WTI Crude Oil steadies after seven-day slide, markets eye US-Russia peace talks

- WTI Crude Oil rises on Monday, breaking a seven-day losing streak and rebounding from a two-month low.

- Market focus shifts to US-Russia peace talks on Ukraine scheduled for Friday in Alaska.

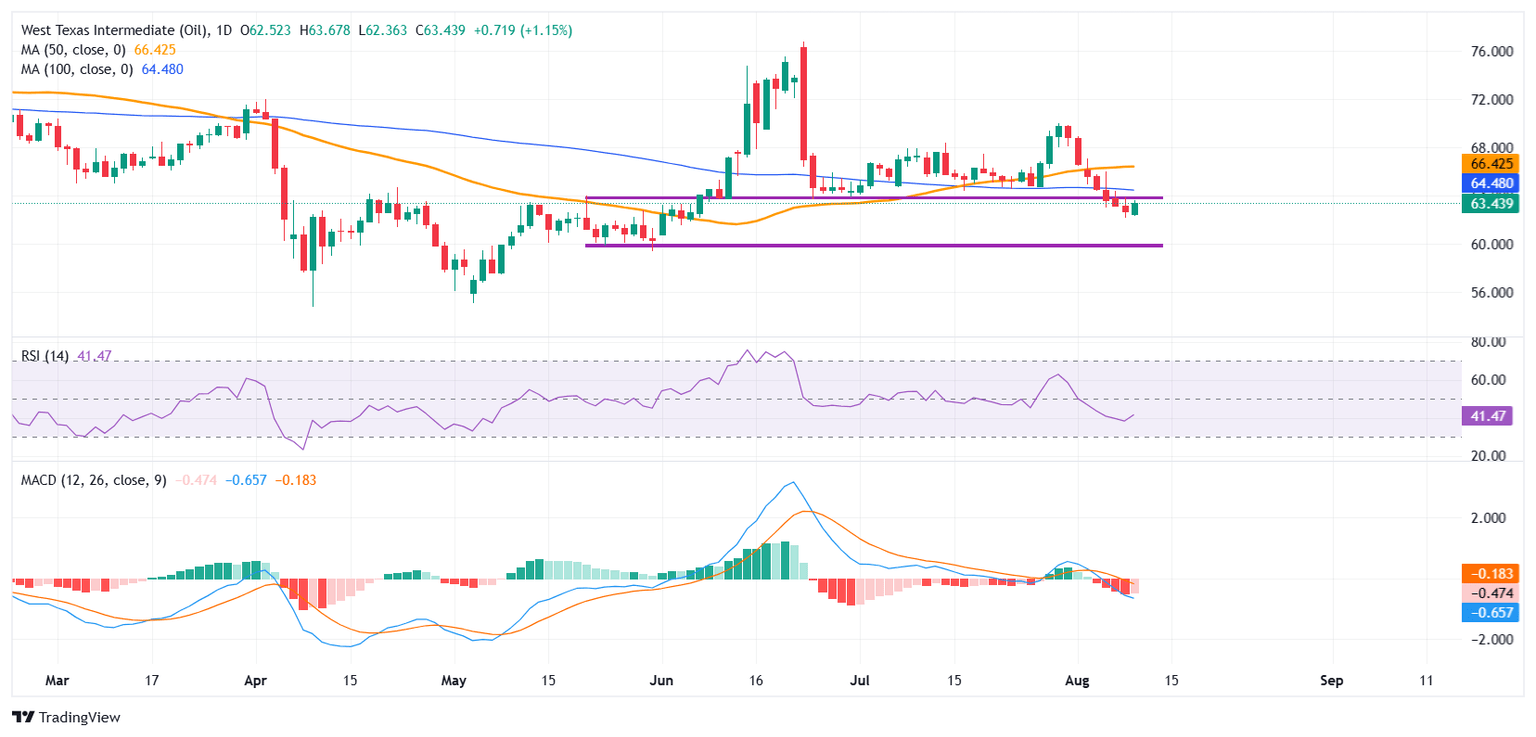

- WTI faces immediate resistance at Friday’s high of $63.89, with further hurdles at the 100-day SMA ($64.48) and 50-day SMA ($66.42).

West Texas Intermediate (WTI) Crude Oil attracts fresh buying interest on Monday, breaking a sharp seven-day losing streak that had dragged prices to their lowest level in two months. The rebound comes as traders shift their attention to the upcoming US-Russia peace talks on Ukraine, scheduled to take place in Alaska on Friday.

The mild recovery comes after a bruising week in which the US benchmark slid nearly 5% its steepest drop since late June, amid fears over slowing global demand, fresh tariff shocks, and rising Organization of the Petroleum Exporting Countries (OPEC+) output. At the time of writing, the Crude Oil is trading around $63.50, up over 1.0% at the start of the American trading session.

Adding to the backdrop, Washington’s latest sanctions drive has intensified pressure on major Russian oil buyers. The US recently imposed an additional 25% tariff on Indian goods over New Delhi’s purchases of discounted Russian Oil, while similar measures against China are reportedly under consideration.

Any diplomatic breakthrough in the Alaska talks could ease geopolitical risk premiums and open the door to a recalibration of global Oil flows, particularly if it results in a phased rollback of sanctions on Russian exports. Conversely, if negotiations fail to produce tangible outcomes, markets may brace for renewed volatility as traders hedge against the risk of further supply disruptions and heightened geopolitical tensions.

Traders also await monthly reports from the US Energy Information Administration (EIA), OPEC+, and the International Energy Agency (IEA) this week for further insights into supply and demand trends.

From a technical perspective, WTI is attempting to recover from last week’s heavy losses but faces immediate resistance at Friday’s high of $63.89, a level that overlaps with a key support-turned-resistance zone and serves as a pivotal hurdle for bulls. If cleared, the next obstacles are the 100-day Simple Moving Average (SMA) at $64.48 and the 50-day SMA at $66.42.

On the downside, initial support is seen at the intraday low of $62.36, with short-term support at $61.50. A break below this level could expose the $60.00 handle, which stands as a strong psychological and structural support.

The Relative Strength Index (RSI) on the daily chart is at 42, recovering modestly after sliding toward the lower end of the neutral range, suggesting that while bearish momentum has eased, any rebound could still face headwinds unless buying pressure strengthens. The Moving Average Convergence Divergence (MACD) indicator remains in negative territory, with the signal line above the MACD line and histogram bars still slightly red, indicating that downward momentum persists. However, the recent flattening of the histogram suggests selling pressure may be stabilizing, hinting at a potential shift if follow-through buying emerges.

Brent Crude Oil FAQs

Brent Crude Oil is a type of Crude Oil found in the North Sea that is used as a benchmark for international Oil prices. It is considered ‘light’ and ‘sweet’ because of its high gravity and low sulfur content, making it easier to refine into gasoline and other high-value products. Brent Crude Oil serves as a reference price for approximately two-thirds of the world's internationally traded Oil supplies. Its popularity rests on its availability and stability: the North Sea region has well-established infrastructure for Oil production and transportation, ensuring a reliable and consistent supply.

Like all assets supply and demand are the key drivers of Brent Crude Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of Brent Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of Brent Crude Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact Brent Crude Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.