Where will the S&P 500 find a bottom?

Yesterday, the FED’s forecast for only two rate cuts in 2025 catalyzed the markets to usher in the correction we were already anticipating five weeks ago. Namely, using the Elliott Wave (EW) for the SP500 (SPX), we found back then

“if the index can stay at least above SPX5880, and especially last week’s low at SPX5696, we must allow it to ideally target SPX6060, possibly as high as SPX6175 before the next correction of around 5-7% can start.”

We backed that up two weeks ago as we concluded

“[The SPX] can reach the typical c=a extension at SPX6175ish, but the 0.764x extension is around $6060. Moreover, the usual grey W-c target zone is $6145+/-10, but the market can also deviate from that. So, we still expect the red W-iii to reach SPX6060-6175, from where the red W-iv can materialize.”

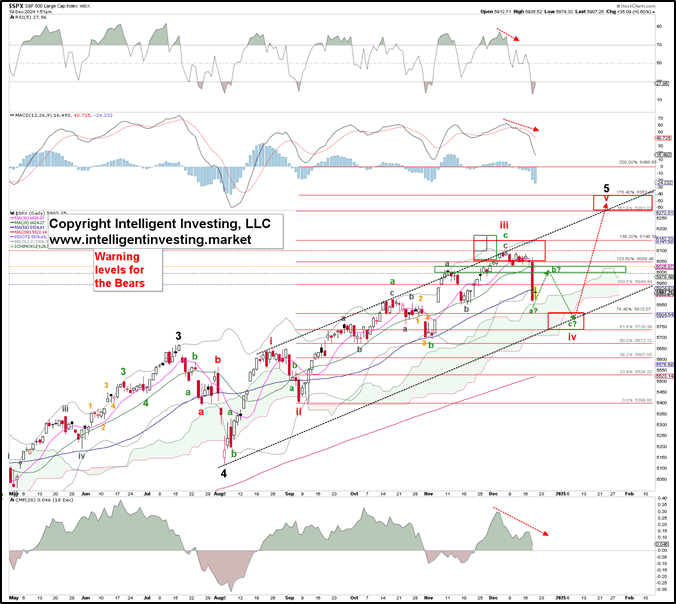

So far so good, as we based our analyses on the fact that the index's advance since the August low resembled an Ending Diagonal (ED) structure. As a reminder, an ED’s waves (i-ii-iii-iv-v) comprise three waves: 3-3-3-3-3 = abc-abc-abc-abc-abc. Besides, W-iii typically targets the 123.60% extension of W-i, measured from W-ii. The W-iv then tends to correct back to the 61.80% extension, after which the last W-v targets the 161.80% extension. We were looking at W-iii to reach at least SPX606 in this case. See Figure 1 below.

Figure one: Preferred Elliott Wave count for the S&P 500

True to the ED’s path, the index peaked at $6099 on December 6. That’s only 0.6% off the ideal target, showing that the EWP is an amazingly accurate tool for forecasting the financial markets. This greatly helps our premium members stay on the right side of the trade and gives them precise and prudent trade-trigger levels.

Thus, with yesterday’s -3% day, the red W-iv “correction of around 5-7%” we anticipated announced itself and should subdivide, as shown, over the next few days, to the ideal target zone of $5735-5810. Contingent on the index holding above at least $5670, and especially $5400, we must expect the ED’s path we have been tracking for weeks to unfold. W-iv is underway and should bottom out around $5735-5810 over the coming days before W-v can reach at least $6280.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.