Wall Street close: Sea of red again, fears of coronavirus spread continues

- DJIA, fell around 121 points, or 0.4%, closing near 26,960.

- S&P 500 lost about 12 points or 0.4% to finish trading near 3,117.

- Nasdaq Composite Index ended near 8,981, up 15 points or 0.2%.

US stocks closed mostly lower on Wednesday as the fear of the super-spreader coronavirus keeps investors sidelined as US yields fall to a record low of 1.2940%. The coronavirus is spreading worldwide at a faster rate than it is in China, as reported by the WHO into the close in New York.

Consequently, the Dow Jones Industrial Average DJIA, fell around 121 points, or 0.4%, closing near 26,960, while the S&P 500 lost about 12 points or 0.4% to finish trading near 3,117 and the Nasdaq Composite Index ended near 8,981, up 15 points or 0.2%. The VIX closed at 27.56 -1.04%.

Earlier in the day, an FDA official warned that the coronavirus was on the cusp of becoming a pandemic sending the indexes and crude off a cliff. This followed yesterday's comment from Anne Schuchat, principal deputy director of the CDC, who said, “Current global circumstances suggest it’s likely this virus will cause a pandemic.”

All eyes on the White House and Trump presser

We are waiting to hear from US President Donald Trump today who will address the nation in a press conference where it is expected that he will play down the recent rhetoric from US health advisors. Upon returning from an overseas trip to India, Trump complained that media outlets were "doing everything possible to make the Caronavirus look as bad as possible, including panicking markets, if possible," misspelling the name of the virus. He then criticized the pushback from Democrats on the administration's response to the outbreak and added, "USA in great shape!"

The event takes place after the Wall Street close, (scheduled for 2330GMT), so it will not be until tomorrow that US stock markets will react on the White Houses response to the sudden outbreaks, however, gold will be on to monitor which trades twenty-three hours a day from 2200 GMT until 2100 GMT on the daily charts.

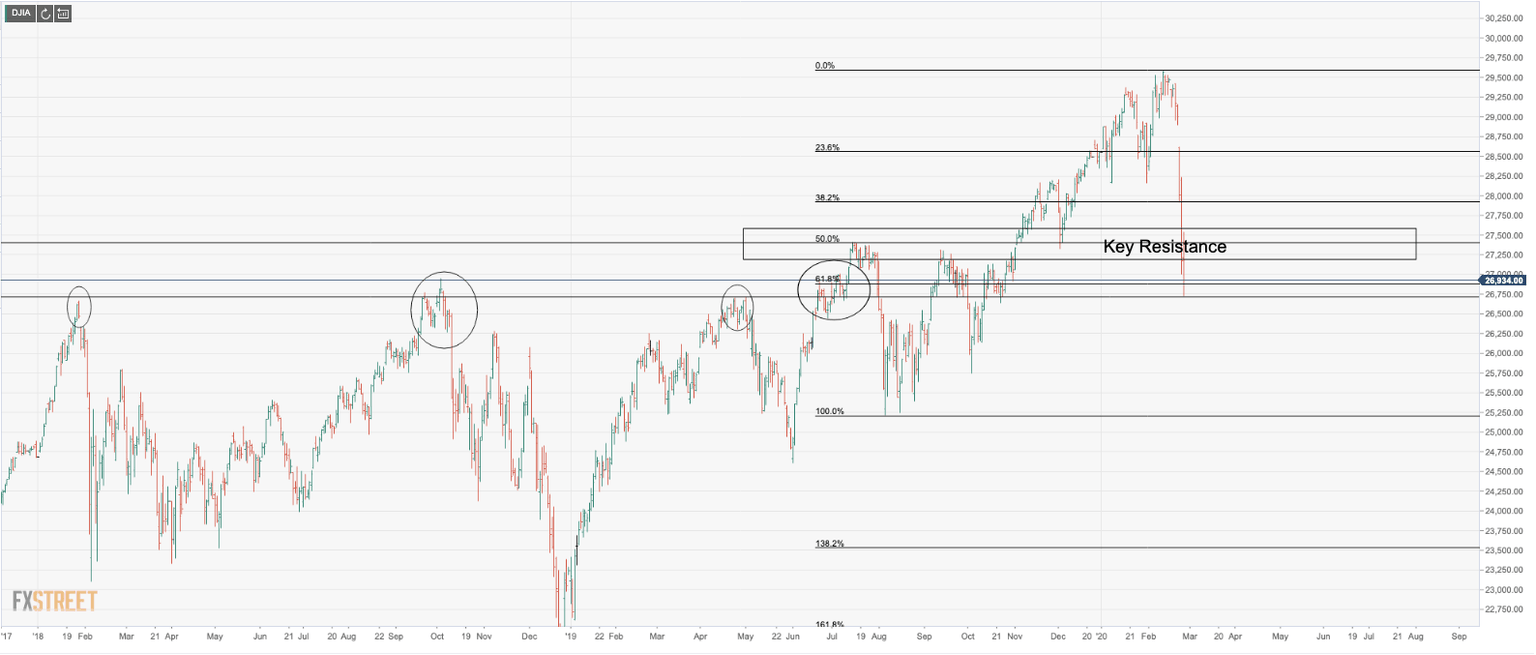

DJIA levels

As can be seen, the bears have juiced out the downside about as much as it is to be expected without there being a healthy retracement and the 50% mean reversion level is a key structure which meets a confluence of highs and lows. On failures by the bears there, the upside targets for the bulls can be met in a hold above this structure. However, further downside can be expected if the resistance holds with eyes on a 100% retracement to the August lows down in the 25200s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.