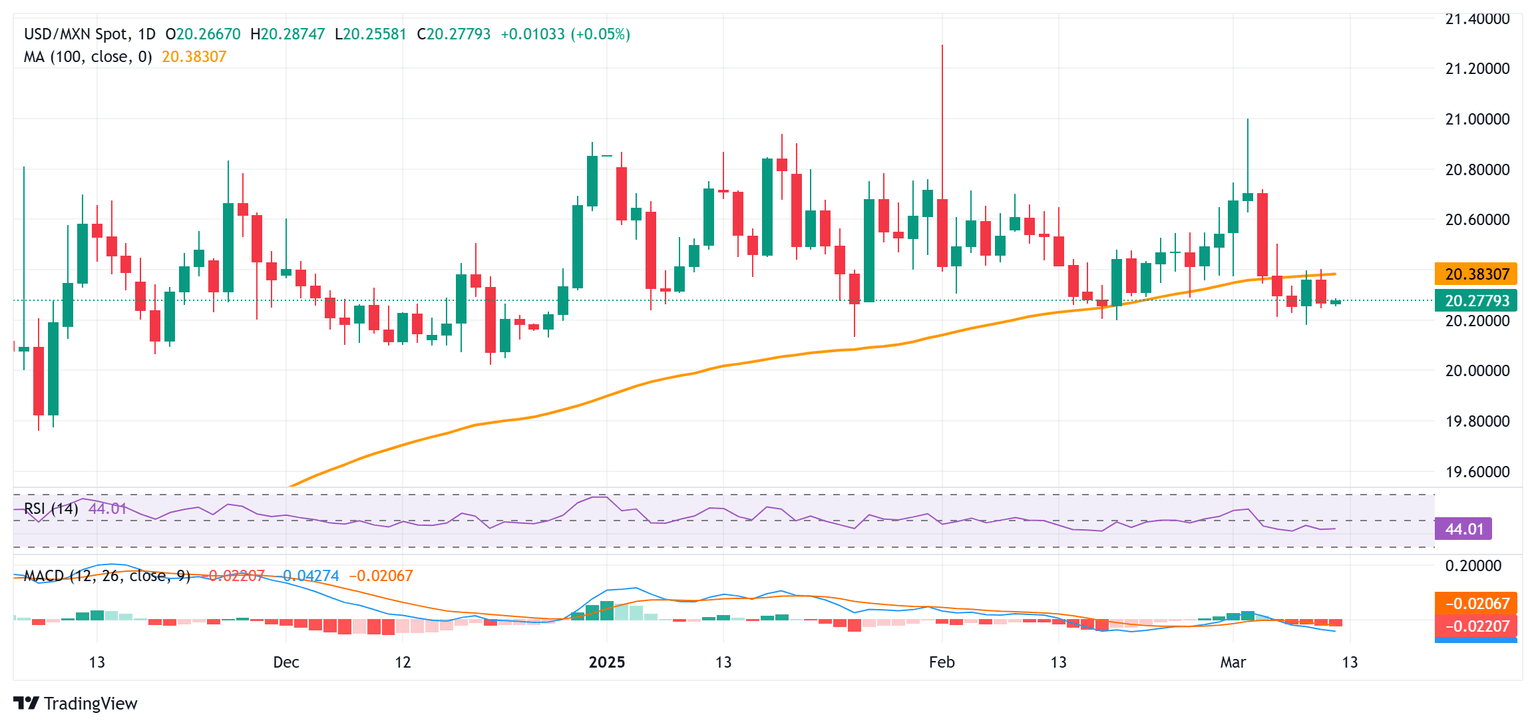

USD/MXN Price Forecast: Seems vulnerable while below 100-day SMA; US CPI awaited

- USD/MXN consolidates in a range above the monthly low touched earlier this week.

- The technical setup favors bearish traders and supports prospects for further losses.

- A sustained strength beyond the 100-day SMA is needed to negate the negative bias.

The USD/MXN pair struggles for a firm intraday direction on Wednesday and oscillates in a narrow trading band, around the 20.2790-20.2795 region through the Asian session. Spot prices, meanwhile, remain close to the lowest level since January 24 touched on Monday, and seem vulnerable to slide further amid the underlying bearish sentiment surrounding the US Dollar (USD).

Investors now seem convinced that a tariff-driven slowdown in the US economic activity and signs of a cooling US labor market might force the Federal Reserve (Fed) to cut interest rates several times this year. This, in turn, has been a key factor behind the recent USD downfall to its lowest level since mid-October set on Tuesday. The USD bears, however, seem reluctant to place fresh bets ahead of the release of the US consumer inflation figures, which, in turn, is seen acting as a tailwind for the USD/MXN pair.

From a technical perspective, last week's breakdown and acceptance below the 100-day Simple Moving Average (SMA) for the first time since May 2024 favors the USD/MXN bears. Moreover, oscillators on the daily chart have just started gaining negative traction and suggest that the path of least resistance for spot prices remains to the downside. Hence, any intraday move-up might be seen as a selling opportunity and remain capped near the 20.3825-20.3830 region, or the 100-day SMA support breakpoint.

However, some follow-through buying beyond the weekly top, around the 20.4040 area, might prompt some short-covering move and lift the USD/MXN pair to the 20.5040 area en route to the next relevant hurdle near the 20.6060-20.6070 region. The momentum could extend further towards the 20.7035-20.7040 resistance before spot prices eventually aim to challenge the monthly swing high, around the 21.0000 round-figure mark.

On the flip side, weakness below the 20.2540-20.2535 area could find some support near the 20.1810 region, or the monthly low touched on Monday. This is followed by the year-to-date through, around the 20.1345 zone, below which the USD/MXN pair could accelerate the fall towards the 20.0715 intermediate support en route to the December 2024 swing low, around the 20.0215 region.

USD/MXN daily chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.