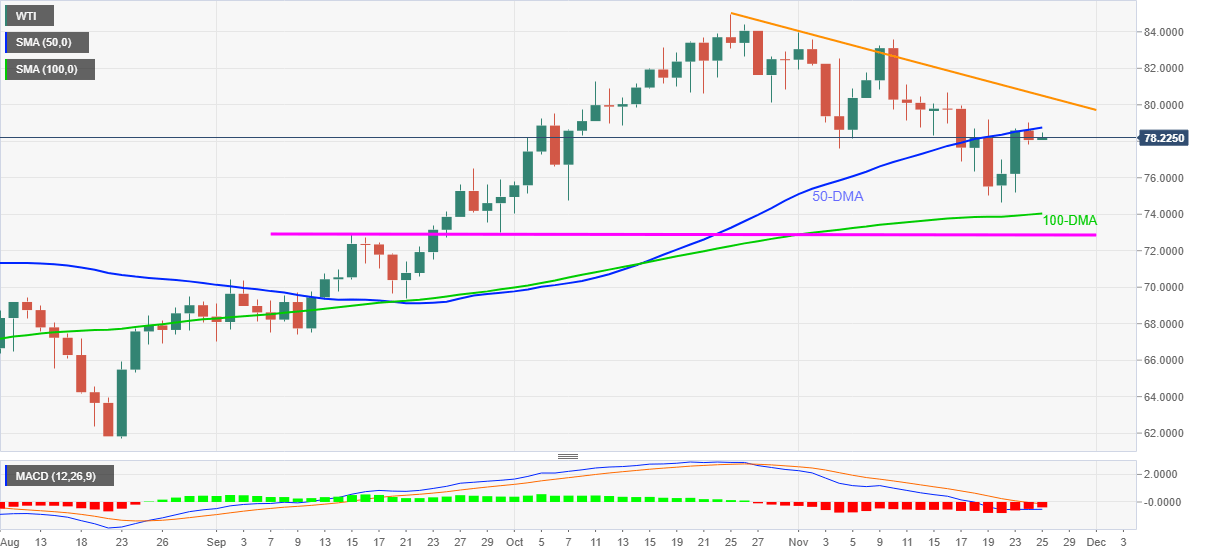

WTI Price Analysis: 50-DMA guards immediate upside

- WTI fades bounce off intraday low, grinds around weekly top.

- Easing bearish bias of MACD, 100-DMA challenges sellers.

- Monthly falling trend line offers extra hurdle for the bulls to tackle.

WTI crude oil prices fade the early Asian gains, easing to $78.23 ahead of Thursday’s European session.

The black gold posted its first daily loss of the week the previous day following its failures to cross the 50-DMA hurdle. Even so, the MACD conditions hint at further challenges for the oil sellers.

Also challenging the oil prices is the latest swing low, also the monthly trough, surrounding $74.65, as well as the 100-DMA level of $74.00.

It’s worth noting that a horizontal area comprising multiple levels marked in September around $72.90 becomes important for WTI sellers to watch for confirmation.

Meanwhile, a daily closing past 50-DMA level of $78.75 will aim for a one-month-old resistance line near $80.50.

Following that the monthly peak near $84.00 and the recently flashed multi-month high around $85.00 will be in focus.

Overall, WTI crude oil prices remain lackluster but the bears seem running out of steam of late.

WTI: Daily chart

Trend: Recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.