Wake Up Wall Street (SPX) (QQQ): Turnaround Thursday, thanks to Waller, Bullard

Here is what you need to know on Friday, July 15:

Thursday was another one to keep investors on their toes as the delayed reaction to Wednesday's shock inflation seemed more in keeping with what should have happened, i.e. more selling. Things were going swimmingly for bears until Fed man Waller stepped up to the plate and swatted away talk of a 100-basis-point hike in July. Fed funds futures markets totally repriced, and the probability for a 100 bps hike moved from near 90% certainty back to 50/50 now versus 75 bps. James Bullard then told the Nikkei later that he was going for 75 bps in July. Both Waller and Bullard would be noted hawks (higher rates), so the market took this accordingly. The S&P and Nasdaq recovered about 2% from intraday lows to close almost unchanged.

Earnings season has commenced, and Jamie Dimon remained in hurricane crisis mode as the bank missed on both EPS and revenue estimates, stopped its buybacks, and generally spoke gloomily about prospects for the economy. Citibank (C) though this morning is making a mockery of those commenters as it smashes earnings forecasts, beating EPS expecations by a wide margin, $2.19 versus $1.69, and revenue as well. Citigroup shares are up 5% in the premarket.

The commodity sphere remains focused on an impending recession as prices remain bearish. Oil is still below $100 at $98 now, which is a tad higher than Thursday. Copper remains under pressure, and we will delve a bit more deeply into this space in our Week Ahead on Wall Street article posted in a few hours. Gold is also lackluster at $1,710, while Bitcoin is managing to gain 2% up to $21,000 now. The dollar remains near multi-decade highs at $108.20 for the dollar index. Europe remains in basket case mode as the Italians rumble over whether to have a leader or not, taking the lead from the UK, while Germany prepares for a pretty cold winter irrespective of what happens to the actual weather. Sovereign spreads continue to blow out, helping the euro to continue its path below parity versus the dollar. Yields too have begun to move lower as bond markets increasingly price in a global recession.

European markets are higher: Eurostoxx +0.6%, FTSE +0.7% and Dax +1.6%.

US futures are also higher: S&P +0.5%, Dow +0.6% and Nasdaq +0.3%.

Wall Street top news (SPX) (QQQ)

ECB Rehn says likely to hike 25 bps in July.

China announces more covid lockdowns.

China economic growth slows sharply, GDP worse than expected.

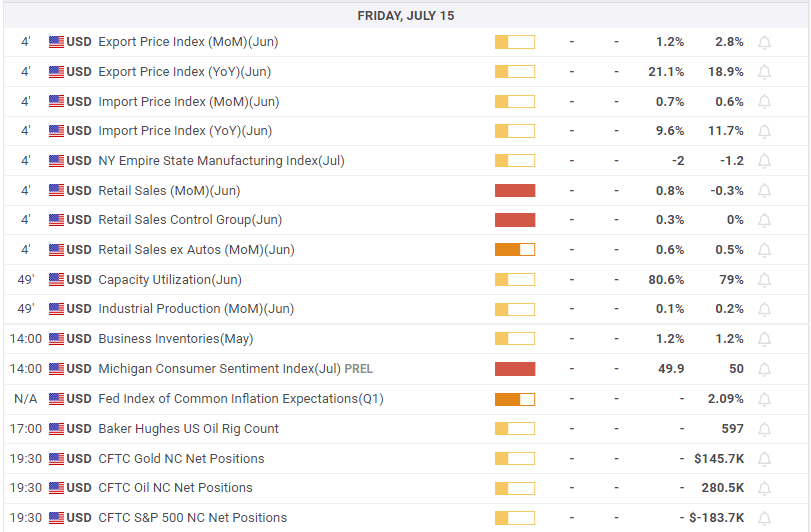

US retail sales remain strong though: 1% versus 0.9% expected and core 1% versus 0.7% expected.

Fed's Bostic says moving too dramatically could undermine the economy and add to uncertainty. 75 bps it is then!

Citibank (C) beats on top and bottom lines.

Pinterest (PINS) spikes higher on Elliot Investment Management stake.

Wells Fargo (WFC) follows Citigroup in missing due to bad debt provision increases.

Rio Tinto (RIO) warns of labor shortages.

BlackRock (BLK) missed on top and bottom lines.

United Health (UNH) beats on EPS and revenue.

Canoo (GOEV) gets an Army contract.

Solar Edge (SEDG) is down on Senator Manchin blocking the climate bill.

Novavax (NVAX) is down as EMA side effects news.

State Street (STT) beats on EPS but misses revenue.

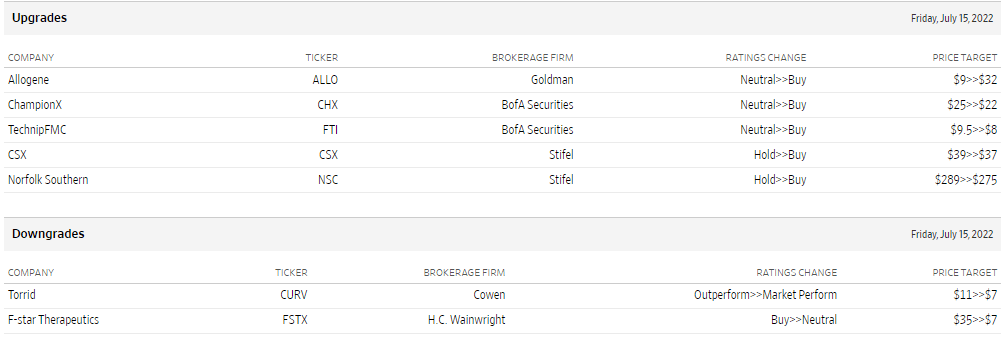

Upgrades and downgrades

Source: WSJ.com

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.