Wall Street stocks reverse Friday's blood bath

- Wall Street stocks rallied out of the gate and stayed strong throughout the day.

- UK politics, a softer US dollar and global yields helped to boost risk appetite amid strong financial's earnings.

It's been a much better day for Wall Street on Monday with the bulls charging out of the starting blocks from the get-go with pre-market prices pointing up into the open and the cash market running on risk-on sentiment. In the UK, politics were in a better place which calmed nerves in global financial markets and corporate earnings expectations were leaning bullish.

By midday, the Dow Jones Industrial Average advanced 1.8% to 30,311.95 from 29,997.62 ad up over 2%. The S&P 500 was up 2.77% to 3,681 and the Nasdaq Composite was 3.58% higher at 11,073.19. Consumer discretionary and real estate led the gainers, with all sectors in the green. in turn, risk currencies, such as the NZD, were firmer ahead of the Reserve Bank of New Zealand later today. The US dollar slid into support on the daily chart, as illustrated below, while the 10-year yield fell below 4% and tapped into its daily support structure too.

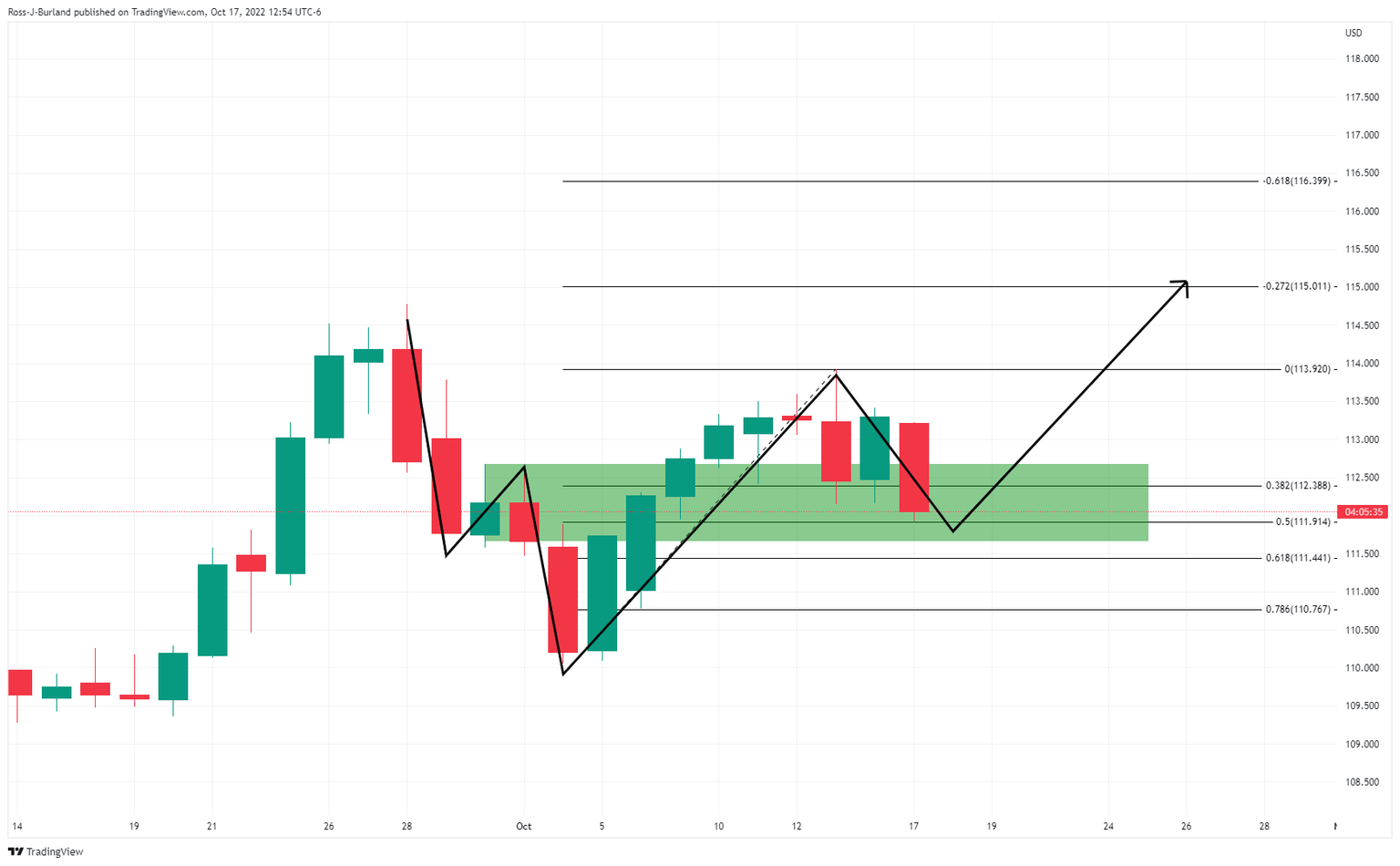

US dollar, DXY, daily chart

In terms of performers, financials were on the up with shares of Bank of America rallying some 5.3% intraday. The lender, which benefits fro higher interest rates, reported better-than-expected third-quarter results. Net interest income grew 24% to $13.77 billion, driven by higher interest rates, lower premium amortization and loan growth.

Additionally, the Bank of New York Mellon's Chief Executive Robin Vince said in a statement after posting stronger-than-anticipated performance,

"our performance benefitted from higher interest rates and continued strength in client volumes and balances across our securities services and market and wealth services segments." The giant raised its net interest revenue outlook for the full year.

As for interest rates, markets are pricing in the probability of the fourth consecutive 75-basis-points hike to more than 99% on Monday from almost 77% a week ago, according to the CME Group's FedWatchTool.

US data of late has been a mixed bag but Federal Reserve speakers have continued to paint a hawkish outlook for the final meetings of the year. Analysts at Brown Brothers Harriman noted that ''Bostic and Kashkari speak tomorrow while Kashkari, Evans, and Bullard speak Wednesday. Harker, Jefferson, Cook, and Bowman speak Thursday. Williams speaks Friday. At midnight Friday, the media embargo goes into effect and there will be no Fed speakers until Chair Powell’s press conference on November 2.''

The Fed's Beige Book will be a highlight this week on the calendar. The analysts at BBH said that ''the last report was based on survey responses on or before August 29. Since then, we have gotten two sets of job and inflation data that show that the labour market remains firm and price pressures are still rising and broadening.''

''However,'' they said, ''recent PMI readings suggest that the supply chains continue to heal. When all is said and done, we believe the report will support a 75 bp hike at the November 1-2 FOMC meeting. Of note, a 50 bp hike at the December 13-14 FOMC meeting is fully priced in, with over 65% odds of a larger 75 bp move then. The swaps market is still pricing in a peak Fed Funds rate near 5.0% but this could move even higher.'' In turn, US stock as a whole will be at the mercy of anything more hawkish than that assessment of current pricing.

UK politics in focus

Meanwhile, however, they have enjoyed some better sentiment out of the UK's political scene. The new British finance minister Jeremy Hunt announced a plan to reverse almost all of his predecessor's unfunded tax cuts announced earlier this month in a mini-budget. This sent gilts higher, rates lower and the pound recovered into the 1.14 area, printing as high as 1.1439 at one moment. The political backdrop helped to boost market confidence which was reflected in today's rally on Wall Street.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.