USD/TWD plunges as Taiwan Dollar posts historic surge amid trade speculation

- The pair trades near 28.95 after a two-day collapse exceeding 10%, triggered by speculation Taiwan is revaluing the TWD.

- Broader Asia FX rally fueled by bets that regional currencies will be allowed to strengthen to win U.S. trade concessions.

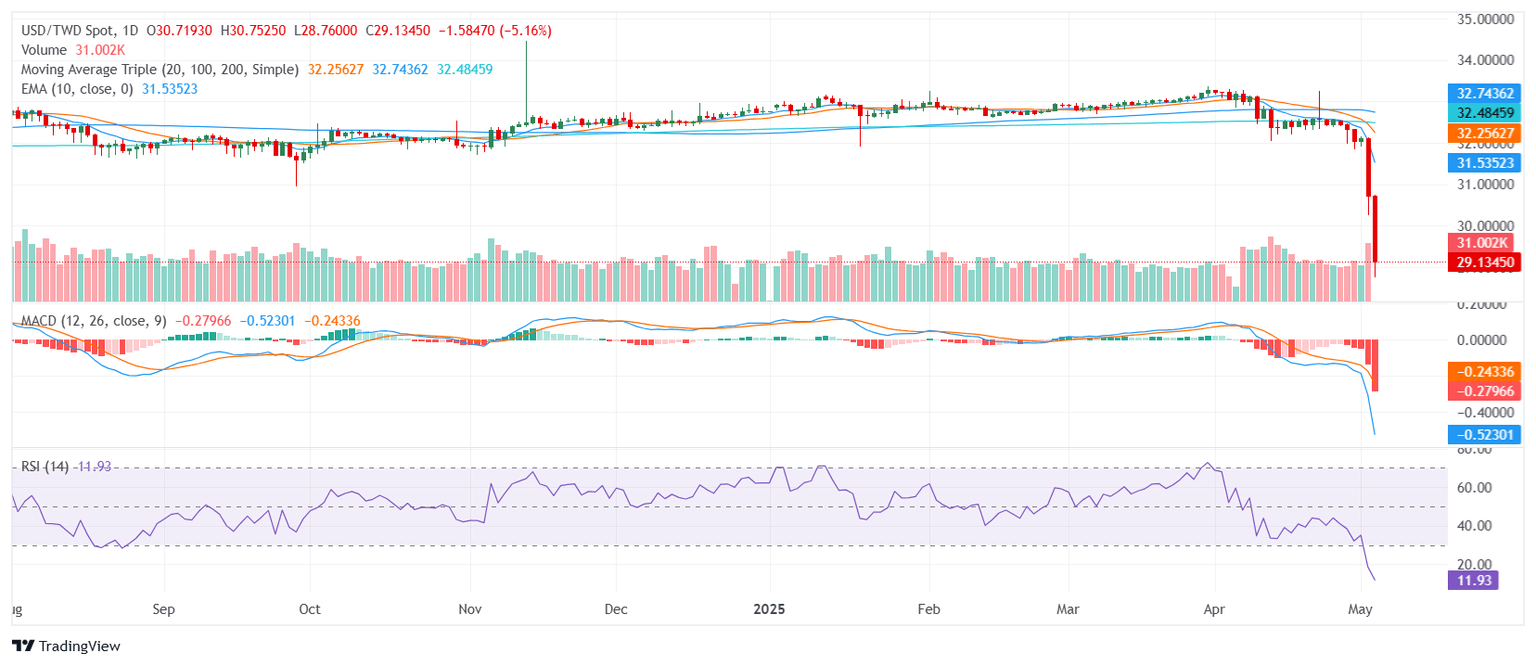

- Technical bias turns sharply bearish; USD/TWD trades near three-year lows with support at 28.80 and resistance around 29.60.

USD/TWD cratered into the 28.90 area on Monday, deepening its historic collapse after a 5.7% drop added to Friday’s 4.4% fall. The Taiwan Dollar’s two-day rally of over 10% is the sharpest in more than three decades and has triggered broader speculation that Asian economies may be allowing their currencies to appreciate to gain leverage in U.S. trade negotiations.

While the Taiwanese central bank denied intervention or coordination with the U.S., Governor Yang Chin-long was forced to hold a rare press conference, reaffirming there had been no exchange rate discussions with Washington. Still, markets interpreted the central bank’s passive stance—alongside hot money inflows from exporters—as an unofficial green light for appreciation. The move brought the TWD to its strongest level since mid-2022, amplifying volatility across Asia FX.

This dynamic spilled over to other major currencies in the region. The US dollar dropped 0.7% against the Japanese yen and Australian dollar, with the latter touching a five-month high. The offshore Chinese yuan hit a six-month peak at 7.1881 before paring gains. Market sentiment is shifting rapidly on the belief that peak tariffs from President Trump’s administration may be behind us, fueling a rebound in risk-sensitive assets and EM currencies.

In the U.S., economic indicators remain mixed. The ISM Services PMI rose to 51.6 in April, and Nonfarm Payrolls surprised to the upside at 177,000, though broader uncertainty around tariffs and Fed policy continues to weigh on the dollar. Markets are still pricing in rate cuts later in the year, albeit at a slightly slower pace than last week.

Technical Analysis

From a technical standpoint, USD/TWD is in free fall. After breaching multiple support zones, the pair now hovers near three-year lows. Immediate support lies at 28.80, followed by 28.60 and 28.40. Resistance is likely to emerge around 29.60, 29.90, and 30.20. Momentum indicators confirm the bearish bias, and unless Taiwanese authorities step in or trade rhetoric shifts materially, further downside cannot be ruled out.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.