When is the BoJ and how might it affect USD/JPY?

At around 0300 GMT, (as there is no fixed time as usual for the decision, but traders will be looking for it around this time), the Bank of Japan is expected to maintain its key interest rates at today’s meeting. The BOJ continues to defend low rates with bond buying.

''Quarterly forecasts should show inflation for FY2022 revised up from 1.1% to nearer 2% but probably lower in 2023 and with Gross Domestic Product growth revised down,'' analysts at Westpac explained. ''The BoJ views the pickup in inflation as very much cost-push, not demand-pull. Governor Kuroda will be asked about the Japanese yen at the press conference.''

How might the BoJ affect USD/JPY?

While the decision itself is probably a non-mover for the yen, FX intervention themes surrounding a much stronger US dollar could be. The US dollar has rallied to five-year highs and the BoJ and US Treasury are a phone call away from collaborating on any such practice as to try and take on the market. However, jawboning has been a theme of late, as recent as early Asia with Japan's finance minister Suzuki out again commenting on the price, saying that rapid yen moves are undesirable.

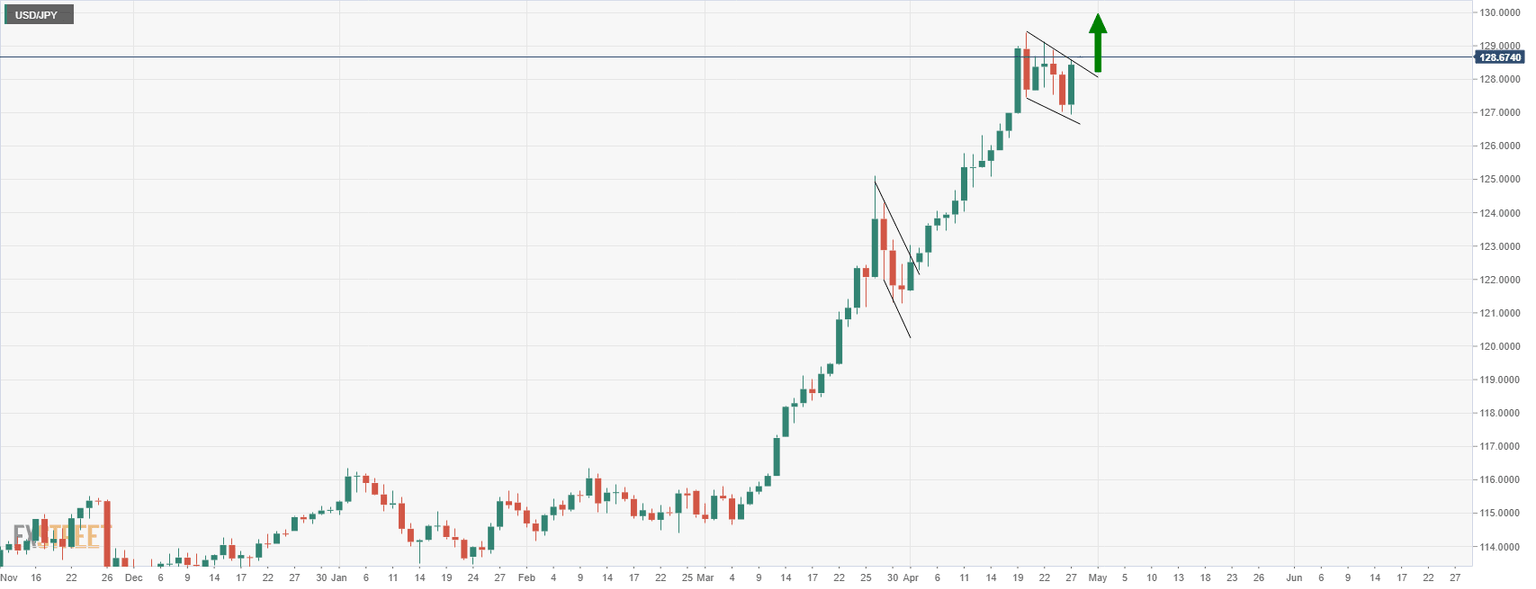

Meanwhile, the bid in the US dollar has seen the price of the yen pushed to the ceiling of a short-term descending channel, drawn off the April 20 cycle high. As with the flag of late March business, the bulls will be looking for a firm close outside of the channel and the subsequent formation of a bull flag, signalling the potential for continuations for the foreseeable future.

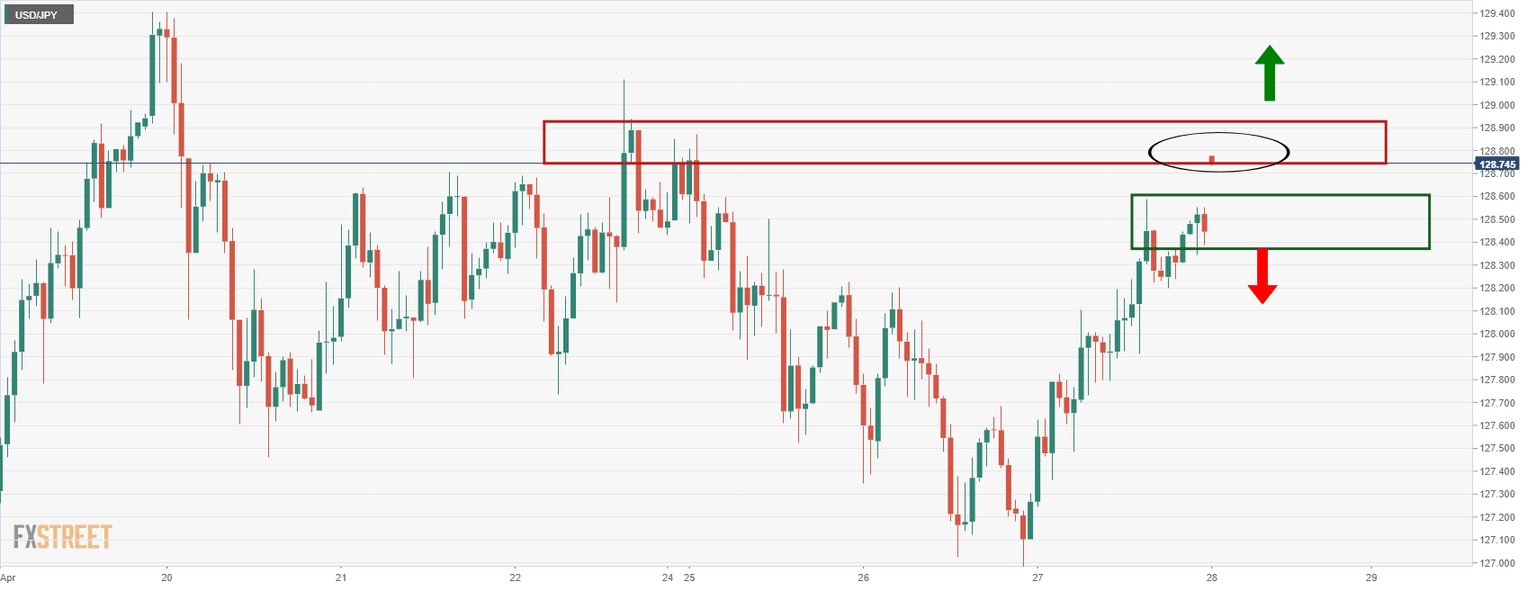

From an hourly perspective:

...the price is testing the key resistance area ahead of the event. Bulls will need to get through 129.00 and hold the fort above there for a convincing case for higher for longer. On a switchback, a break below the prior lows near 128.35 could be important.

About the BoJ interest rate decision

BoJ Interest Rate Decision is announced by the Bank of Japan. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the JPY. Likewise, if the BoJ has a dovish view on the Japanese economy and keeps the ongoing interest rate, or cuts the interest rate it is negative, or bearish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.