Wake Up Wall Street (SPY) (QQQ): Can the employment report finally calm equities?

Here is what you need to know on Friday, May 6:

Equity markets have been swinging wildly this past week and that stepped up a notch on Thursday. The Fed had appeared to open the door to a bear-market rally on Wednesday before the Bank of England slammed it firmly shut on Thursday. Raising rates but warning of a recession sent investors into panic selling mode. At the end of it, all the indices closed near the lows of the day with Nasdaq 5% lower and the S&P over 3.5% down.

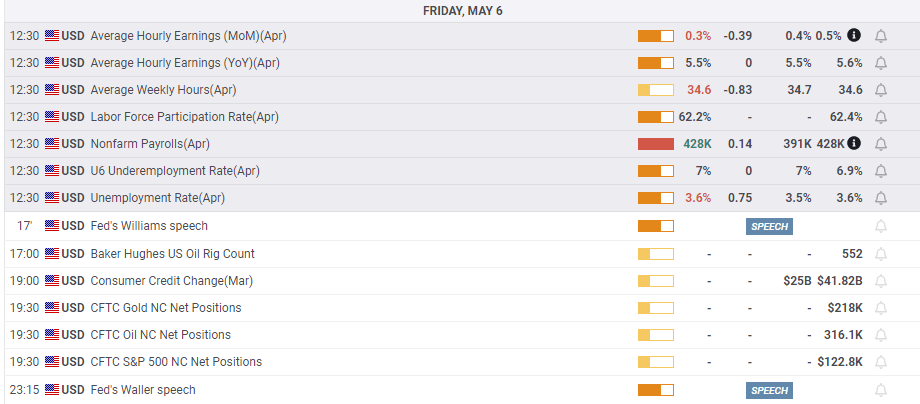

Friday's reaction now will set the tone. Was this a panic-induced last dip to step into? We did have a 90% down day which can be a sign of imminent recovery. The employment report just out was pretty good for equity investors in our view, a strong number but wage growth slightly lower than expected. Certainly, yields and the dollar seem to agree as both have fallen slightly on the release. Let's see how shaken investors react.

The US dollar index is now at 103.32 and Gold price has moved up to $1,885. Oil remains bid at $109.50 and Bitcoin under pressure at $36,100.

European marketrs are lower: Eurostoxx -0.8%, FTSE -0.7% and Dax -1%.

US futures are lower but recovering: Nasdaq -0.1%, Dow flat and S&P -0.1%.

Wall Street (SPY) (QQQ) top news

Employment in US comes in stronger (406k v 378k) average wages lower (0.3 v 0.4%).

Under Armour (UAA) collapses on profit miss.

Virgin Galactic (SPCE) down 6% on earnings.

Draft Kings (DKNG) revenue beat sees stock up 10%.

ShakeShack (SHAK) low outlook hits shares.

Block (SQ) up on earnings miss but bullish commentary. CNBC.

Opendoor (OPEN) up on earnings.

DoorDash (DASH) up on strong revenue.

Peloton (PTON) exploing partial sale according to WSJ.

FuboTV (FUBO) down 21% on earnings.

Johnson and Johnson (JNJ) down on restricted use for covid vaccine from FDA.

Zillow (ZG) down sharply on outlook.

Funko (FNKO) up 20% on new investor and deal with EBAY.

Upgrades and downgrades

Source: Benzinga Pro

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.