USDTRY rises to new all-time highs around 18.6500

- USDTRY prints new record highs around 18.6500 on Thursday.

- Inflation in Türkiye ran at a new 24-year top in October.

- The CBRT is expected to cut rates to single digits later in the month.

The Turkish lira remains on the defensive and lifts USDTRY to new all-time peaks around 18.6500 on Thursday.

USDTRY now shifts the attention to CBRT

USDTRY adds to Wednesday’s gains and rises to the 18.6500 region on the back of the unabated upside bias in the greenback, while another record high in the domestic inflation figures also put the lira under extra pressure.

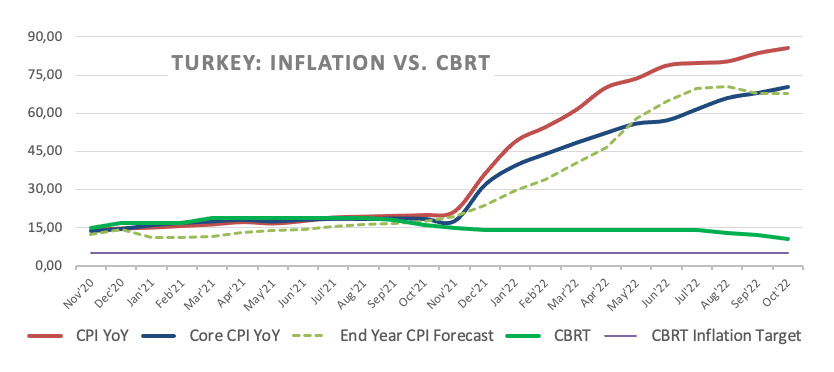

On the latter, inflation in Türkiye rose to a new 24-year high at 85.51% in the year to October when gauged by the headline CPI and 3.54% from a month earlier. In addition, the Core CPI gained 70.45% YoY and Producer Prices advanced 157.69% vs. October 2021.

Investors’ attention is now expected to shift to the next interest rate decision by the Turkish central bank (CBRT) on November 24, where consensus appears tilted to another (the last one?) rate cut, taking the One-Week Repo Rate to single digits (currently at 10.50%) for the first time since August 2020 (8.25%).

What to look for around TRY

USD/TRY extends the upside to new all-time peaks around 18.6500 on Thursday.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.07% at 18.6141 and faces the next hurdle at 18.6503 (all-time high November 3) followed by 19.00 (round level). On the downside, a break below 18.4379 (weekly low November 1) would expose 18.3765 (55-day SMA) and finally 17.8590 (weekly low August 17).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.