USD/ZAR Price Analysis: Bullish bias remains intact above $15.90

- USD/ZAR stays mildly bid, keeps upside break of 200-HMA, short-term key resistance.

- Firmer RSI line suggests continuation of recovery moves.

- Fibonacci retracement signals intermediate stops before the multi-month high flashed in November.

USD/ZAR pokes intraday high around $15.97, up 0.08% on a day heading into Monday’s European session.

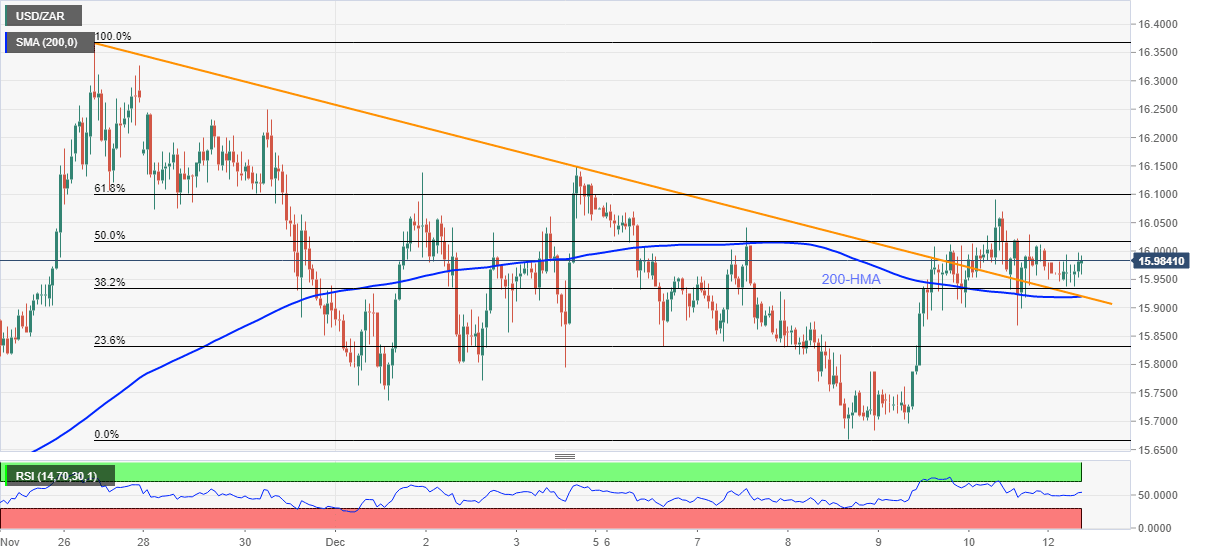

The South African currency (ZAR) pair crossed a fortnight-old descending trend line, as well as the 200-HMA, the previous day but failed to cross the $16.10 hurdle of late.

Even so, the quote remains firmer past the stated key moving average and previous resistance line, around $15.90 by the press time. Given the steady RSI line favoring the latest rebound, the USD/ZAR can portray another attempt to cross the key Fibonacci retracement (Fibo.) levels of November 26 to December 08 declines.

Among them, the 50% and 61.8% Fibo. levels surrounding $16.00 and $16.10 are crucial before the quote can challenge November’s high of $16.36.

In a case where USD/ZAR bulls keep reins past $16.36, the mid-October peak close to $16.70 can offer an intermediate halt during the run-up to $17.00.

Meanwhile, a downside break of $15.90 support convergence will direct USD/ZAR bears towards the monthly low of $15.66.

However, the pair’s declines past $15.66 will be challenged by March 2021 tops near $15.58.

USD/ZAR: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.