Wake Up Wall Street (SPY) (QQQ): Will the market ever be grand again?

Here is what you need to know on Wednesday, September 15:

Equity markets remain nervous, and Tuesday saw initial optimism fade away by the close. Tuesday saw meme stocks suffer and Apple fail to sparkle after a product launch day. China is once again taking centre stage as the Evergrande saga drags on. For those not familiar, Evergrande is one of China largest property companies and is in trouble financially. Bonds in Evergrande have traded for as low as 30 cents on the dollar, and now China this morning says Evergrande will not pay interest due next week. Most investors had been betting that China was unlikely to let Evergrande go bust due to possible contagion risks on other parts of the economy. That may be getting a bit riskier now with today's announcement.

Meme stocks were also in trouble, and instead of going to the moon, AMC and others fell sharply. Speaking of the moon though, SpaceX is set for its first commercial flight later on Wednesday.

The dollar is weaker at 1.1830 versus the euro, Oil is higher at $71.70, and Bitcoin is trading at $47,700. Gold is unchanged at $1,805.

European markets are lower: FTSE flat, Dax -0.2% and Eurostoxx -0.3%.

US Futures are mixed: Dow -0.1%, S&P flat and Nasdaq +0.2%.

SPY top news

ECB says inflation is transitory, and markets may be overestimating risk from Delta on economic activity.

China informed banks that Evergrande will not meet its September 20 interest payment.

Weber (WEBR) barbeque maker sales rise 19% on strong earnings that see the shares up over 3% in premarket.

Macau potential regulatory tightening hitting casino stocks again with WYNN and LVS down in premarket.

Crocs (CROX): Investor day statement sees it upgrade outlook.

SAGE Therapeutics (SAGE) receives fast track designation for Huntington's treatment, up 5% premarket.

Citrix (CTXS) up 4% on sale rumours, according to a Bloomberg report.

Yum China (YUMC) says profits may drop 50-60% because of the Delta variant.

Curevac (CVAC) down 4% after cutting covid vaccine production plans on Tuesday.

Roblox (RBLX) reports daily active users up 32% YoY. Stock down in premarket.

JustEat (GRUB) down in premarket on news Amazon (AMZN) and Deliveroo to partner for free food delivery for UK Prime members.

Kansas City Southern (KSU): Canadian National (CNI) will not increase its bid, according to CNBC. Canadian Pacific (CP) would then be able to finalize the purchase.

Microsoft (MSFT) hikes dividend by 11% and announces a $60 billion buyback.

Lucid Motors (LCID) started as a buy from Bank of America with a $30 price target.

Chevron (CVX): JPMorgan downgrades the stock.

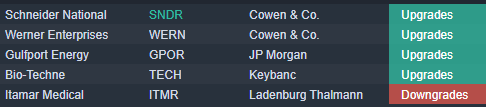

Upgrades, downgrades and premarket movers

Source: Benzinga Pro

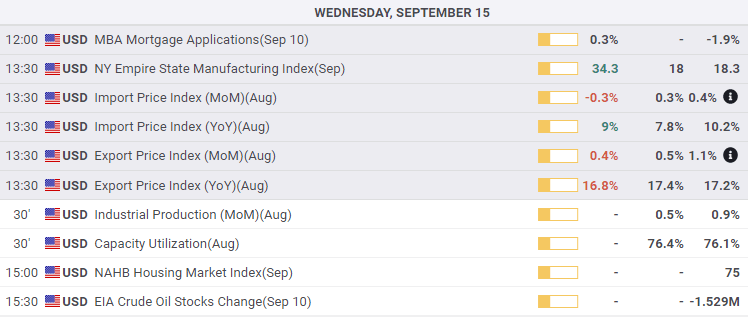

Economic releases due

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.