Wake Up Wall Street (SPY) (QQQ): Bond yields fall so equities rally but massive earnings to set the tone

Here is what you need to know on Tuesday, April 26:

With the Fed hawks safely locked away, it was time for the bond vigilantes to also take a time out on Monday as bond yields finally gave up their ascent of Everest. With yields falling, equities eventually took the bait and staged a strong afternoon rally of about 2% across the board for the main indices. Elon Musk getting his hands on Twitter naturally helped the tech space and saw TWTR close up 6%. As of this morning, yields are slightly lower again albeit modestly with the US 10-year shedding just 5bps. China remains a real concern for markets after Monday's hammering of Chinese ADRs following more covid lockdowns. Oil too dipped on fears of Chinese demand. This week though remains earnings-centric with tonight seeing Alphabet Google (GOOGL) and Microsoft (MSFT) topping the bill. Before the open UPS and Pepsi (PEP) are in with strong beats following on from Coke (KO) yesterday.

Oil as mentioned fell below $100 and remains there at $99.70 now. Gold is $1902 and Bitcoin is $40,500. The dollar has strengthened and is at 1.0675 now versus the euro and 101.96 for the dollar index. A two year high for the dollar index.

European markets are higher: FTSE +0.1%, Dax +1.2% and Eurostoxx -0.4%. Ok so not all higher!

US futures are all lower: Dow and S&P -0.4% and Nasdaq -0.3%.

Wall Street top news (SPY) (QQQ)

Russia Foreign Minister Lavrov says the threat of nuclear war is real-oh great!

ECB board member Kazakhs says 2-3 rate hikes this year is ok.

EU says more Russia sanctions are on the way.

Rouble hits 2 year high versus euro.

UBS beats earnings on top and bottom lines.

Pepsi (PEP) beats on top and bottom lines.

UPS beats on top and bottom lines.

Microsoft (MSFT), Google (GOOGL) and General Motors (GM) out after the close.

Twitter (TWTR) gets taken out by Elon Musk in case you somehow missed it!

DWAC President Trump says no intention of rejoining Twitter, will be on Truth Social next week.

Warner Brothers Discovery (WBD) Adds 2 million subscribers (Netflix!)

General Electric (GE) beats on earnings per share but revenue misses. Also mentions the dreaded supply chain and inflationary problems so the stock dumps 4%.

3M (MMM) beats on earnings.

DR Horton (DHI) beats on earnings.

Sherwin Williams (SHW) up on earnings beat.

Invesco (IVZ) misses on earnings and assets under management.

Walgreens (WBA) sets mid-May deadline for Boots sell off.

United Airlines (UAL) says to boost transatlantic travel 25% above 2019 levels.

Upgrades and downgrades

Source: Benzinga Pro

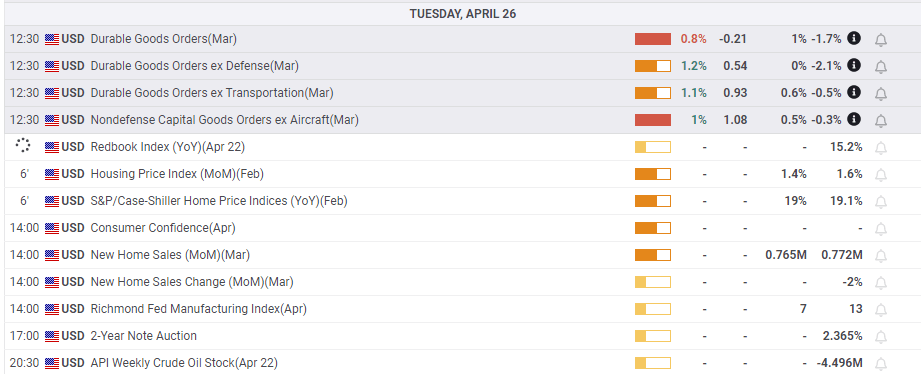

Economic releases

The author is short Tesla stock.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.