USD/TRY looks firm around 8.3000

- USD/TRY recedes from earlier tops around 8.3300.

- Turkey’s inflation figures extended the uptrend in April.

- The Turish central bank (CBRT) meets on Thursday.

The Turkish lira depreciates further vs. the greenback and lifts USD/TRY to fresh multi-day highs around 8.3300 at the beginning of the week.

USD/TRY now looks to the CBRT

USD/TRY advances for the third consecutive session on the back of further selling bias around the Turkish currency.

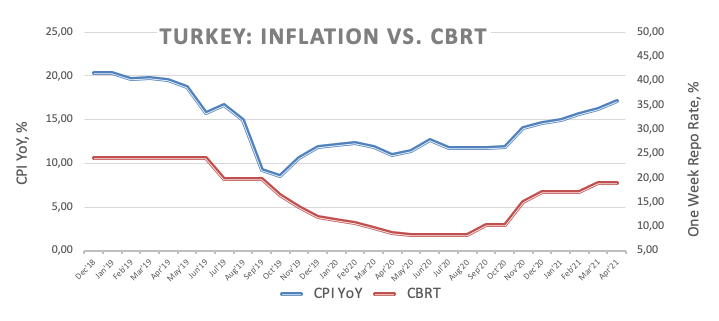

In fact, the lira loses further ground and extends the drop to multi-day lows after inflation in Turkey showed no signs of abating, at least in the near-term. However, consumer prices are expected to peak in May or June and start a downward path later in the year.

In the meantime, the focus of attention this week will be on the CBRT interest rate decision (Thursday), although recently released CPI figures could pour cold water over speculations of further easing, at least in the very near-term.

In the domestic docket, inflation figures tracked by the CPI showed consumer prices rose further in April, this time 1.68% MoM and 17.14% from a year earlier. Additional data saw Producer Prices rising 4.34% inter-month and 35.17% YoY, while the manufacturing PMI eased to 50.40 last month (from 52.60).

USD/TRY key levels

At the moment the pair is advancing 0.17% at 8.2887 and faces the next up barrier at 8.3308 (weekly high May 3) followed by 8.4840 (2021 high Apr.26) and then 8.5777 (all-time high Nov.6 2020). On the other hand, a drop below 8.1316 (weekly low Apr.29) would aim for 7.9937 (weekly low Apr.15) and then 7.8602 (50-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.