Wake Up Wall Street (SPY) (QQQ): Elon makes Twitter noise as markets stay quiet

Here is what you need to know on Monday, April 4:

The equity market remains relatively calm this morning after a hectic dose of volatility last week. We had the meme stock movement, which began to fade as last week wore on, but overall the equity market held up pretty well. Friday's employment report was a bit mixed and did not give the hoped-for direction. The headline number was a bit behind expectations, but revisions were strong. Overall, the labor market looks strong, and the US economy then is set up to withstand the aggressive Fed rate hiking cycle.

We will see how this plays out. We do notice that a lot of recent flow activity from corporate buybacks and trend following systems has dropped and so too has quarter-end positioning. This may mean equities have a harder time of it this week. The tech space may get some renewed interest though as Elon Musk discloses a chunky 9.2% stake in Twitter (TWTR). TWTR stock spiked immediately over 20% on the news, while other social media stocks also moved up, notably Facebook Meta (FB). Tesla (TSLA) itself also made news over the weekend with some solid delivery numbers. Deliveries reached a record above 300,000 but did fall just short of analysts' estimates.

The dollar index is a bit higher at 98.85, while oil is steady at $100 after US reserves release. Gold too is higher at $1,928, and Bitcoin is at $46,100.

European markets are flat: Eurostoxx -0.02%, FTSE -0.03% and Dax -0.02%.

US futures are also fairly flat: Nasdaq +0.3%, Dow, and S&P are flat.

Wall Street Top News

Germany and France say more sanctions are on the way against Russia.

Austria says it will not back the Russian gas embargo, and Germany is also cautious.

Starbucks (SBUX): Returning CEO halts the stock repurchase program.

Truth Social (DWAC) loses two key executives-Reuters.

Exxon Mobil (XOM) suspends the LNG project in Russia.

General Motors (GM): Canada to support plans for two plants, one of which will be for commercial EVs-Reuters.

JPMorgan (JPM): CEO Jamie Dimon says JPM could lose $1 billion from Russia exposure.

Tesla (TSLA) announced record deliveries for the first quarter.

Twitter (TWTR): Elon Musk discloses 9.2% stake.

JD, BABA, NTES and other Chinese stocks soar on China mulling audit access.

Hertz (HTZ) announces a partnership with Polestar (GGPI) to buy up to 65,000 EVs over the next five years.

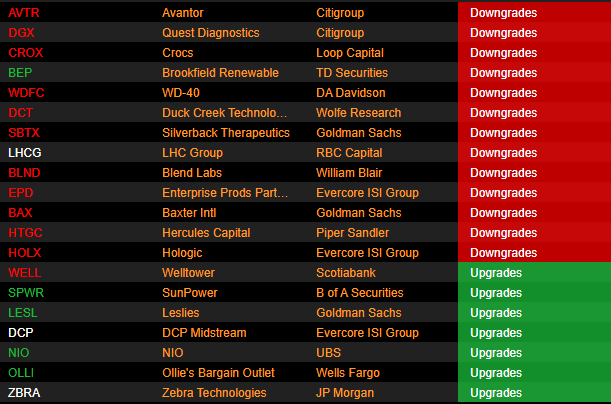

Upgrades and Downgrades

Source: Benzinga Pro

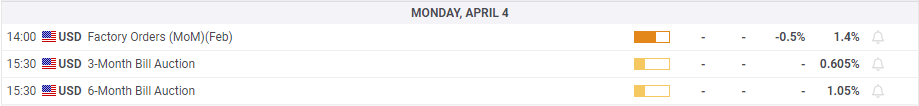

Economic Releases

The author is long BABA and GGPI.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.