Wake Up Wall Street (SPY) (QQQ): ZEW puts recession odds on, PPI surges, stocks stage bounce on peace hopes

Here is what you need to know on Tuesday, March 15:

Bond markets remain in catch-up mode and are quickly making up for lost time. Having seen massive safe haven inflows since the start of the Russia-Ukraine conflict, which drove yields lower, they are now back in surge mode. The last four sessions have seen the Bund yield move nearly 40 basis points, and the US 10-year has also been on the move, back above 2.1% now. All this of course is not going to help equity valuations, and the Nasdaq is the big loser as it dropped just under 2% on Monday.

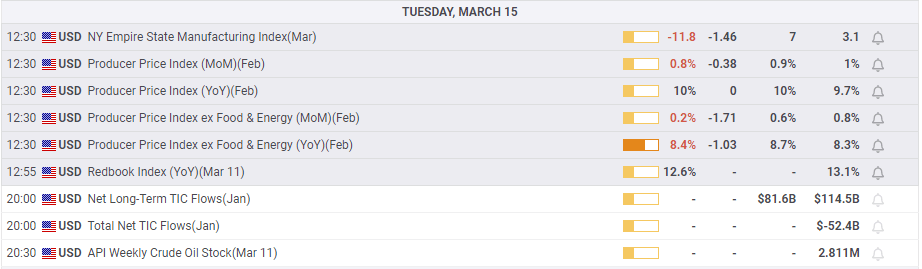

The US PPI just arrived, and it contained no real surprises given the inflation cat is out of the bag and central banks are miles behind in the race to rein it in. Rate hikes will have to come no matter the stagflationary scenario. This is now becoming more and more likely with the release of the German ZEW this morning. The ZEW Economic Sentiment Index slumped from a prior reading of 54.3 to -39.3. No doubt Germany is massively affected by the gas price spikes. This can be seen as an early warning sign for the US economy, and already we see last week's Michigan Sentiment number coming in worse than expected.

For a minute, let us try to pitch an alternative scenario to the overwhelming bearish case currently. Blue sky thinking: Russia and Ukraine agree on a peace deal, energy prices drop 10-20%, sanctions are rowed back on relatively quickly. Corporate buyback activity is still at record high levels, but we are left with then central banks turning even more hawkish as the economic headwinds from energy and sanctions abate. The Fed goes for more aggressive tightening as does the ECB. Inflation persists until early 2023, at which stage consumers have adjusted their spending downwards. Supply chain disruptions from sanctions and lockdowns in China do not ease so quickly and are still a headwind. In our view then, it is still not a bullish environment for equities.

As mentioned the bond markets are rushing to this realization and US 10-year yields are over 2.1% now, the highest since June 2019. The dollar index is lower at 98.70, and Gold is at $1,922. Oil is back under $100 at $96.10 due to supply talks.

European markets are lower but off earlier lows: Eurostoxx -0.45, FTSE -0.4%, and Dax -0.5%.

US futures are positive: S&P +0.5%, Dow +0.4% and Nasdaq +0.8%.

Wall Street News (SPY) (QQQ)

German ZEW -39.3, prio 54.3.

The latest Bank of America Fund Manager survey shows the worst outlook since Great Financial Crisis.

AMC invests in Hycroft Mining (HYMC).

Tesla (TSLA) raises prices again.

Apple (AAPL) supplier Foxconn said to be planning Saudi factory.

Delta (DAL) raises outlook, up 6% premarket.

HYMC gets investment from AMC, shares up 100% premarket.

NIO earnings are confirmed for March 24.

United Airlines (UAL) says guidance to be near the top end of the range, up 6%.

Occidental Petroleum (OXY) down 5% premarket following downgrade.

DOLE up on strong earnings.

Lucid (LCID): Steve Wozniak says new car is a Lucid.

GitLab (GTLB) up 9% on earnings.

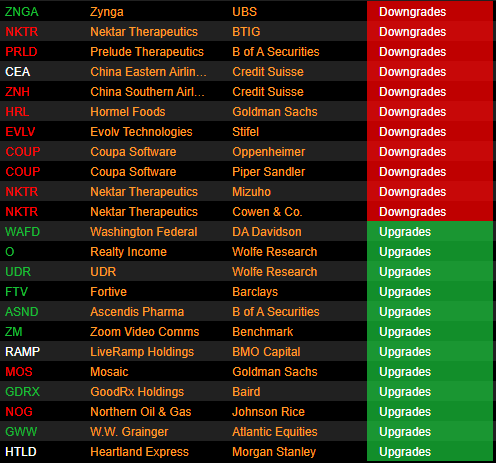

Upgrades and Downgrades

Source: Benzinga Pro

Economic Releases

The author is long Nasdaq (QQQ) puts.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.