Visa Inc. (V) Elliott Wave technical analysis [Video]

![Visa Inc. (V) Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/Economic-Indicator_Consumer-Confidence-4_XtraLarge.png)

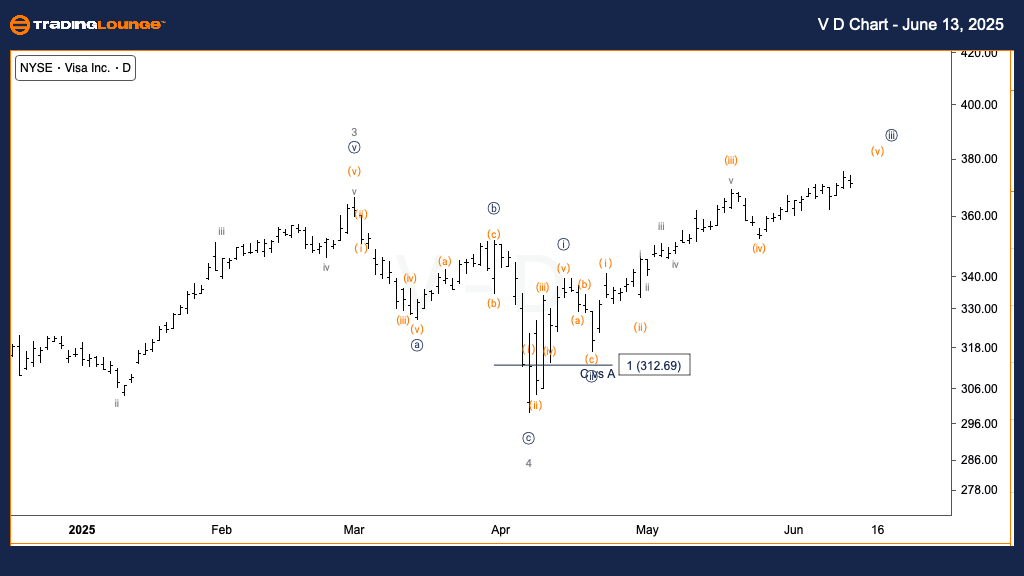

V Elliott Wave Analysis - Daily chart

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {iii} of 5.

Direction: Uptrend in wave {iii}.

Details: Approaching potential peak at $380 (MinorGroup2); possible sideways wave {iv} correction may follow.

The daily chart analysis of Visa Inc. (V) reflects a strong bullish trend, with the stock currently in wave {iii} of primary wave 5. Price action is nearing a potential resistance zone at $380, identified as the top of Minor Group2. At this level, a profit-taking phase or temporary sideways movement could emerge, forming wave {iv} before the uptrend resumes.

Visa Inc. (V) – One-hour chart

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave iii of (v).

Direction: Continued uptrend in wave v.

Details: Currently in wave iv, setting up for final push in wave (v).

On the 1-hour chart, Visa appears to be in wave iv of (v), suggesting that the market is preparing for one more upward movement to complete wave (v). This expected move aligns with the daily chart’s projection towards $380, reinforcing the potential top scenario in wave {iii}.

Summary

Visa Inc. (V) is exhibiting a strong impulsive trend structure across both daily and intraday timeframes. The current setup points to a nearing short-term high, with potential for consolidation before continuing upward momentum. Traders should watch for confirmation of wave {iv} and wave (v) patterns as the stock approaches the $380 level.

Visa Inc. (V) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.