Wake Up Wall Street (SPY) (QQQ): Rouble payment rumbles on, CPI spikes in Europe

Here is what you need to know on Friday, April 1:

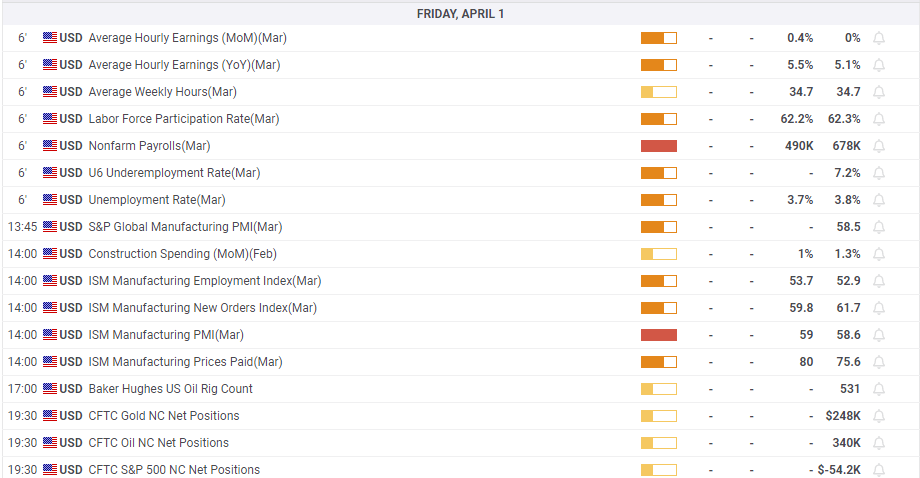

Equity markets in Europe are so far reacting positively to the soaring inflation data out from the block this morning. All eyes are naturally on the US employment report for more clues for both the US economy and stock markets. Fed Chair Powell bet the house on the strength of the US economy, so we will see if he is proven correct. Expectations are for 490k jobs to be added. Europe as expected saw a high CPI print earlier this morning, but stock markets and the euro shrugged it off. It was largely expected given the bloc is stuck with sky-high energy imports.

The dollar is moderately higher as all current traders look to the Rouble. Gazprom has reportedly begun sending payment switch requests to clients today, requesting payment in Roubles now. Bitcoin is lower at $44,900, gold is lower at $1,931, and Oil is back to $99.45 as the UK also says it will join the US in releasing oil from its strategic reserves.

European markets are higher: FTSE +0.3%, Eurostoxx +1% and Dax +0.3%.

US futures are all higher: Nasdaq, Dow and S&P are all +0.5%.

Wall Street Top News (SPY) (QQQ)

Gazprom sending payment requests for Roubles.

UK to release oil from strategic reserves.

Kremlin says the decision to make gas payable in Roubles is irreversible.

China weighs giving the US access to audit most firms-Bloomberg.

Alibaba (BABA) is up 7% premarket on the above news.

XPeng (XPEV) up on strong deliveries.

NIO announces strong March and Q1 deliveries.

GameStop (GME) surges as it looks for stock split approval.

AMC follows GME!

Blackberry (BB) misses on revenue, down 4% premarket.

Wynn Resorts (WYNN) up after Citi upgrade.

Poshmark (POSH) downgraded at Stifel.

Apple (AAPL): JPMorgan removes from analyst focus list-CNBC.

Didi Global (DIDI) is up 19% on China audit access news.

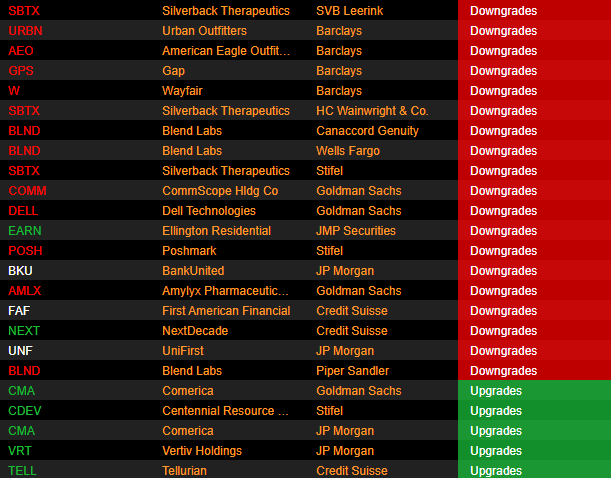

Upgrades and Downgrades

Source: Benzinga Pro

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.