With Q3 earnings rally, it's time for Broadcom to replace Tesla in Magnificent 7

- Broadcom's massive Q3 report makes it a prime target for Mag7 inclusion.

- It should replace Tesla as the latter has a lower valuation and profit profile.

- Broadcom's move into AI chips makes it a competitor to Nvidia.

- August NFP shows large reduction in hiring, spurs equity flight.

Broadcom (AVGO) seems to finally be getting its due. After initially selling off after a slim fiscal third-quarter beat on Thursday, the stock went on a tear, rising as much as 16% on Friday.

The initial ho-hum market treatment on Thursday gave way to a red-hot rally after CEO Hock Tan announced that Broadcom had secured over $10 billion in AI infrastructure orders from a new customer. Since Broadcom already works with all the major hyperscalers, many presume this to be Sam Altman's OpenAI.

That news sent Nvidia (NVDA) stock some 3% lower since it means that the leading chipmaker has new competition from Broadcom's custom AI chips.

The broader market has slumped on Friday after the Bureau of Labor Statistics (BLS) announced only 22K net new US hires in August, far below the Nonfarm Payrolls (NFP) consensus for 75K. June's hiring data was also revised down by 27K to a 13K job loss.

Broadcom should replace Tesla in the Magnificent 7

Broadcom's roughly $160 billion gain in market cap on Friday places it well above Tesla (TSLA), and this is reason enough for Hock Tan's company to replace the latter in the Magnificent 7 list of leading tech stocks.

With a market cap of $1.44 trillion, Broadcom is now about one-third larger in valuation than the leading EV maker. That makes it the seventh-largest stock in the US market.

%20-1757088584113-1757088584116.png&w=1536&q=95)

Largest stocks by market cap as of September 5, 2025

While Tesla's board has signaled it will give CEO Elon Musk the largest executive pay package in history, giving Musk $1 trillion in compensation if he can boost Tesla's market cap to $8.5 trillion over the next ten years, Tesla is banking on a yet unproven technology.

Earlier this week, Musk said that 80% of Tesla's value would come from humanoid robots over the coming years. This promise comes after Musk has spent years saying that Tesla's robotaxi operation would eventually become the primary profit center of the business. The problem, besides Musk routinely overpromising and under-delivering, is that Musk is focused on businesses that are unlikely to achieve the margins necessary to remain in the Mag7.

This becomes clear when you place Tesla's net income next to the same companies from the market cap chart. As you can see below, Tesla's paltry $5.9 billion is less than one-third of Broadcom's $18.9 billion. While Berkshire's net income is much larger, it gets excluded for being a holding company and for featuring slower growth. Walmart (WMT) is also largely a retail company that doesn't have the tech chops to compete with the first six. That leaves Broadcom.

%20-1757089228088-1757089228089.png&w=1536&q=95)

Ten Largest US stocks (market cap) by trailing-twelve-month net income

Broadcom's guidance for AI semiconductor revenue of $6.2 billion in fiscal Q4 and the overall largest backlog on record of $110 billion mean that investors can expect the company's market cap to continue rising at a swift pace. But of course, only if the macro picture obliges.

When it comes to rising revenue and profits, this is probably just the start of Broadcom's lead over Tesla.

Broadcom stock forecast

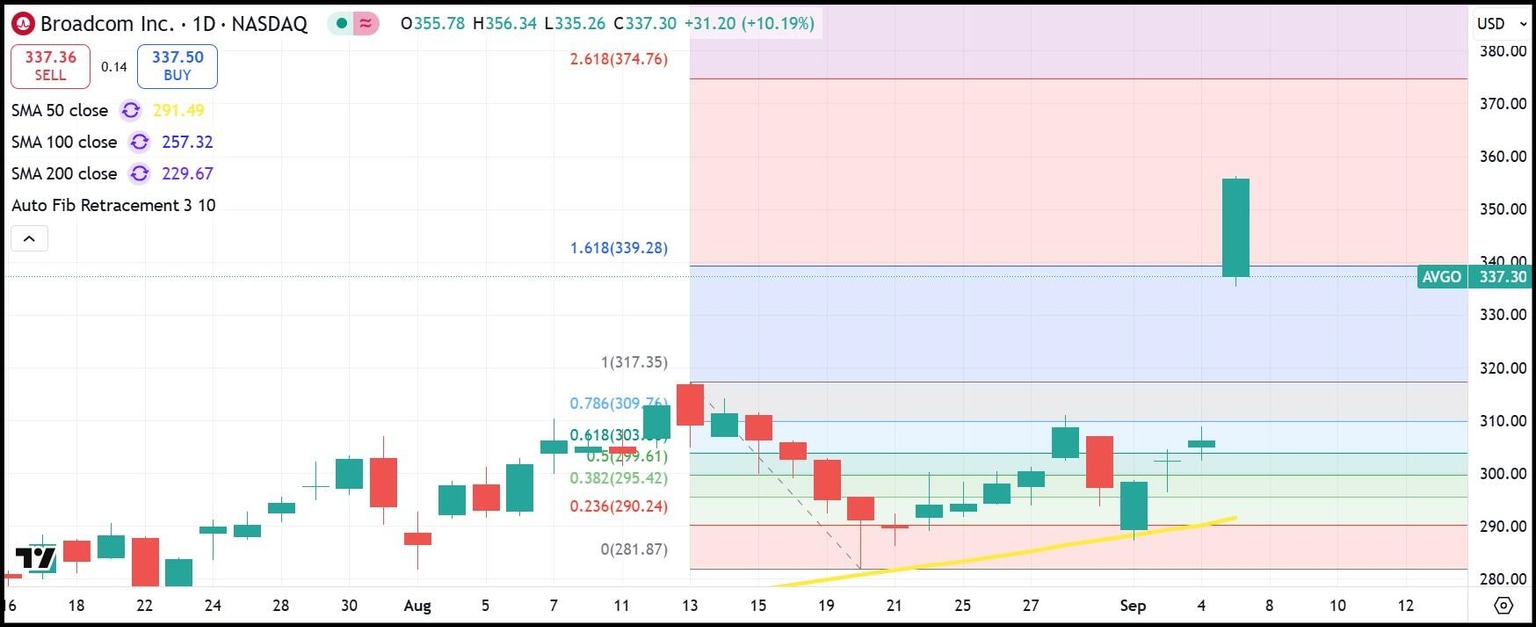

After launching to an all-time high of $356.34, investors took profits, pushing AVGO stock back to $337. That is a little below the 161.8% Fibonacci retracement at $339.28. In the coming sessions, it wouldn't be surprising to see AVGO move back to $317.35, the 100% Fibo placeholder and high from August 13.

A further rally should see Broadcom stock attempt to reach the 261.8% Fibo at $374.76. Support remains at the 50-day Simple Moving Average (SMA), which is rising swiftly but currently tails the price level at $291.45.

AVGO daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.