Wake Up Wall Street (SPY) (QQQ): Shortened trading session unlikely to see fireworks

Here is what you need to know on Friday, November 25:

US equity markets re-open today for a shortened session after Thanksgiving. Occasionally that can make for a sprint to the finish line on heightened volatility but that seems unlikely this time around. Bond markets remain pretty calm and the earlier drop in US Treasury yields is being partially reversed today. That is leading everything risk-off higher with the US Dollar and Oil both up. The situation in China remains a moveable feast as more covid lockdowns seem to be announced daily and protest at the Foxconn plant worsen. Overnight the Chinese bank's reserve requirements were also lowered, a form of easing. The US Dollar caught a small bid on this news.

Gold price is lower on the back of the strong dollar and has higher yields of $1,747 now. Oil is $78.66 while the US Dollar Index (DXY) is 106.30. Bitcoin price is at $16,400.

European markets are virtually flat with the Dax -0.15, FTSE +0.1% and Eurostoxx unchanged.

US futures are lower to flat, Nasdaq -0.5%, S&P and Dow are flat.

Wall Street top news

EU to restart Russian Oil price cap discussions tonight.

Activision Blizzard (ATVI) is down as FTC is likely to sue to block Microsofts (MSFT) takeover.

Manchester United (MANU) is up again as it is in play.

Bed Bath & Beyond (BBBY) struggling to keep stores stocked according to WSJ.

Coupa Software (COUP) is up on takeover speculation.

Reuters headlines

Apple Inc (AAPL) Foxconn's flagship iPhone plant in China is set to see its November shipments further reduced by the latest bout of worker unrest this week, a source with direct knowledge of the matter said on Friday

Activision Blizzard Inc (ATVI), Microsoft Corp (MSFT) & Salesforce.com (CRM) Microsoft is likely to face an EU antitrust investigation as regulators intensify their scrutiny into its practices in a case triggered by Salesforce.com's workspace messaging app Slack.

Amazon.com Inc (AMZN) Workers at Amazon sites across the globe, including in the United States, Germany and France, were expected to go on strike on Black Friday.

Berkshire Hathaway Inc (BRKA) The company said Warren Buffett has donated more of his fortune to four family charities

BP Plc: Employees of oil services firm Petrofac working on several of BP's British North Sea oilfields have voted for industrial action on Dec. 8 and 9 over working conditions, the Unite Union said on Thursday.

Credit Suisse Group AG (CS): The lender has made 889 million new shares available to existing investors at 2.52 Swiss francs ($2.67) per share, the bank said on Thursday.

Ford Motor Co (F) The carmaker is recalling 634,000 sport utility vehicles (SUVs) worldwide over fire risks from possible cracked fuel injectors.

Stellantis NV (STLA) The Fiat parent has concluded it can't currently make affordable electric vehicles in Europe and is looking at lower-cost manufacturing in markets such as India.

Tesla Inc (TSLA) The U.S.-based electric car maker is recalling more than 80,000 China-made and imported cars produced from as early as 2013, for software and seat belt issues, a statement by the Chinese market regulator revealed.

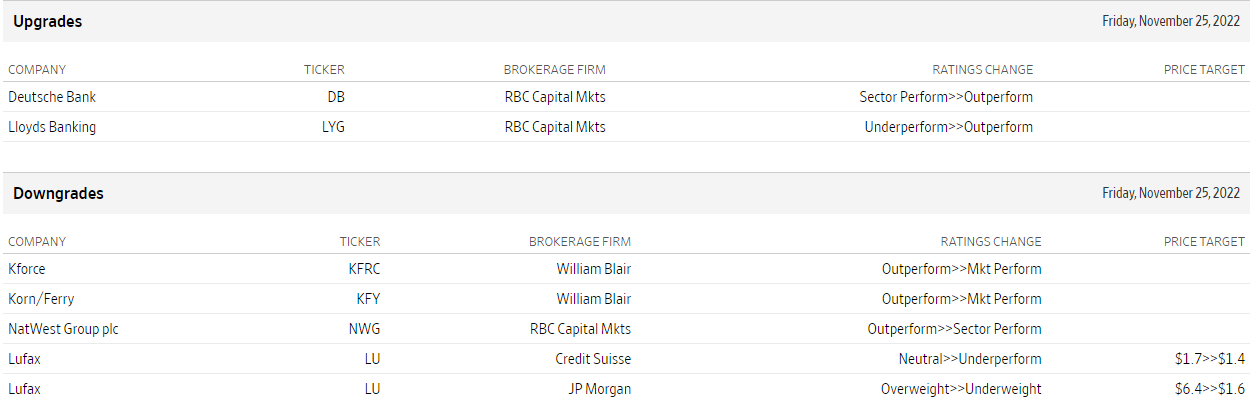

Upgrades and downgrades

Source: WSJ.com

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.