USD/TRY recedes from weekly tops near 8.4000

- USD/TRY is up smalls around 8.3300 on Thursday.

- The Turkish central bank kept rates on hold at its meeting.

- Policymakers opened the door to a probable rate cut.

The Turkish lira trades slightly on the defensive and pushes USD/TRY to the 8.3400 region on Thursday, where seems to have met some resistance.

USD/TRY capped by 8.4000

Following weekly highs in the vicinity of 8.4000 (Wednesday), USD/TRY now attempts to move into a consolidative theme after the Turkish central bank (CBRT) failed to surprised markets at Thursday’s meeting.

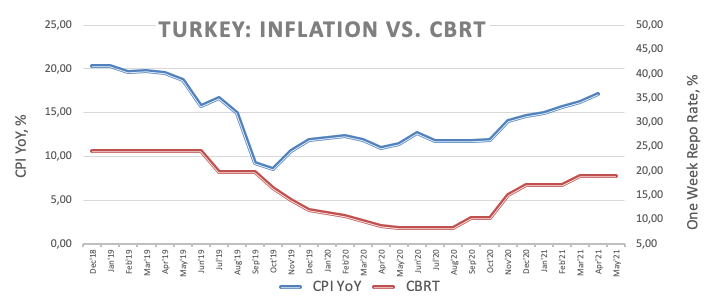

In fact, the CBRT left the key One-Week Repo Rate unchanged at 19.00, as largely anticipated by market participants. Despite the statement shows signs of some hawkish intentions, it also leaves the door open to the start of an easing cycle later in the year after it reiterates that rates will be set above the inflation.

Indeed, despite inflation edged higher and reached the 17% area in April, it is expected to start grinding lower in the relatively near-term and so will the One-Week Repo Rate in the next months.

In the meantime, the lira extends the cautious note and keeps looking to the performance of the economic recovery amidst the unabated pandemic and recent tighter lockdown measures.

What to look for around TRY

The near-term outlook for the lira remains fragile to say the least. Despite keeping rates unchanged at its meeting, Governor S.Kavcioglu is gradually expected to reverse (wipe out) the shift to a market friendly approach of the monetary policy that was successfully implemented by former Governor N.Agbal back in November 2020. Against this, it will surprise nobody to see the CBRT returning to the unorthodox/looser monetary stance in the next months, opening the door to further lira depreciation, FX reserves exodus and rising bets on a Balance of Payment crisis. Against this backdrop, it will surprise nobody to see spot trading around 10.00 in the medium-to-longer run.

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Capital controls? The IMF could step in to bring in financial assistance.

USD/TRY key levels

At the moment the pair is advancing 0.21% at 8.3320 and faces the next up barrier at 8.3710 (weekly high May 4) followed by 8.4840 (2021 high Apr.26) and then 8.5777 (all-time high Nov.6 2020). On the other hand, a drop below 8.1316 (weekly low Apr.29) would aim for 7.9937 (weekly low Apr.15) and then 7.9268 (50-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.