Visa Inc. (V) Elliott Wave technical analysis [Video]

![Visa Inc. (V) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/stock-market-data-18635784_XtraLarge.jpg)

V Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5 of (1).

Direction: Upside in wave 5.

Details: We are looking for a potential extension in Minor wave 5 as we are trading above Trading Level 3 at 300$.

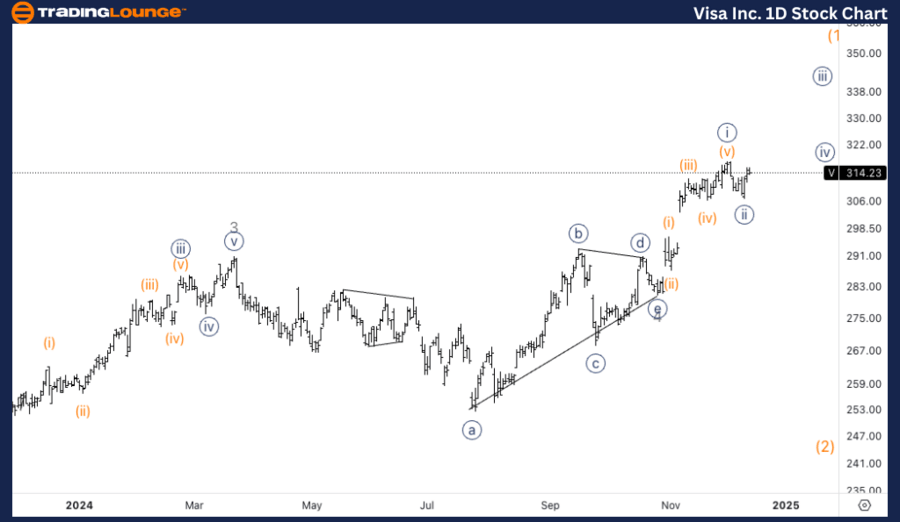

V Elliott Wave technical analysis – Daily chart

Visa's daily chart shows the stock is in wave 5 of (1), continuing its impulsive move upward. The price is trading above TradingLevel3 at $300, indicating strong bullish momentum. There is potential for an extension in Minor wave 5, which could push prices higher as the uptrend progresses.

V Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {iii} of 5.

Direction: Upside in wave {iii}.

Details: Looking for upside into wave (i) of {iii} as we can identify a three wave move into wave {iii} which ended right above 300$.

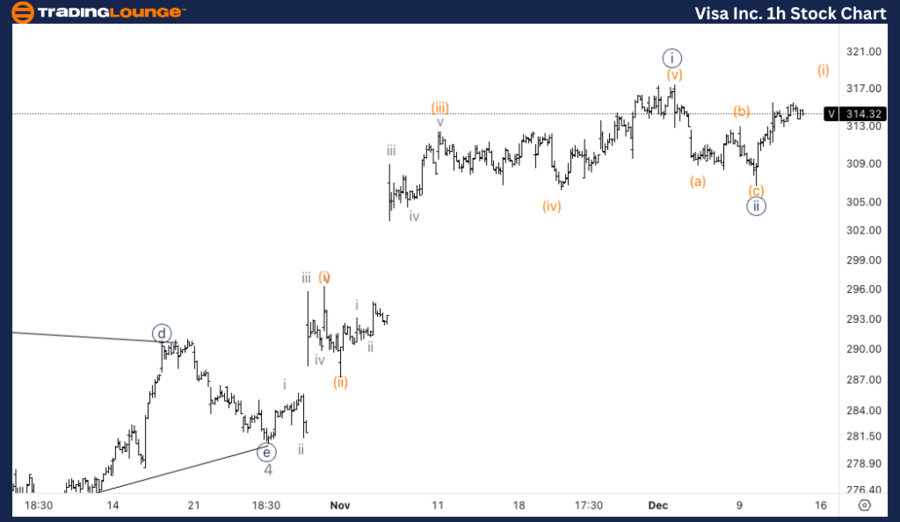

V Elliott Wave technical analysis – One-hour chart

The 1-hour chart shows Visa is in wave {iii} of 5, with a clear three-wave structure within this wave. The stock has maintained strength, holding above $300. We are currently looking for further upside into wave (i) of {iii}, continuing the bullish trend.

This analysis of Visa Inc., (V) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

Visa Inc. (V) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.