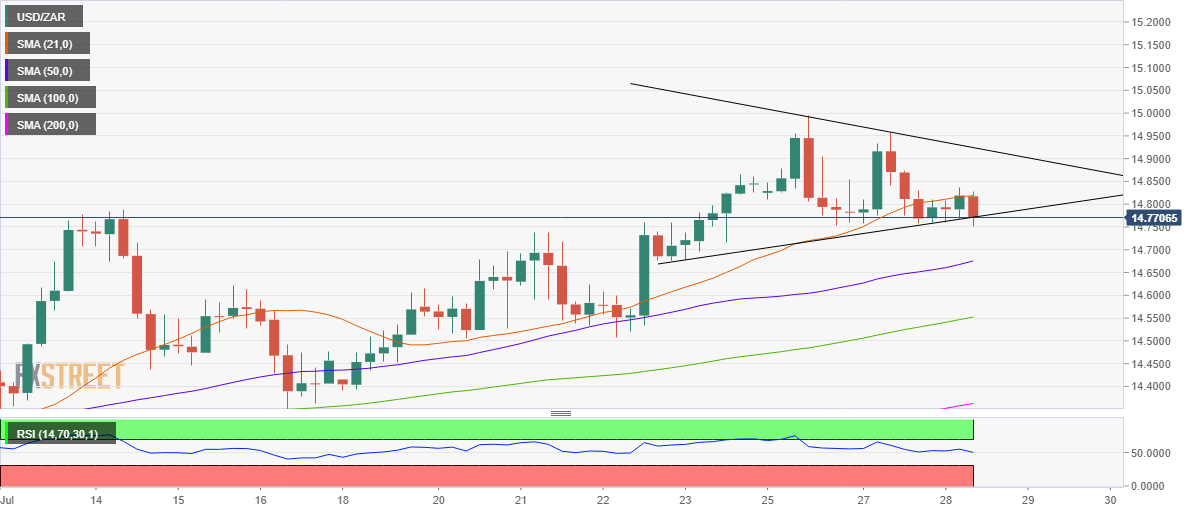

USD/ZAR Price Analysis: Teasing a symmetrical triangle breakdown on 4H

- USD/ZAR remains in the red for the third day in a row.

- The 4H chart shows a potential symmetrical triangle breakdown.

- RSI has flipped bearish, backing the downside bias in the pair.

Having faced rejection at the $15 mark earlier this week, USD/ZAR remains in the red zone for the third straight session on Wednesday, looking vulnerable to additional declines.

The currency pair appears to ignore the broad rebound in the US dollar across the board, as technical indicators scream sell.

As observed on USD/ZAR’s four-hour chart, the cross is on the verge of confirming a symmetrical triangle breakdown if the bears yield a sustained closing below the rising trendline support at 14.77.

If the downside breakout gets confirmed, then a drop towards the upward-sloping 50-Simple Moving Average (SMA) at 14.67 cannot be ruled out.

Additional losses could see the 100-SMA support at 14.55 come into play.

The Relative Strength Index (RSI) has pierced through the midline from above, reviving the bearish interests.

USD/ZAR four-hourly chart

However, should the bulls manage to defend the abovementioned triangle support a retest of the 21-SMA at 14.82 could be next in the pipeline for the optimists.

Acceptance above the latter could trigger a sharp rally towards the falling trendline resistance at 14.92.

All in all, the path of least resistance appears to the downside for USD/ZAR.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.