Watch Live: US Presidential Election Debate

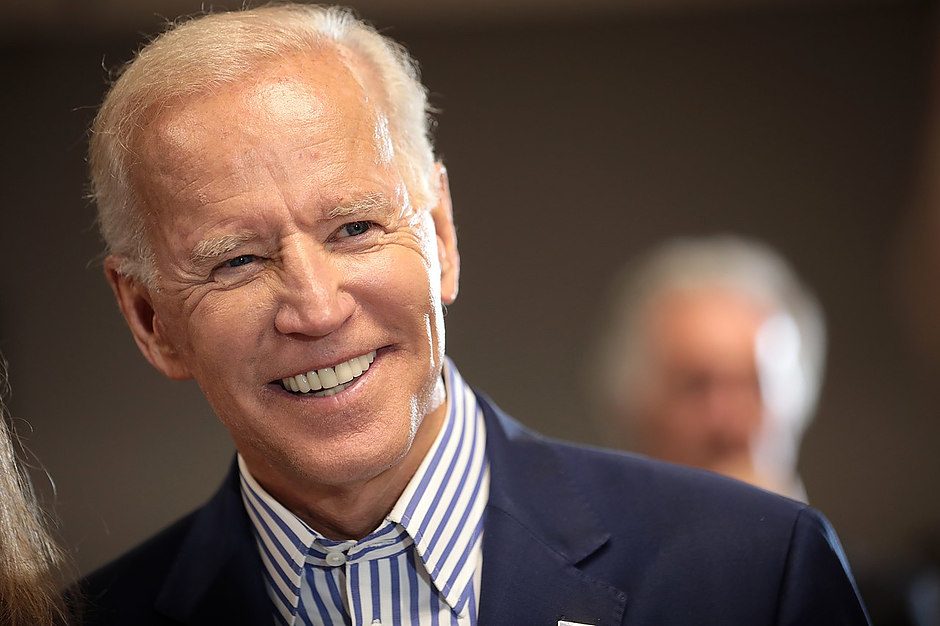

- President Donald Trump and Democratic presidential nominee Joe Biden are set to face off.

- The debate is scheduled to start at 9 p.m. Eastern Time.

It is expected to be a heated debate, so much so that the Commission on Presidential Debates announced on Monday that they will mute each candidates’ microphone for two minutes during the initial response to six of the debate topics.

Trump is renowned for interrupting and taking control for which the rules now are that each candidate speaks uninterrupted, but 15 minutes of open discussion will follow without any muting, according to the commission.

Trump isn't happy about the changes and he told reporters that while he objects to changes for Thursday’s debate, he is committed to debating his opponent regardless.

The debate is scheduled to start at 9 p.m. Eastern Time.

Watch, Live at 9:00 p.m. ET, GMT 01:00, Oct. 22

Who's leading in the battleground states?

At the moment, polls in the battleground states look good for Joe Biden, which is why this debate is so important to Trump's campaign.

Polls point to big leads in Michigan, Pennsylvania and Wisconsin - three industrial states for Biden.

Back in 2016, Trump won by margins of less than 1% to clinch his victory.

However, the battleground states where Mr Trump won big in 2016 is where he will be most concerned for.

His winning margin in Iowa, Ohio and Texas was between 8-10% back then but it's looking much closer in all three at the moment and political analysts rate Trump's chances of re-election as low.

FiveThirtyEight, a political analysis website, says Mr Biden is "favoured" to win the election, while The Economist says he is "very likely" to beat Mr Trump.

Market implications

A Biden landslide, or Blue wave victory which such a landslide has been referred to, would likely see larger fiscal stimulus packages and thus pressure the US dollar lower.

However, there are pros and cons for the stock market, particularly for financials and tech as legislation is expected to be tougher on those sectors under a Democrat government.

On the other hand, a more moderate stance on China and larger fiscal stimulus could be a plus for Wall Street and companies with international exposure.

Can Trump make a comeback? Join our live coverage!

FXStreet's Joseph Trevisani and Yohay Elam will analyze the market reaction to the last presidential debate at 00:45 GMT.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.