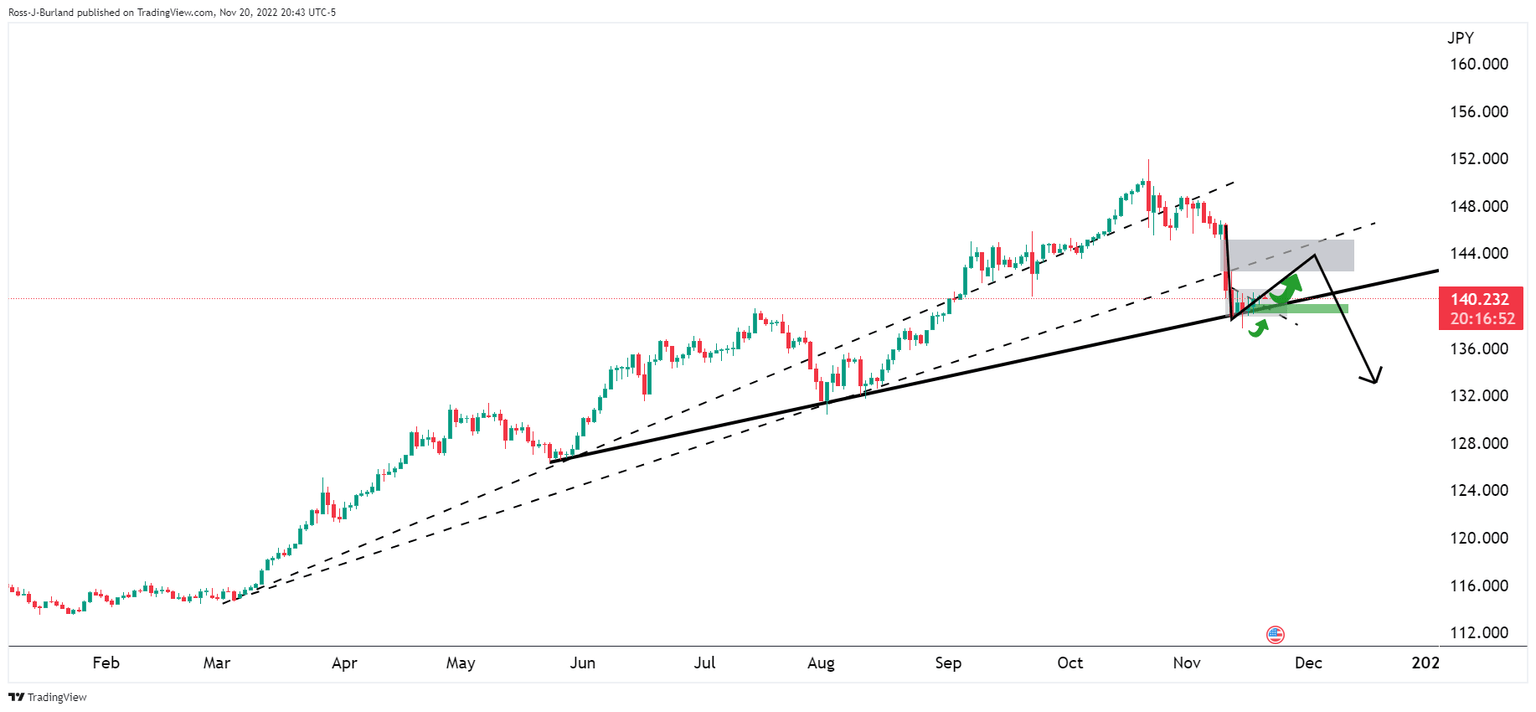

USDJPY Price Analysis: Bull move in and eye 143.00 area

- USDJPY bulls are moving in with eyes on the 61.8% ratio.

- There are prospects for a significant bullish correction in the days ahead.

USDJPY remains on the front side of the trend in the main, albeit breaking down into test the 140/137s. There are prospects of a deeper move on a break below the current trendline as the following will illustrate from a bearish perspective:

USDJPY daily chart

So long as the price stays on the front side of the daily trendline, there will be prospects for a significant bullish correction in the days ahead.

The 61.8% ratio is in sight within a price imbalance area.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.