Germany CPI inflation declines to 1.8% in December

Annual inflation in Germany, as measured by the change in the Consumer Price Index (CPI), declined to 1.8% YoY in December from 2.3% in November, the German statistics office Destatis reported on Tuesday. On a monthly basis, the CPI was unchanged, compared to the market expectation for an increase of 0.2%.

In this period, the Harmonized Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred inflation gauge, rose 2% YoY. This print followed the 2.6% increase recorded in November and came in below the analysts' estimate of 2.2%.

Market reaction to German inflation data

EUR/USD stays under modest bearish pressure after soft inflation readings from Germany, and was last seen losing 0.2% on the day at 1.1700.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.22% | 0.27% | 0.16% | 0.13% | -0.02% | 0.11% | 0.31% | |

| EUR | -0.22% | 0.04% | -0.09% | -0.08% | -0.23% | -0.11% | 0.09% | |

| GBP | -0.27% | -0.04% | -0.13% | -0.13% | -0.28% | -0.16% | 0.05% | |

| JPY | -0.16% | 0.09% | 0.13% | -0.00% | -0.16% | -0.03% | 0.17% | |

| CAD | -0.13% | 0.08% | 0.13% | 0.00% | -0.16% | -0.03% | 0.17% | |

| AUD | 0.02% | 0.23% | 0.28% | 0.16% | 0.16% | 0.13% | 0.33% | |

| NZD | -0.11% | 0.11% | 0.16% | 0.03% | 0.03% | -0.13% | 0.19% | |

| CHF | -0.31% | -0.09% | -0.05% | -0.17% | -0.17% | -0.33% | -0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

(This section below was published as a preview of the German inflation data.)

Flash German HICP data Overview

The preliminary German Harmonized Index of Consumer Prices (HICP) data for December is due for release today at 13:00 GMT.

The Federal Statistics Office of Germany is expected to show that HICP rose at an annual pace of 2.2%, slower than 2.6% in November. On a monthly basis, price pressures are expected to have grown sharply by 0.4% after deflating by 0.5% last month.

Earlier in the day, the inflation data from four states of Germany, Brandenburg, Hesse, Saxony, and North Rhine-Westphalia, showed that year-on-year (YoY) Consumer Price Index (CPI) grew at a moderate pace, while on month, growth in inflationary pressures was faster.

The CPI data of other German states, Bavaria and Baden-Württemberg, will be published on Wednesday. On the same day, Eurostat will publish the preliminary Eurozone HICP data for December.

The impact of the preliminary German HICP data for December will be significant on market expectations for the European Central Bank’s (ECB) monetary policy outlook, given that the German economy is the largest nation of the Eurozone in terms of population and trade.

How could the flash German HICP data affect EUR/USD?

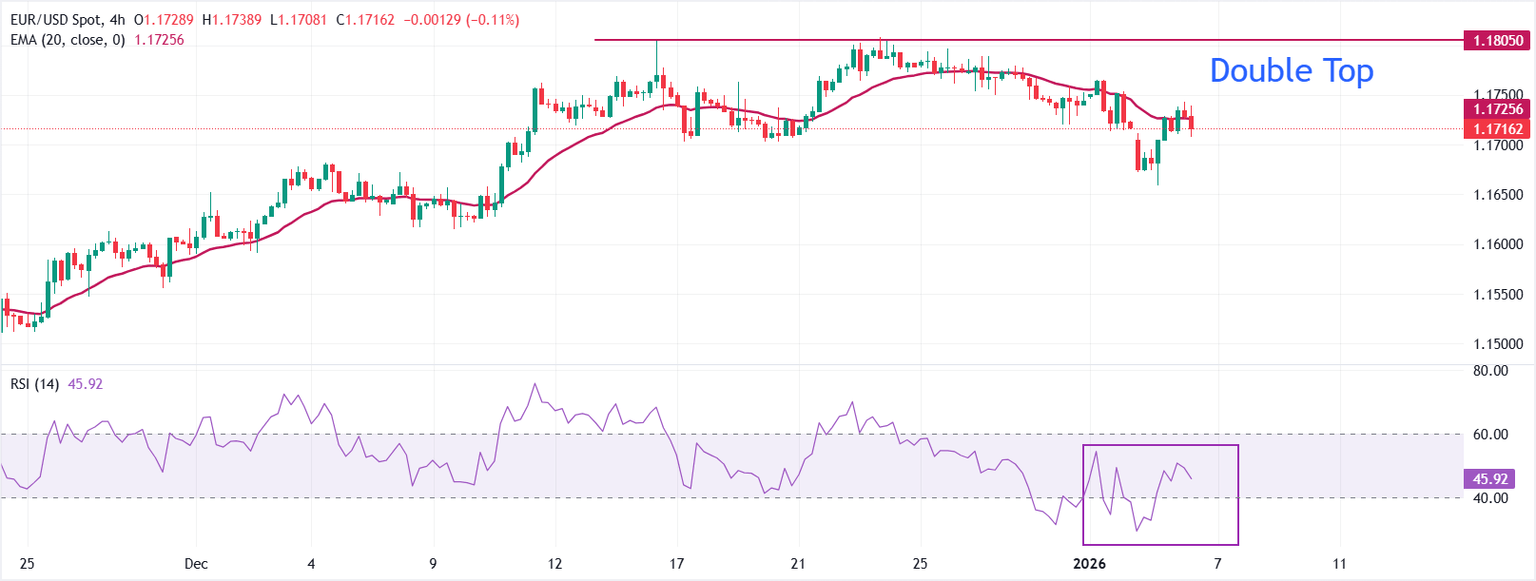

EUR/USD trades 0.11% lower to near 1.1717 ahead of the German HICP data release. On the four-hour timeframe, the major currency pair holds below the 20-period Exponential Moving Average (EMA), which slopes lower at 1.1726 and caps intraday rebounds. The 20-EMA has been easing steadily, keeping the near-term bias on the back foot.

The pair has been under pressure in the past few weeks amid the Double Top formation, which signifies that an intermediate top has been created.

The 14-period Relative Strength Index (RSI) at 46 (neutral) is soft, confirming fading upside momentum.

Below the falling average, sellers remain in control and could push the price lower to near the December 2025 low around 1.1600. On the upside, a clear close above the December 16 high of 1.1804 could open the door to further gains toward the 17 September 2025 high of 1.1919.

(The technical analysis of this story was written with the help of an AI tool.)

(This story was corrected at 11:04 GMT to say in the fifth paragraph that the impact of the preliminary German HICP data for December will be significant, and not September.)

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.